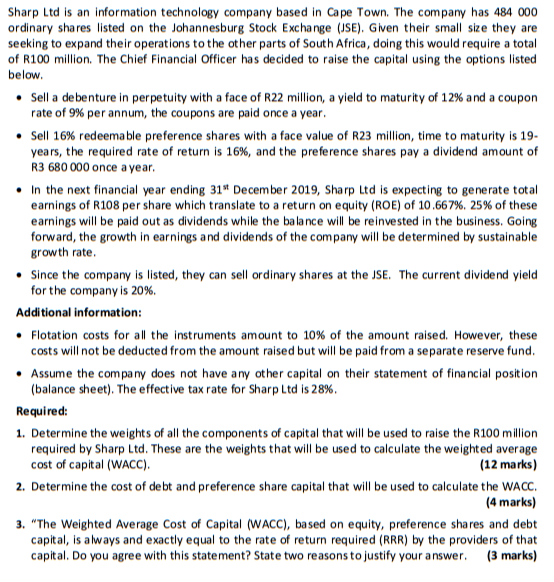

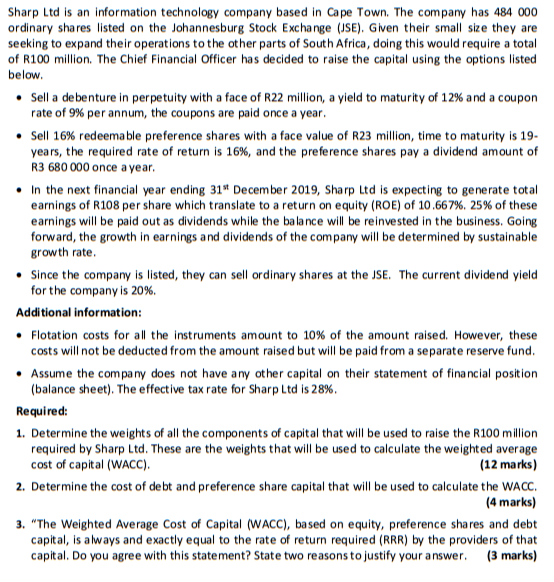

Sharp Ltd is an information technology company based in Cape Town. The company has 484 000 ordinary shares listed on the Johannesburg Stock Exchange (JSE). Given their small size they are seeking to expand their operations to the other parts of South Africa, doing this would require a total of R100 million. The Chief Financial Officer has decided to raise the capital using the options listed below. Sell a debenture in perpetuity with a face of R22 million, a yield to maturity of 12% and a coupon rate of 9% per annum, the coupons are paid once a year. Sell 16% redeemable preference shares with a face value of R23 million, time to maturity is 19. years, the required rate of return is 16%, and the preference shares pay a dividend amount of R3 680 000 once a year In the next financial year ending 31* December 2019, Sharp Ltd is expecting to generate total earnings of R108 per share which translate to a return on equity (ROE) of 10.667%25% of these earnings will be paid out as dividends while the balance will be reinvested in the business. Going forward, the growth in earnings and dividends of the company will be determined by sustainable growth rate. Since the company is listed, they can sell ordinary shares at the JSE. The current dividend yield for the company is 20% Additional information: Flotation costs for all the instruments amount to 10% of the amount raised. However, these costs will not be deducted from the amount raised but will be paid from a separate reserve fund. Assume the company does not have any other capital on their statement of financial position (balance sheet). The effective tax rate for Sharp Ltd is 28%. Required: 1. Determine the weights of all the components of capital that will be used to raise the R100 million required by Sharp Ltd. These are the weights that will be used to calculate the weighted average cost of capital (WACC). (12 marks) 2. Determine the cost of debt and preference share capital that will be used to calculate the WACC. (4 marks) 3. "The Weighted Average Cost of Capital (WACC), based on equity, preference shares and debt capital, is always and exactly equal to the rate of return required (RRR) by the providers of that capital. Do you agree with this statement? State two reasons to justify your answer. (3 marks) Sharp Ltd is an information technology company based in Cape Town. The company has 484 000 ordinary shares listed on the Johannesburg Stock Exchange (JSE). Given their small size they are seeking to expand their operations to the other parts of South Africa, doing this would require a total of R100 million. The Chief Financial Officer has decided to raise the capital using the options listed below. Sell a debenture in perpetuity with a face of R22 million, a yield to maturity of 12% and a coupon rate of 9% per annum, the coupons are paid once a year. Sell 16% redeemable preference shares with a face value of R23 million, time to maturity is 19. years, the required rate of return is 16%, and the preference shares pay a dividend amount of R3 680 000 once a year In the next financial year ending 31* December 2019, Sharp Ltd is expecting to generate total earnings of R108 per share which translate to a return on equity (ROE) of 10.667%25% of these earnings will be paid out as dividends while the balance will be reinvested in the business. Going forward, the growth in earnings and dividends of the company will be determined by sustainable growth rate. Since the company is listed, they can sell ordinary shares at the JSE. The current dividend yield for the company is 20% Additional information: Flotation costs for all the instruments amount to 10% of the amount raised. However, these costs will not be deducted from the amount raised but will be paid from a separate reserve fund. Assume the company does not have any other capital on their statement of financial position (balance sheet). The effective tax rate for Sharp Ltd is 28%. Required: 1. Determine the weights of all the components of capital that will be used to raise the R100 million required by Sharp Ltd. These are the weights that will be used to calculate the weighted average cost of capital (WACC). (12 marks) 2. Determine the cost of debt and preference share capital that will be used to calculate the WACC. (4 marks) 3. "The Weighted Average Cost of Capital (WACC), based on equity, preference shares and debt capital, is always and exactly equal to the rate of return required (RRR) by the providers of that capital. Do you agree with this statement? State two reasons to justify your