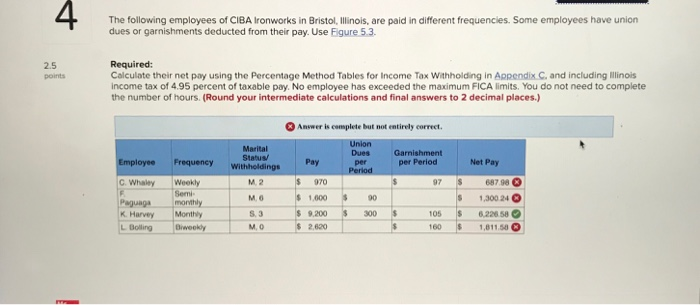

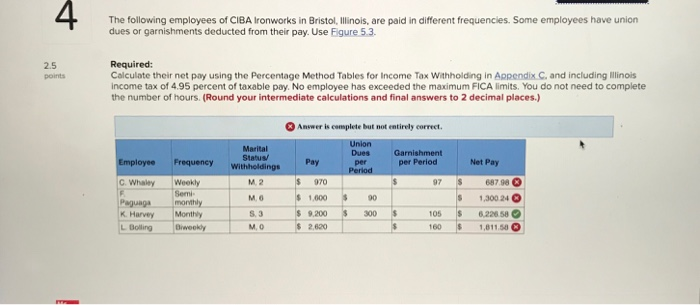

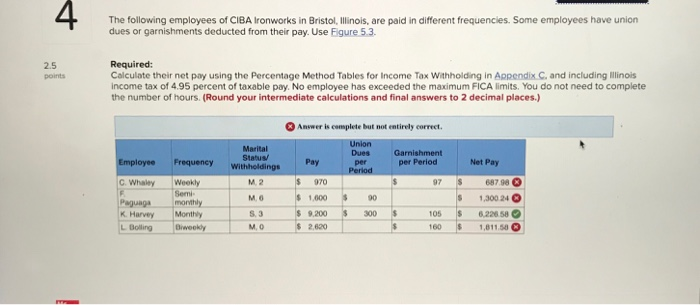

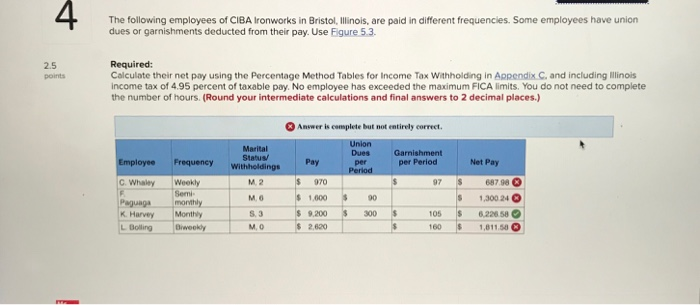

A. The following employees of CIBA Ironworks in Bristol, Illinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Use Eigure 5.3 Required: Colculate their net pay using the Percentage Method Tables for Income Tax Withholding in Appendix C. and including Iillinois income tax of 4.95 percent of taxable pay No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. (Round your intermediate calculations and final answers to 2 decimal places.) 2.5 points Answer is complete but not entirely correct. Marital StatusP Dues per Garnishment per Period Frequency Withholdings Net Pay Pay 97 68798 1,300 24 105 S6.22658 160 1811 50 CWhaley Weokly M. 2 070 Semi M. 61,00090 Peguagemonthly K. Harvey Monthily Bolling Biweeky 9,200 2,620 300 . A. The following employees of CIBA Ironworks in Bristol, Illinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Use Eigure 5.3 Required: Colculate their net pay using the Percentage Method Tables for Income Tax Withholding in Appendix C. and including Iillinois income tax of 4.95 percent of taxable pay No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. (Round your intermediate calculations and final answers to 2 decimal places.) 2.5 points Answer is complete but not entirely correct. Marital StatusP Dues per Garnishment per Period Frequency Withholdings Net Pay Pay 97 68798 1,300 24 105 S6.22658 160 1811 50 CWhaley Weokly M. 2 070 Semi M. 61,00090 Peguagemonthly K. Harvey Monthily Bolling Biweeky 9,200 2,620 300 . A. The following employees of CIBA Ironworks in Bristol, Illinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Use Eigure 5.3 Required: Colculate their net pay using the Percentage Method Tables for Income Tax Withholding in Appendix C. and including Iillinois income tax of 4.95 percent of taxable pay No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. (Round your intermediate calculations and final answers to 2 decimal places.) 2.5 points Answer is complete but not entirely correct. Marital StatusP Dues per Garnishment per Period Frequency Withholdings Net Pay Pay 97 68798 1,300 24 105 S6.22658 160 1811 50 CWhaley Weokly M. 2 070 Semi M. 61,00090 Peguagemonthly K. Harvey Monthily Bolling Biweeky 9,200 2,620 300 . A. The following employees of CIBA Ironworks in Bristol, Illinois, are paid in different frequencies. Some employees have union dues or garnishments deducted from their pay. Use Eigure 5.3 Required: Colculate their net pay using the Percentage Method Tables for Income Tax Withholding in Appendix C. and including Iillinois income tax of 4.95 percent of taxable pay No employee has exceeded the maximum FICA limits. You do not need to complete the number of hours. (Round your intermediate calculations and final answers to 2 decimal places.) 2.5 points Answer is complete but not entirely correct. Marital StatusP Dues per Garnishment per Period Frequency Withholdings Net Pay Pay 97 68798 1,300 24 105 S6.22658 160 1811 50 CWhaley Weokly M. 2 070 Semi M. 61,00090 Peguagemonthly K. Harvey Monthily Bolling Biweeky 9,200 2,620 300