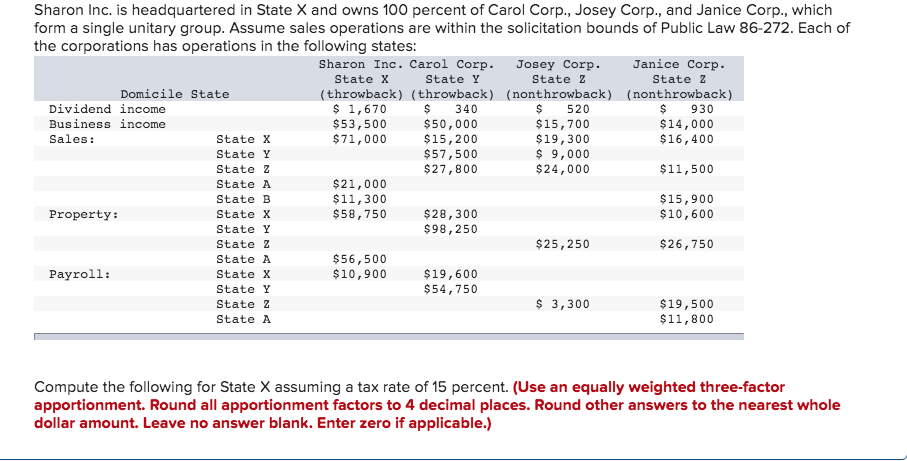

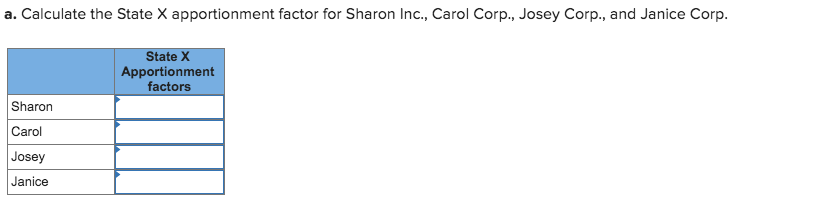

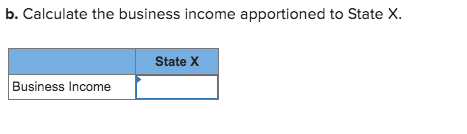

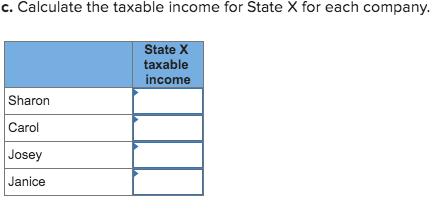

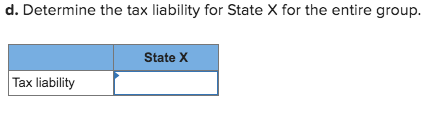

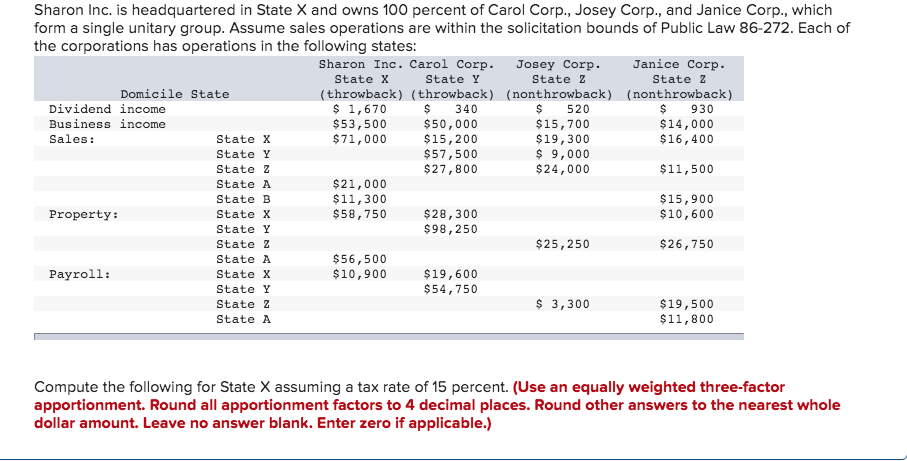

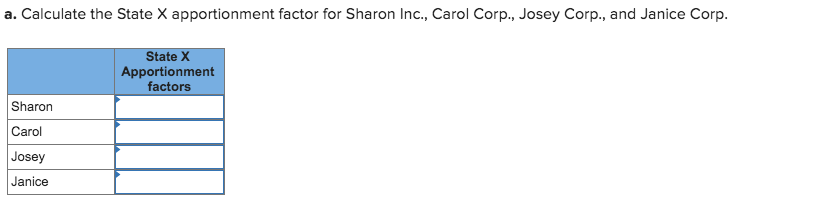

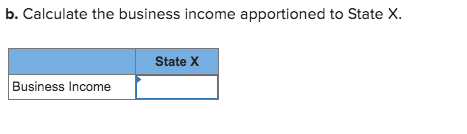

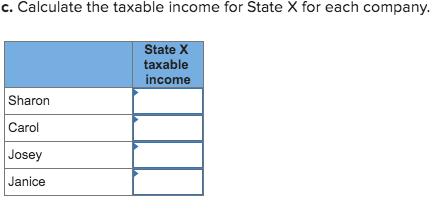

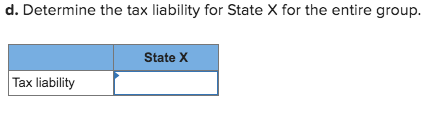

Sharon Inc. is headquartered in State X and owns 100 percent of Carol Corp., Josey Corp., and Janice Corp., which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Sharon Inc. Carol Corp. Josey Corp. Janice Corp. State 2 State 2 State X State Y Domicile State (throwback) (throwback) (nonthrowback) (nonthrowback) $520 $15,700 $19,300 $9,000 $24,000 $930 $14,000 $16,400 Dividend income Business income Sales: 1,670 $53,500 $71,000 $340 $50,000 $15,200 $57,500 $27,800 State x State Y State 2 State A State B State X State Y State Z State A State X State Y State 2 State A $11,500 $21,000 $11,300 $58,750 $15,900 $10,600 $28,300 $98,250 Property: $25,250 $26,750 $56,500 $10,900 Payroll: $19,600 $54,750 $19,500 $11,800 $3,300 Compute the following for State X assuming a tax rate of 15 percent. (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) a. Calculate the State X apportionment factor for Sharon Inc., Carol Corp., Josey Corp., and Janice Corp State X Apportionment factors Sharon Carol Josey Janice b. Calculate the business income apportioned to State X. State X Business Income d. Determine the tax liability for State X for the entire group. State X Tax liability Sharon Inc. is headquartered in State X and owns 100 percent of Carol Corp., Josey Corp., and Janice Corp., which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Sharon Inc. Carol Corp. Josey Corp. Janice Corp. State 2 State 2 State X State Y Domicile State (throwback) (throwback) (nonthrowback) (nonthrowback) $520 $15,700 $19,300 $9,000 $24,000 $930 $14,000 $16,400 Dividend income Business income Sales: 1,670 $53,500 $71,000 $340 $50,000 $15,200 $57,500 $27,800 State x State Y State 2 State A State B State X State Y State Z State A State X State Y State 2 State A $11,500 $21,000 $11,300 $58,750 $15,900 $10,600 $28,300 $98,250 Property: $25,250 $26,750 $56,500 $10,900 Payroll: $19,600 $54,750 $19,500 $11,800 $3,300 Compute the following for State X assuming a tax rate of 15 percent. (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) a. Calculate the State X apportionment factor for Sharon Inc., Carol Corp., Josey Corp., and Janice Corp State X Apportionment factors Sharon Carol Josey Janice b. Calculate the business income apportioned to State X. State X Business Income d. Determine the tax liability for State X for the entire group. State X Tax liability