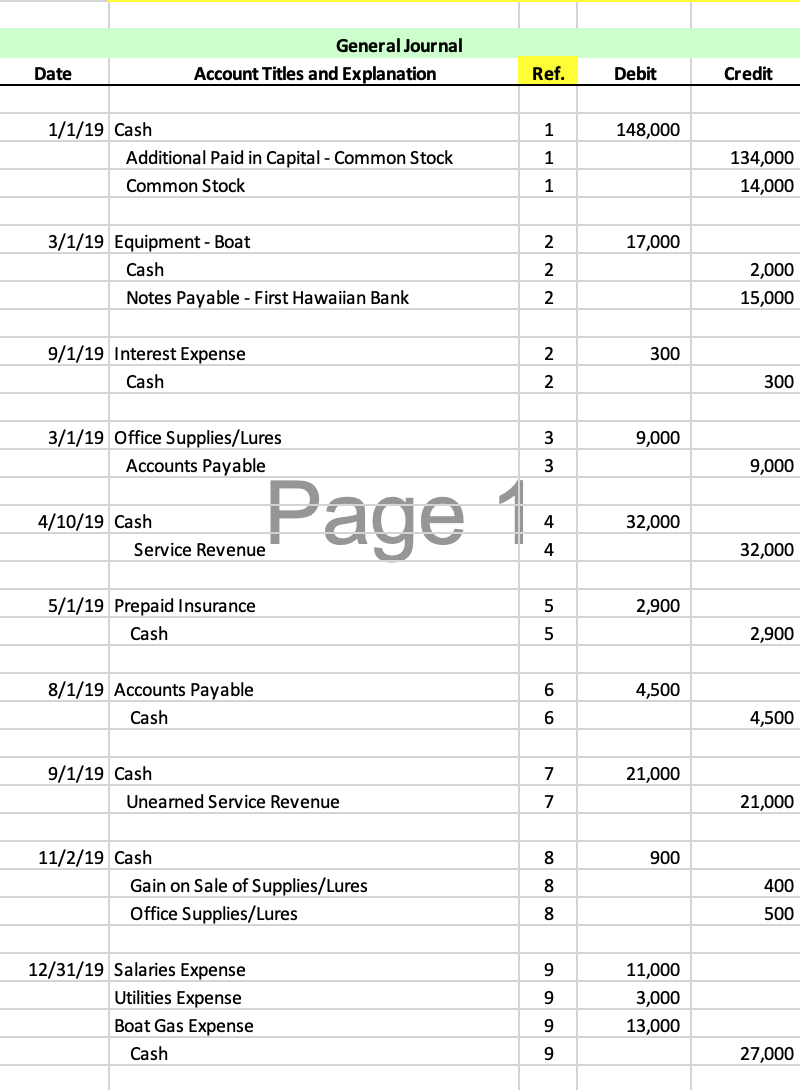

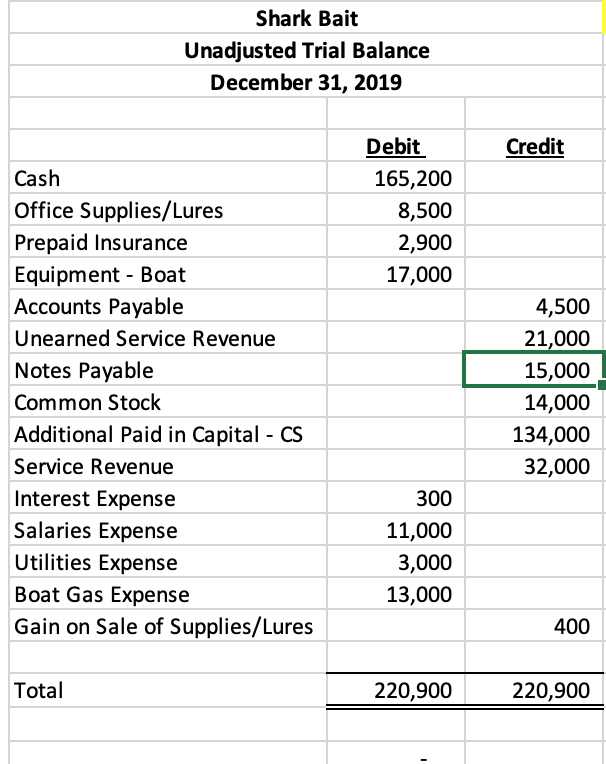

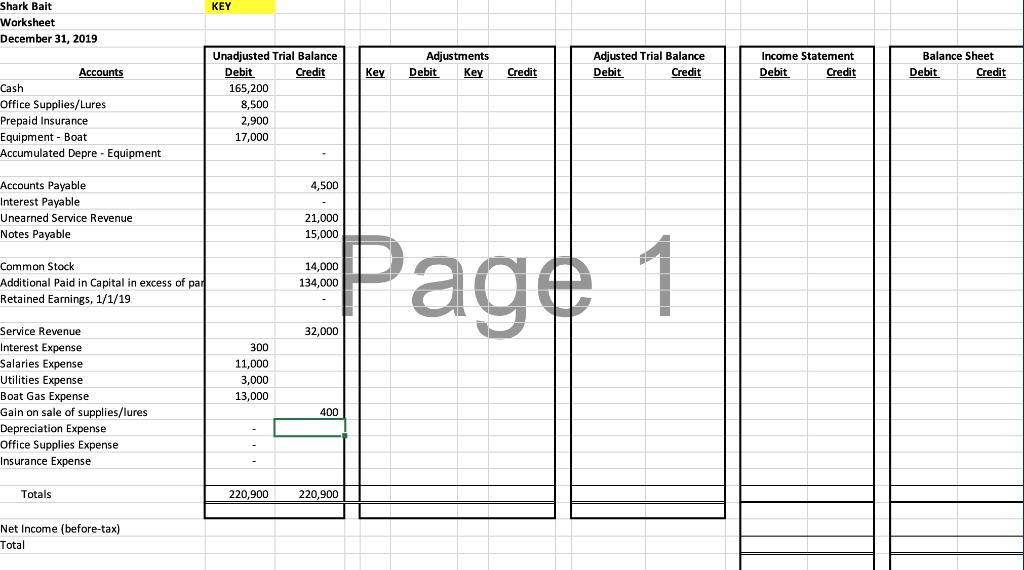

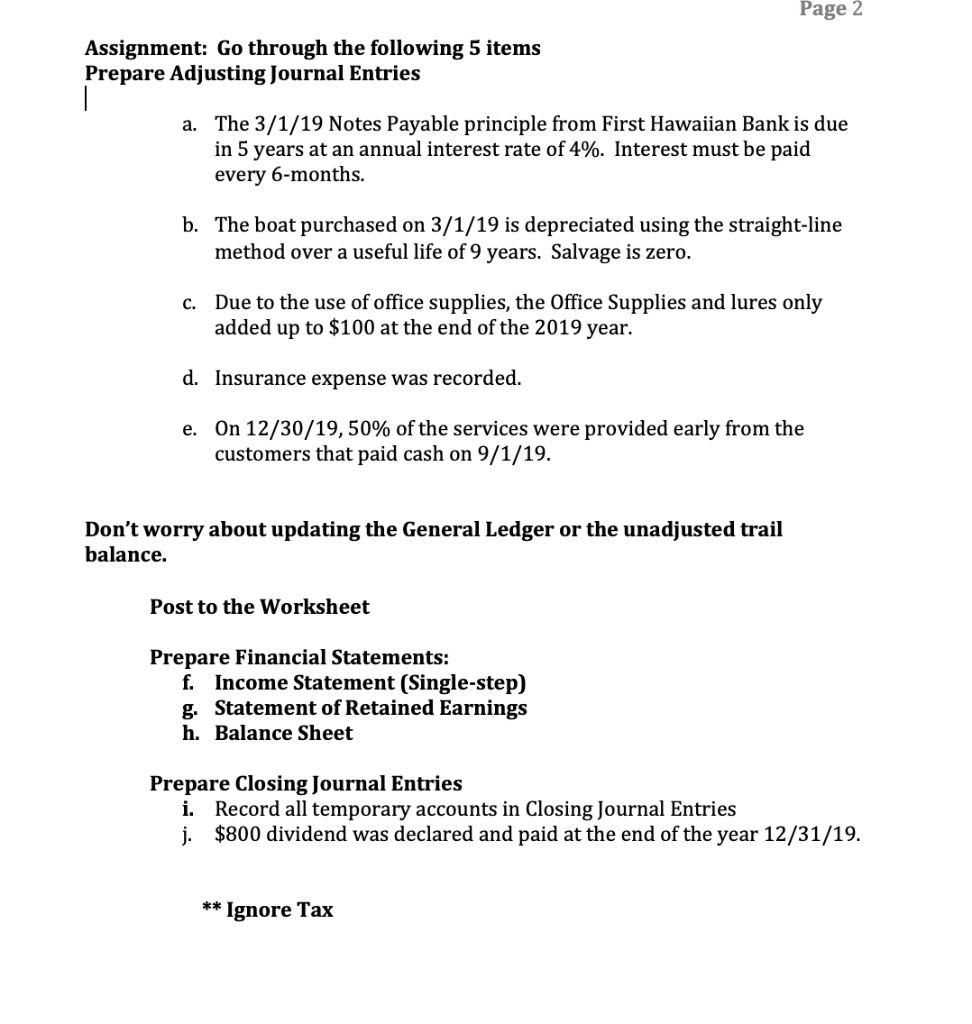

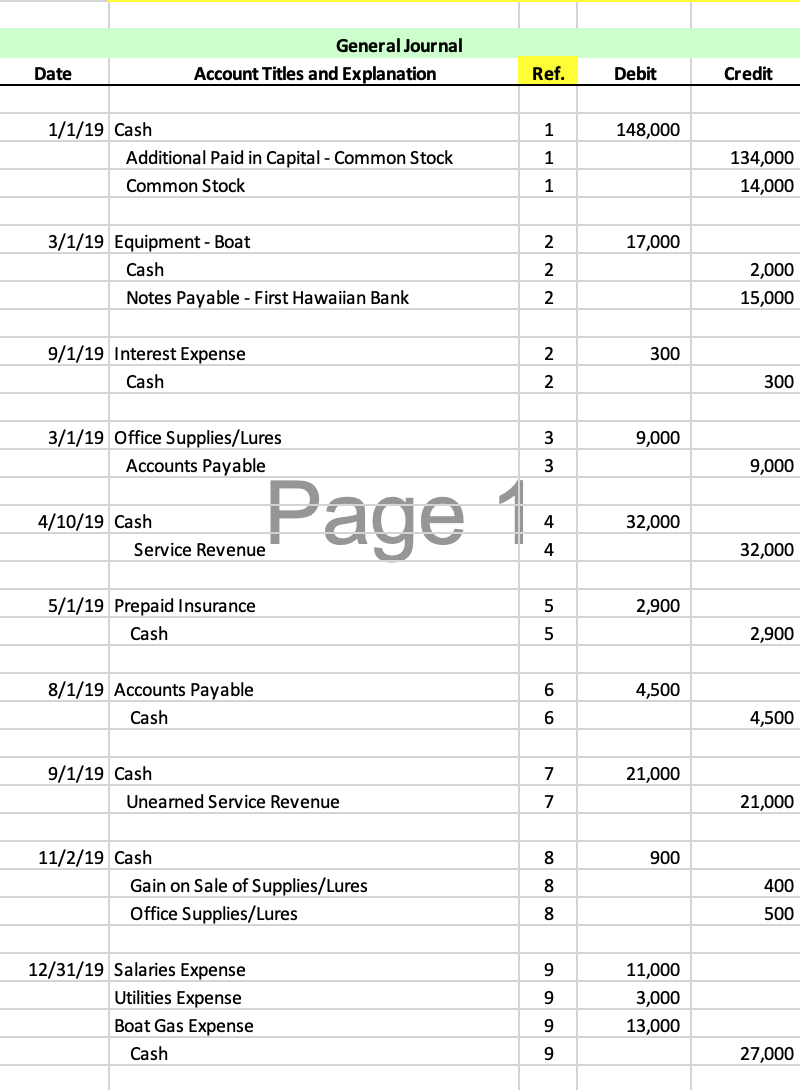

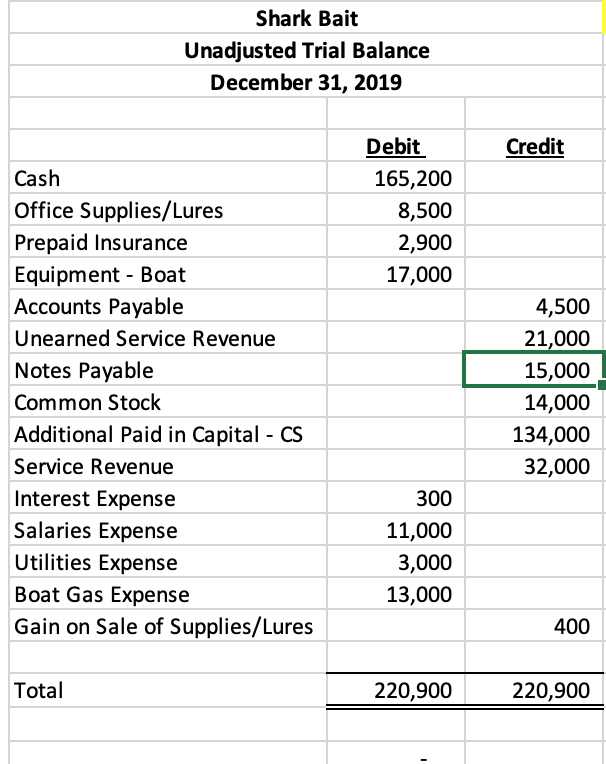

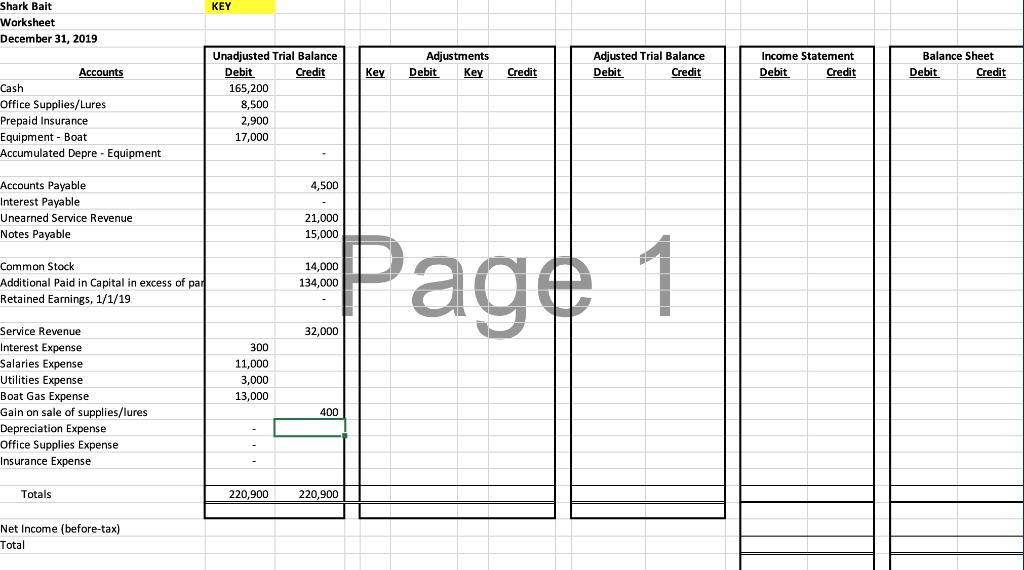

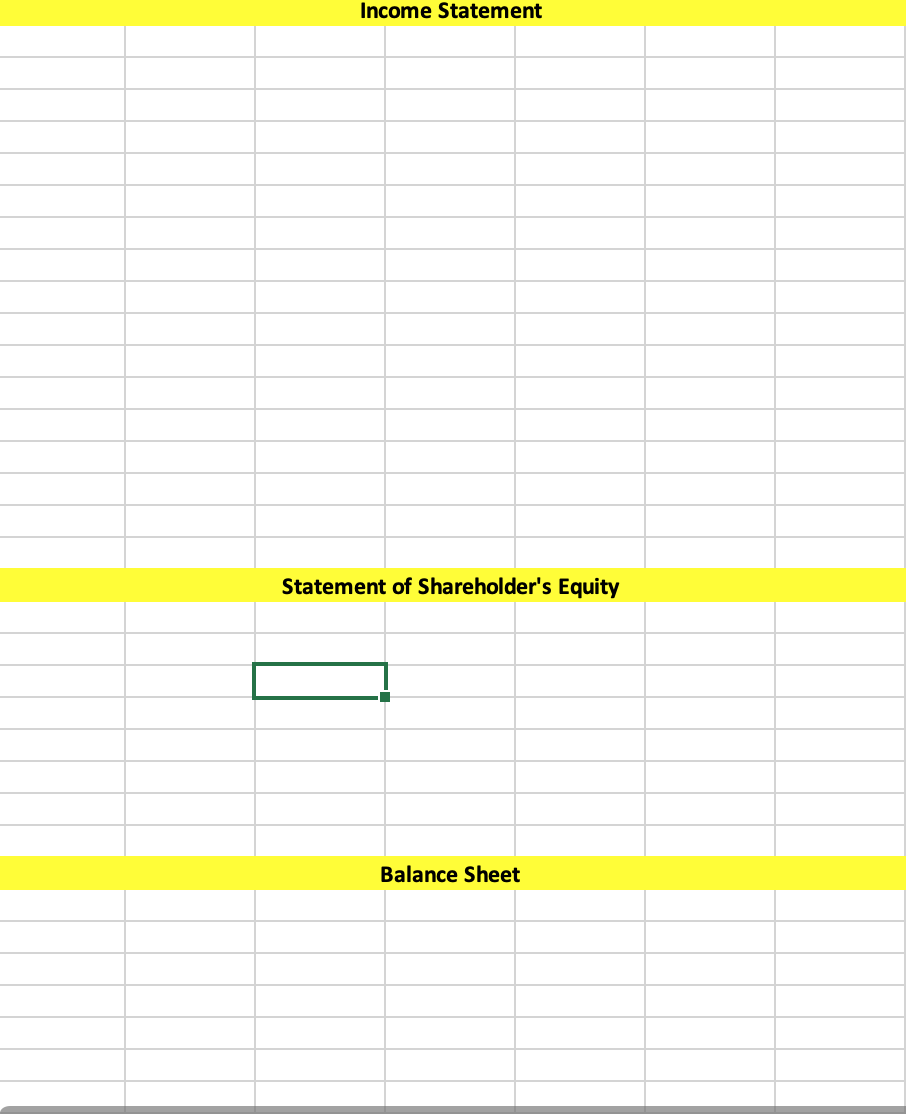

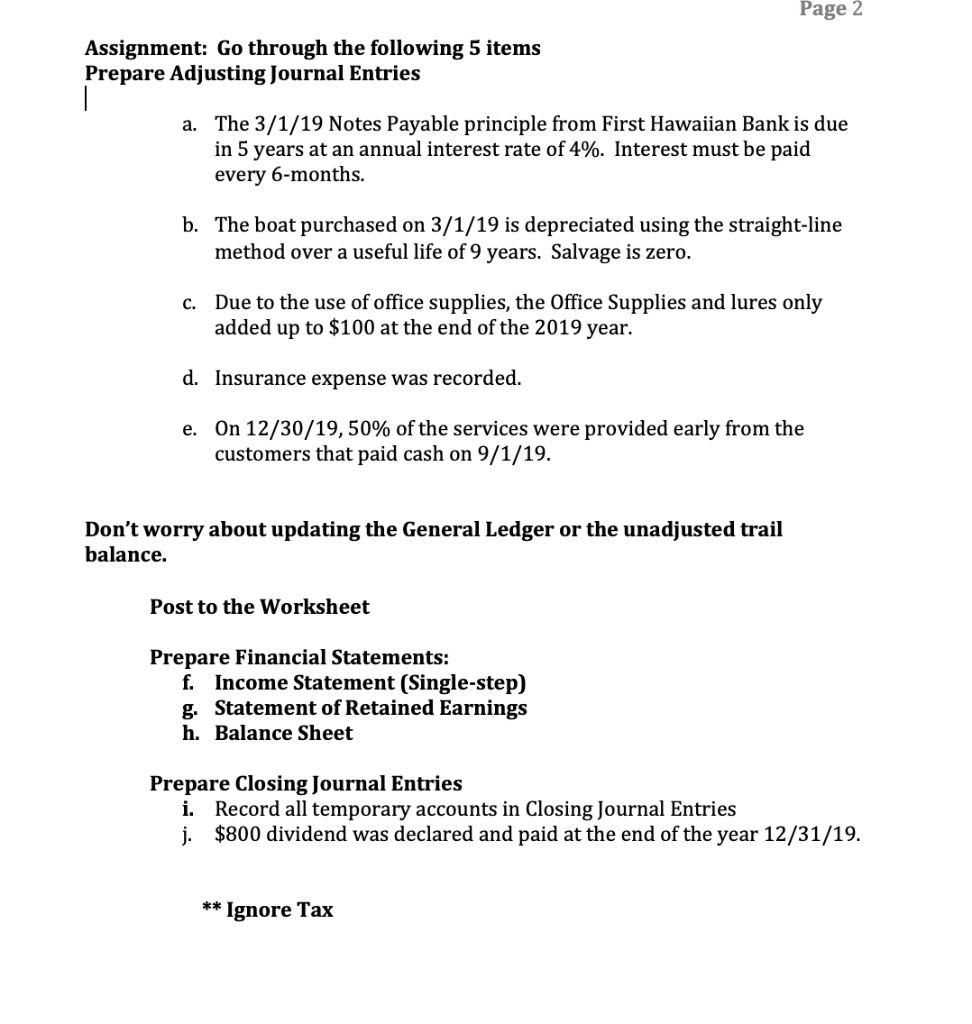

Shark Bait Unadjusted Trial Balance December 31, 2019 Credit Debit 165,200 8,500 2,900 17,000 Cash Office Supplies/Lures Prepaid Insurance Equipment - Boat Accounts Payable Unearned Service Revenue Notes Payable Common Stock Additional Paid in Capital - CS Service Revenue Interest Expense Salaries Expense Utilities Expense Boat Gas Expense Gain on Sale of Supplies/Lures 4,500 21,000 15,000 14,000 134,000 32,000 300 11,000 3,000 13,000 400 Total 220,900 220,900 KEY Shark Bait Worksheet December 31, 2019 Adjustments Debit Key Adjusted Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit Key Credit Accounts Cash Office Supplies/Lures Prepaid Insurance Equipment - Boat Accumulated Depre - Equipment Unadjusted Trial Balance Debit Credit 165,200 8,500 2,900 17,000 4,500 Accounts Payable Interest Payable Unearned Service Revenue Notes Payable 21,000 15,000 Common Stock Additional Paid in Capital in excess of par Retained Earnings, 1/1/19 14,000 134,000 Page 1 32,000 Service Revenue Interest Expense Salaries Expense Utilities Expense Boat Gas Expense Gain on sale of supplies/lures Depreciation Expense Office Supplies Expense Insurance Expense 300 11,000 3,000 13,000 Totals 220,900 220,900 Net Income (before-tax) Total Income Statement Statement of Shareholder's Equity Balance Sheet Page 2 Assignment: Go through the following 5 items Prepare Adjusting Journal Entries a. The 3/1/19 Notes Payable principle from First Hawaiian Bank is due in 5 years at an annual interest rate of 4%. Interest must be paid every 6-months. b. The boat purchased on 3/1/19 is depreciated using the straight-line method over a useful life of 9 years. Salvage is zero. c. Due to the use of office supplies, the Office Supplies and lures only added up to $100 at the end of the 2019 year. d. Insurance expense was recorded. e. On 12/30/19,50% of the services were provided early from the customers that paid cash on 9/1/19. Don't worry about updating the General Ledger or the unadjusted trail balance. Post to the Worksheet Prepare Financial Statements: f. Income Statement (Single-step) g. Statement of Retained Earnings h. Balance Sheet Prepare Closing Journal Entries i. Record all temporary accounts in Closing Journal Entries j. $800 dividend was declared and paid at the end of the year 12/31/19. ** Ignore Tax