Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharma has an advertising business and uses a low value asset pool in calculating his depreciation deductions. The closing balance in his low-value pool

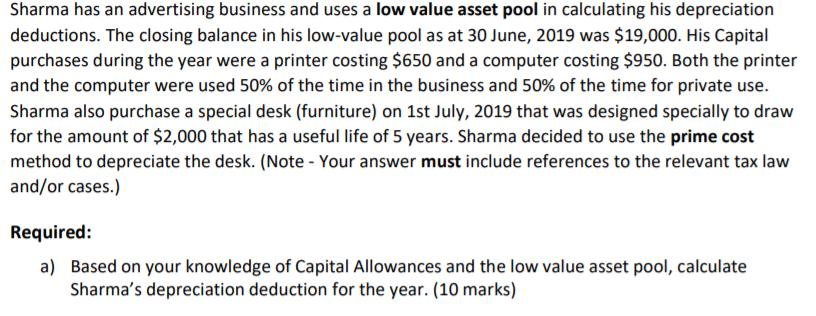

Sharma has an advertising business and uses a low value asset pool in calculating his depreciation deductions. The closing balance in his low-value pool as at 30 June, 2019 was $19,000. His Capital purchases during the year were a printer costing $650 and a computer costing $950. Both the printer and the computer were used 50% of the time in the business and 50% of the time for private use. Sharma also purchase a special desk (furniture) on 1st July, 2019 that was designed specially to draw for the amount of $2,000 that has a useful life of 5 years. Sharma decided to use the prime cost method to depreciate the desk. (Note - Your answer must include references to the relevant tax law and/or cases.) Required: a) Based on your knowledge of Capital Allowances and the low value asset pool, calculate Sharma's depreciation deduction for the year. (10 marks)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a The total depreciation deduction of Sharmas for the year is 7675 Explanations As per law ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started