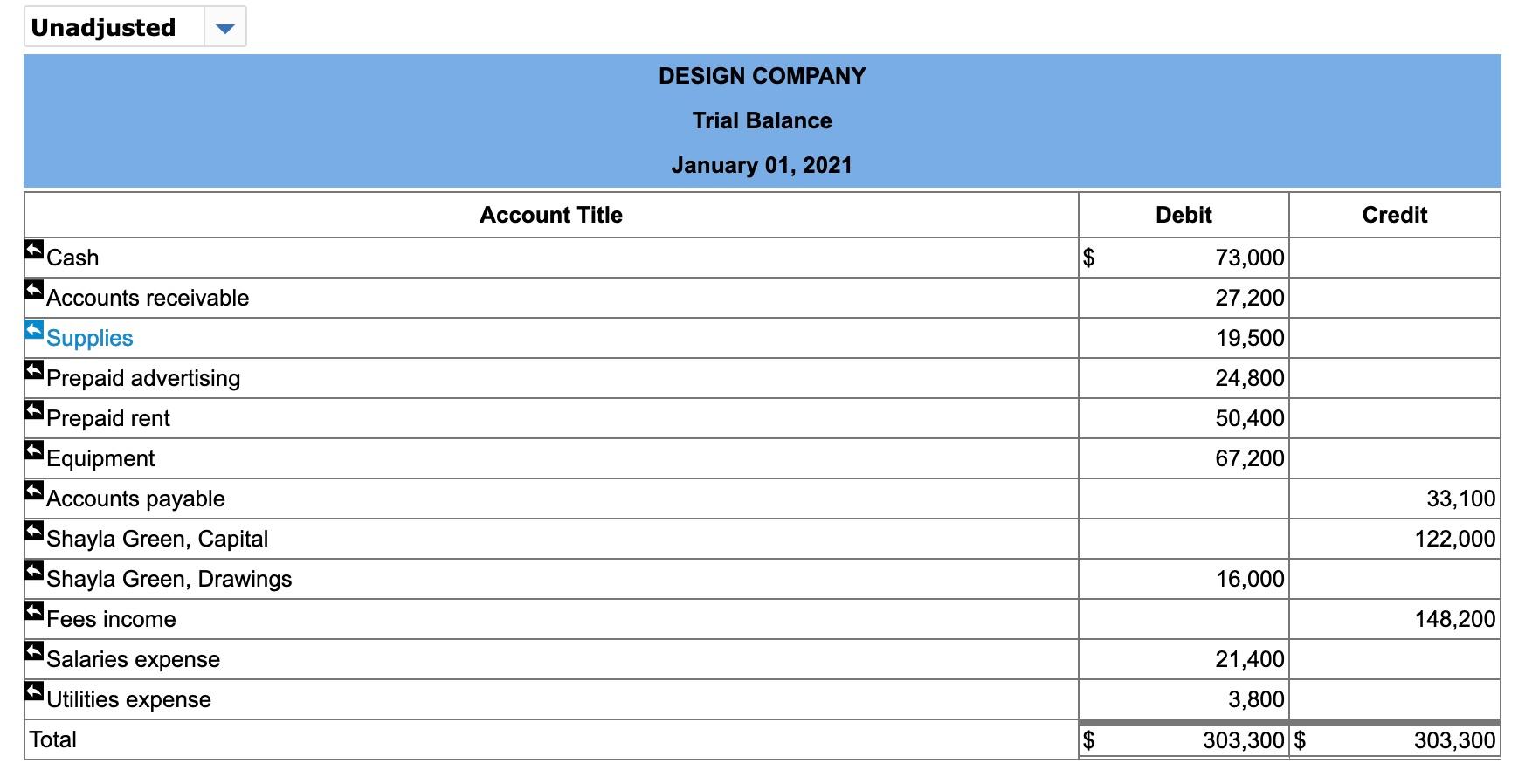

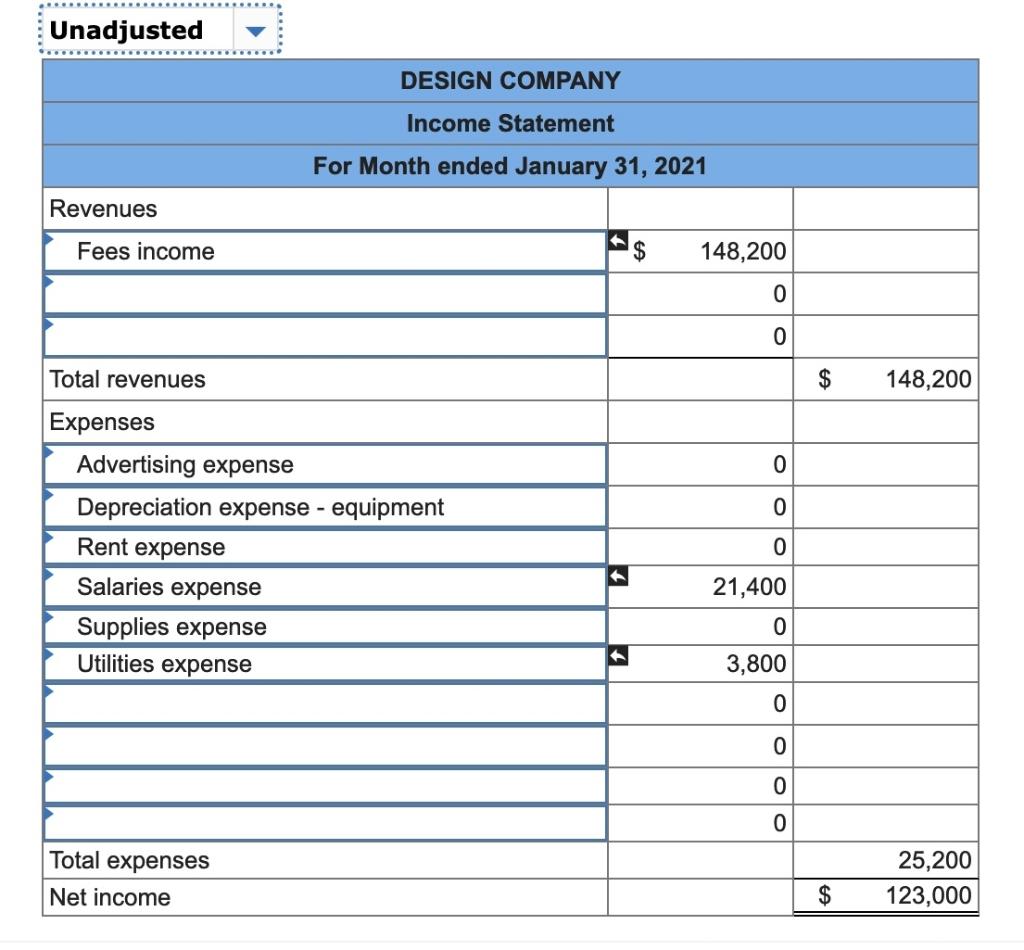

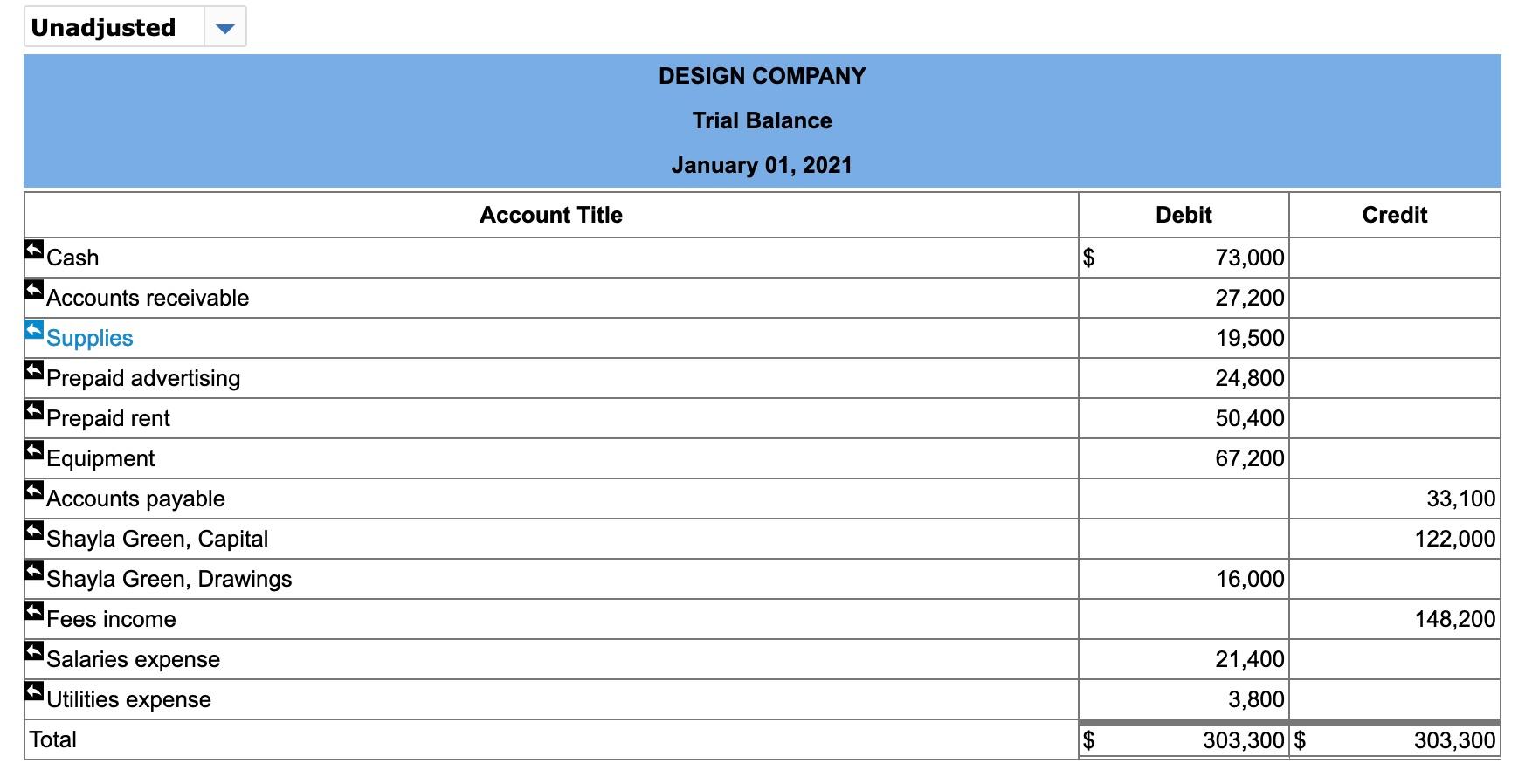

Shayla Green owns Design Company. The trial balance of the firm for January 31, 2021, the first month of operations, is included on the trial balance tab.

| End-of-the-month adjustments must account for the following items: |

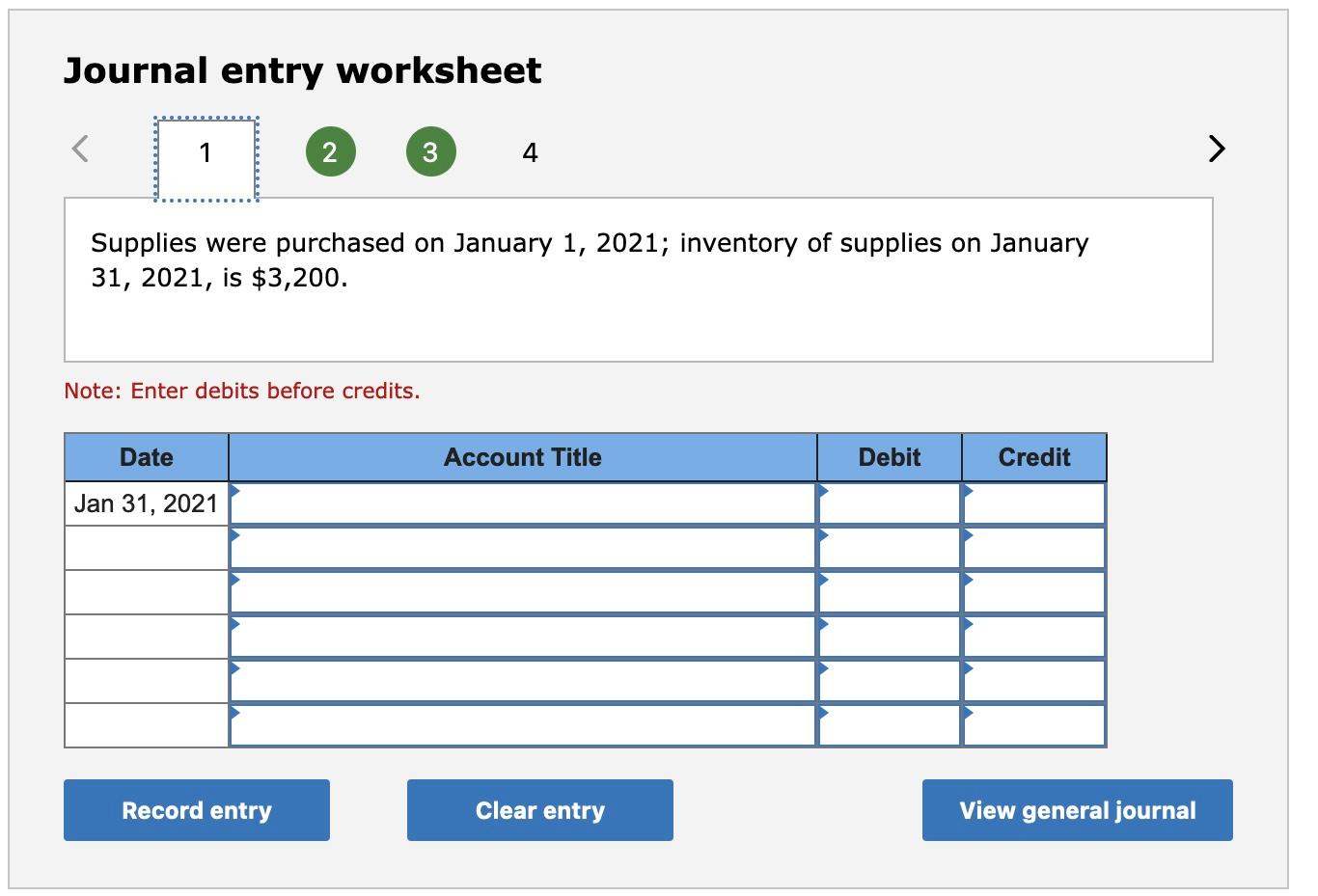

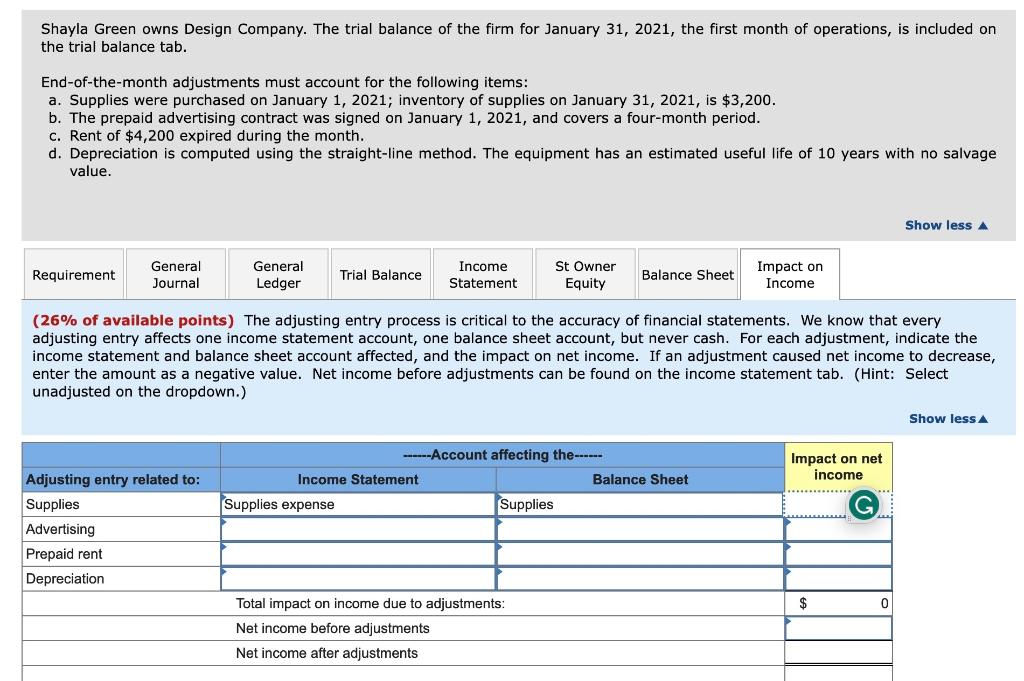

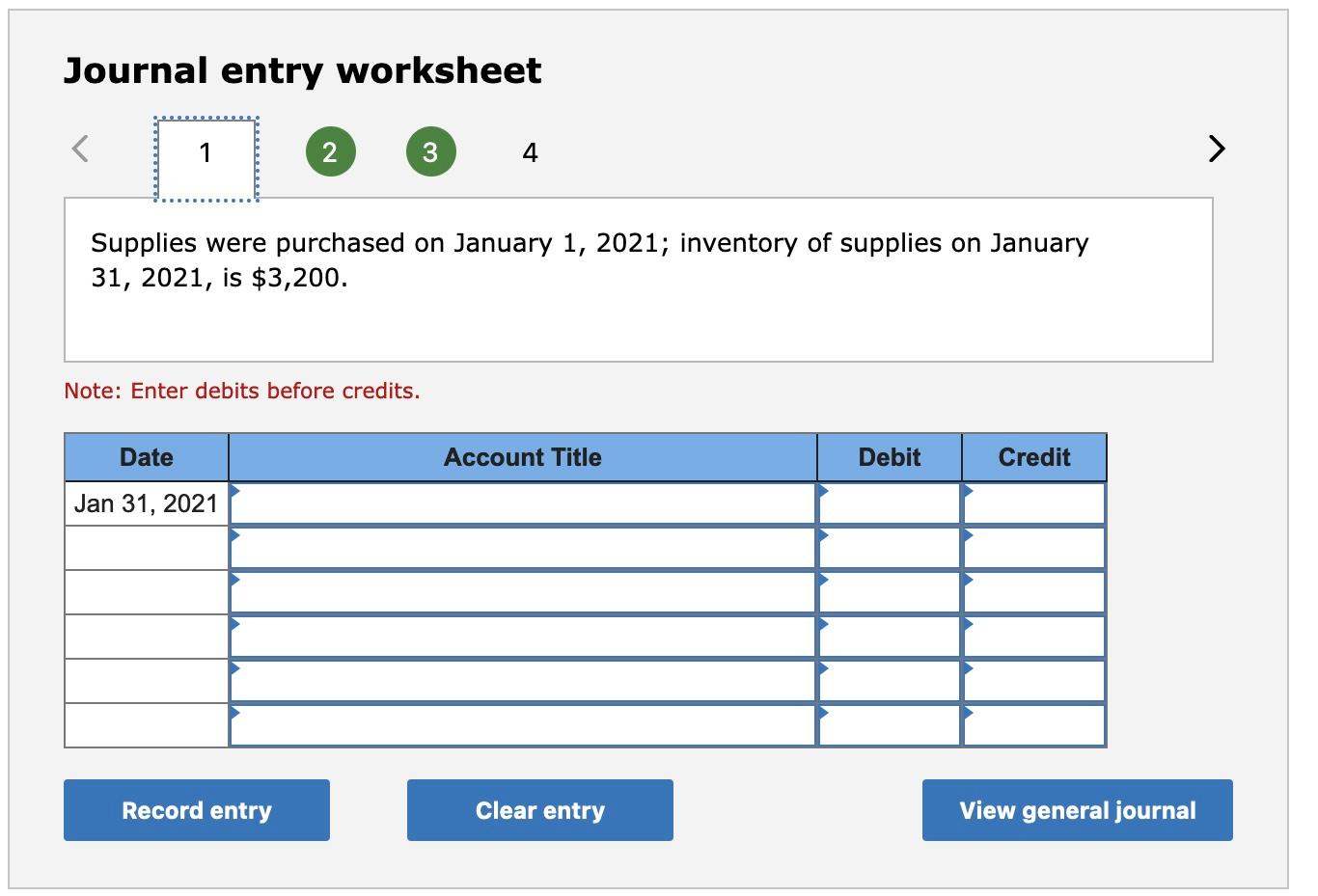

| a. | Supplies were purchased on January 1, 2021; inventory of supplies on January 31, 2021, is $3,200. |

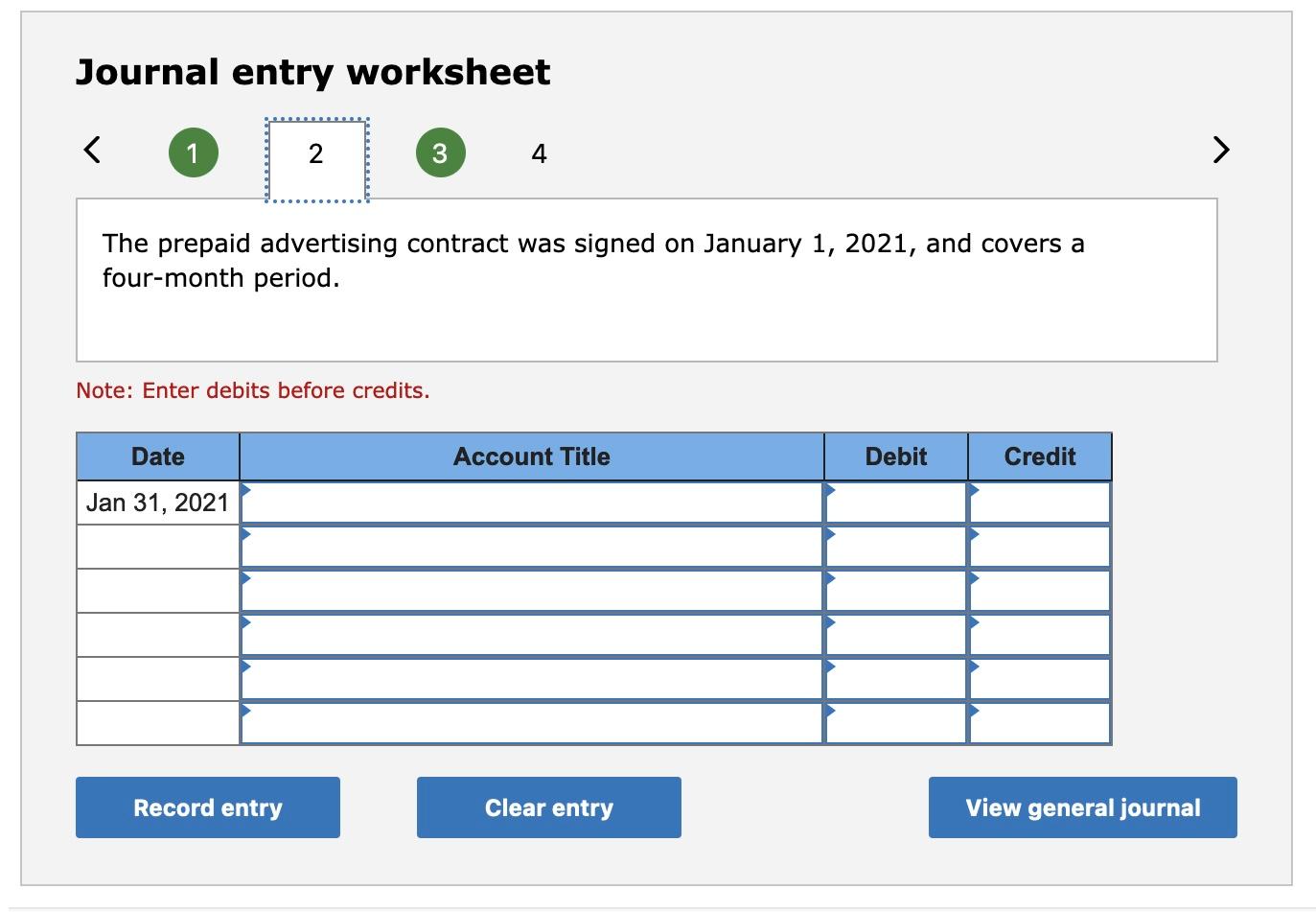

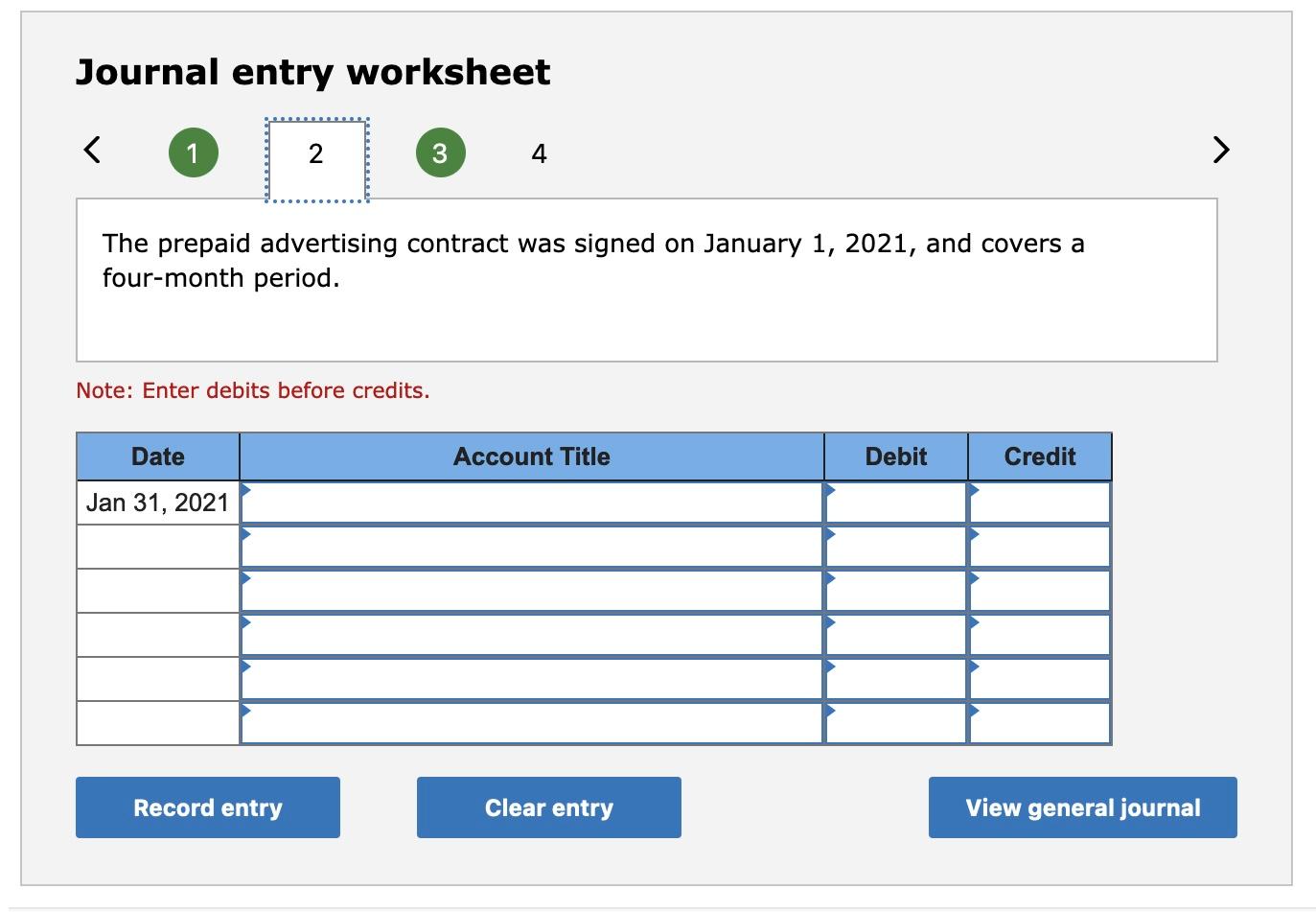

| b. | The prepaid advertising contract was signed on January 1, 2021, and covers a four-month period. |

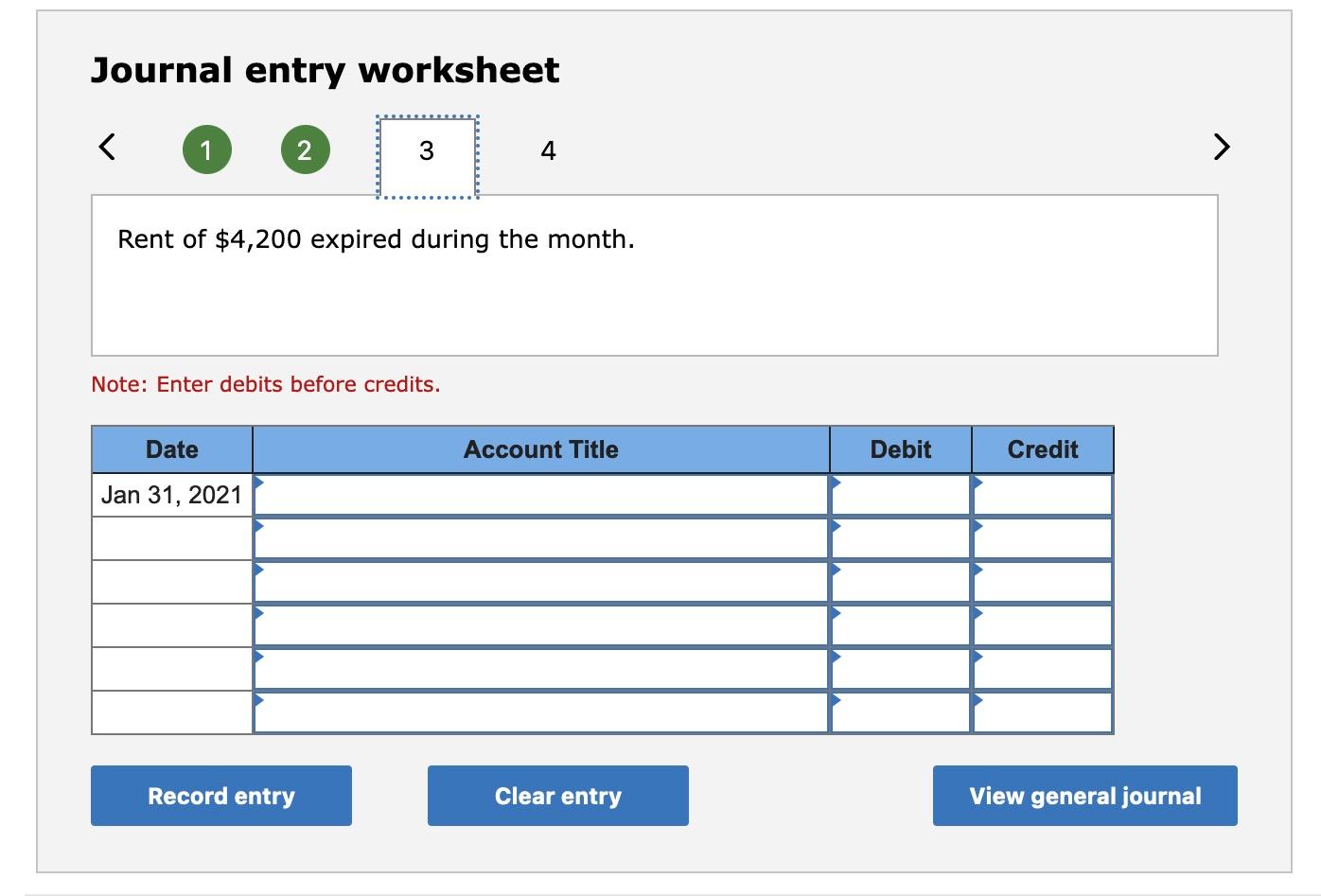

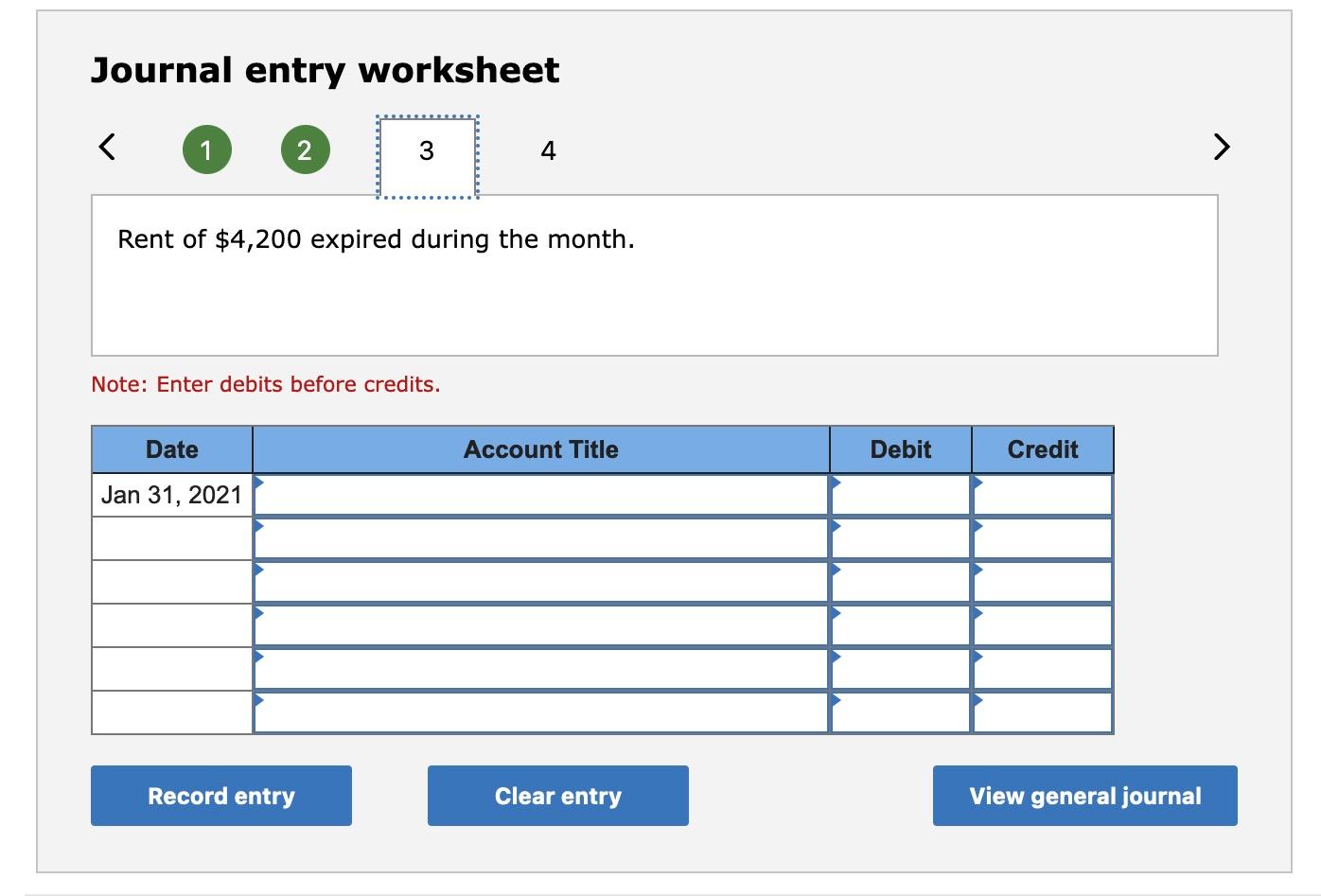

| c. | Rent of $4,200 expired during the month. |

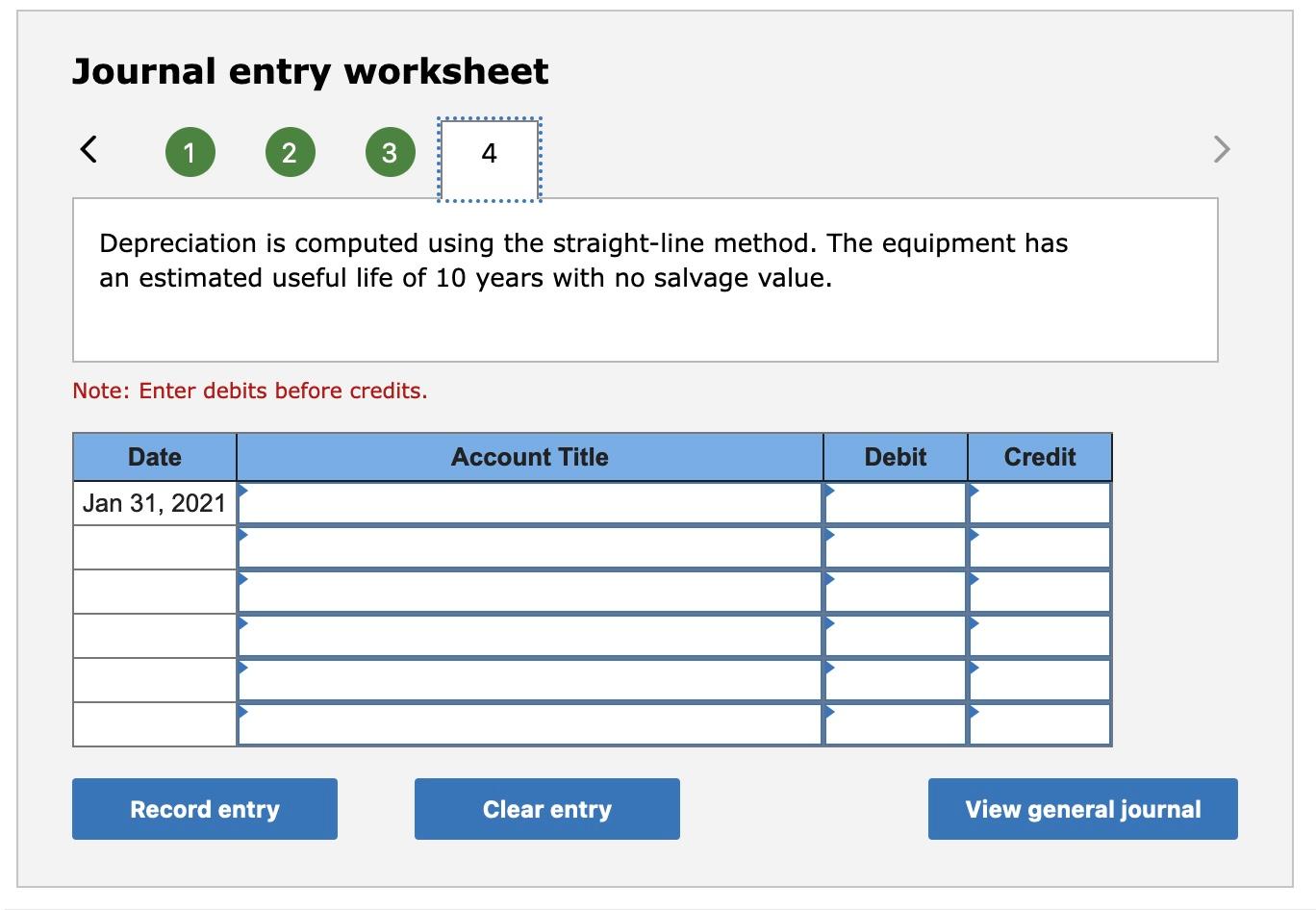

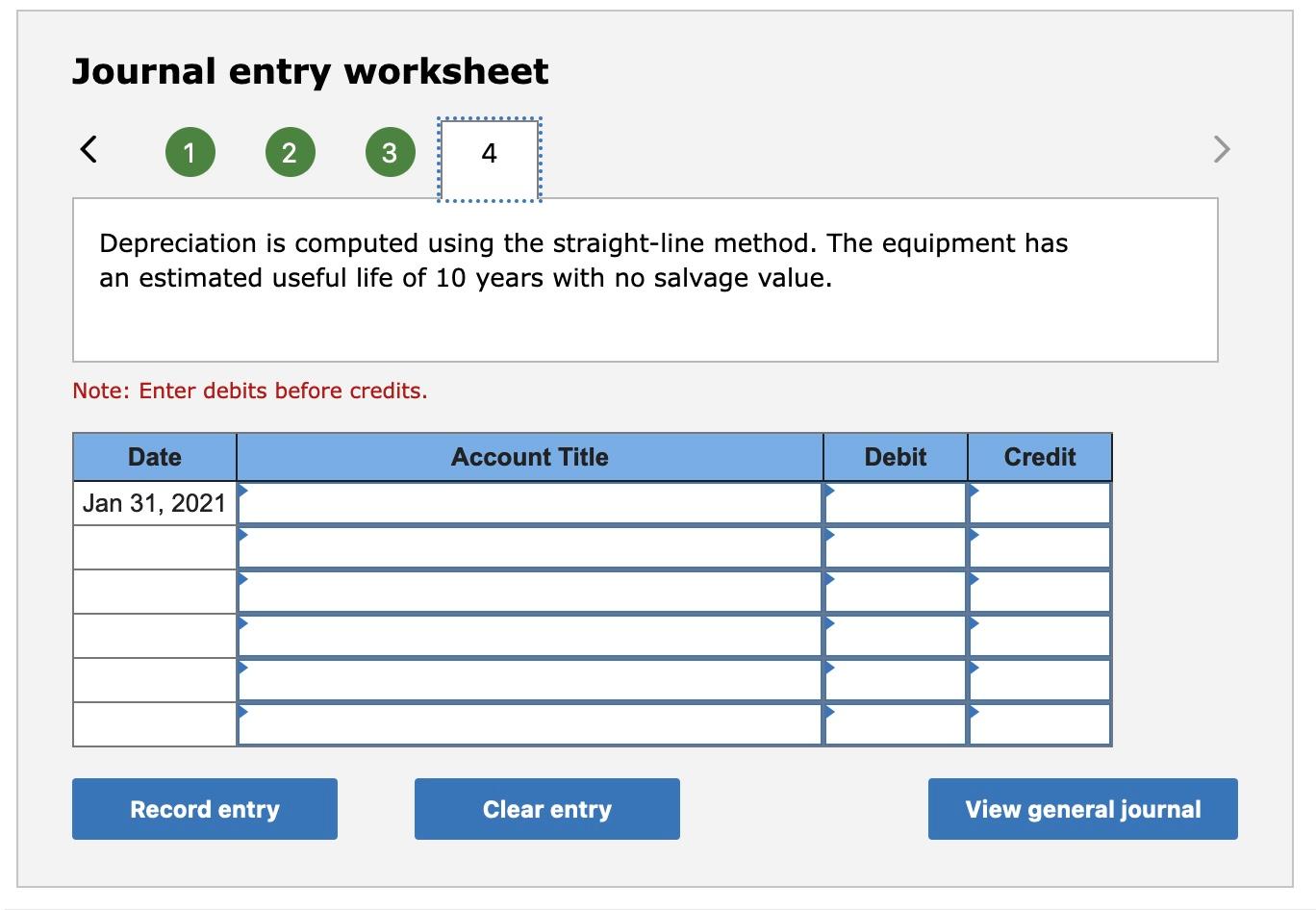

| d. | Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value. |

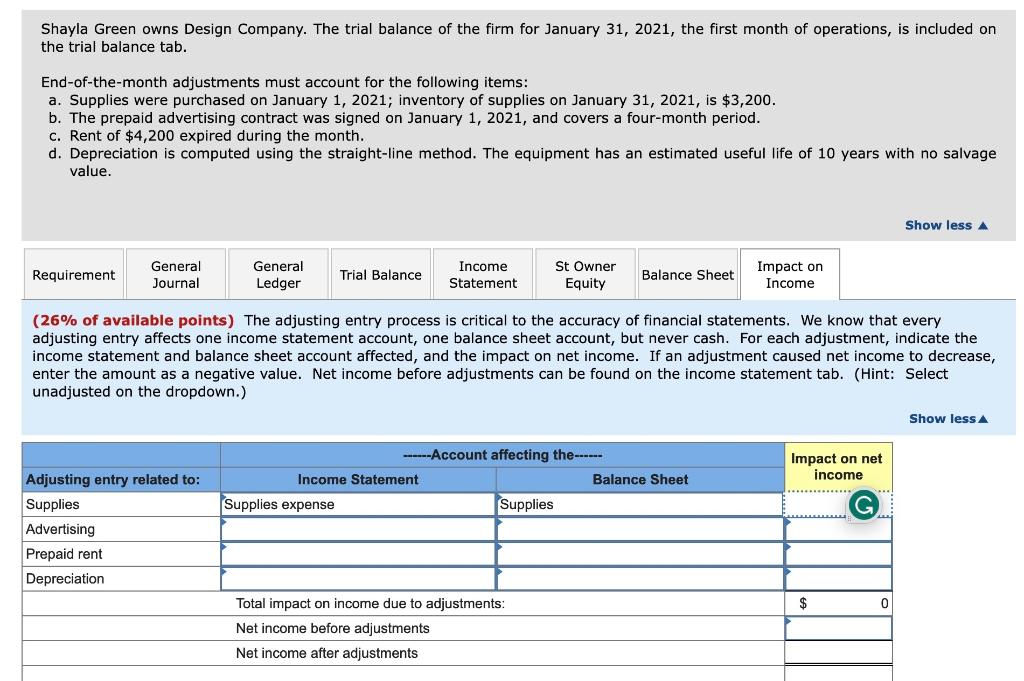

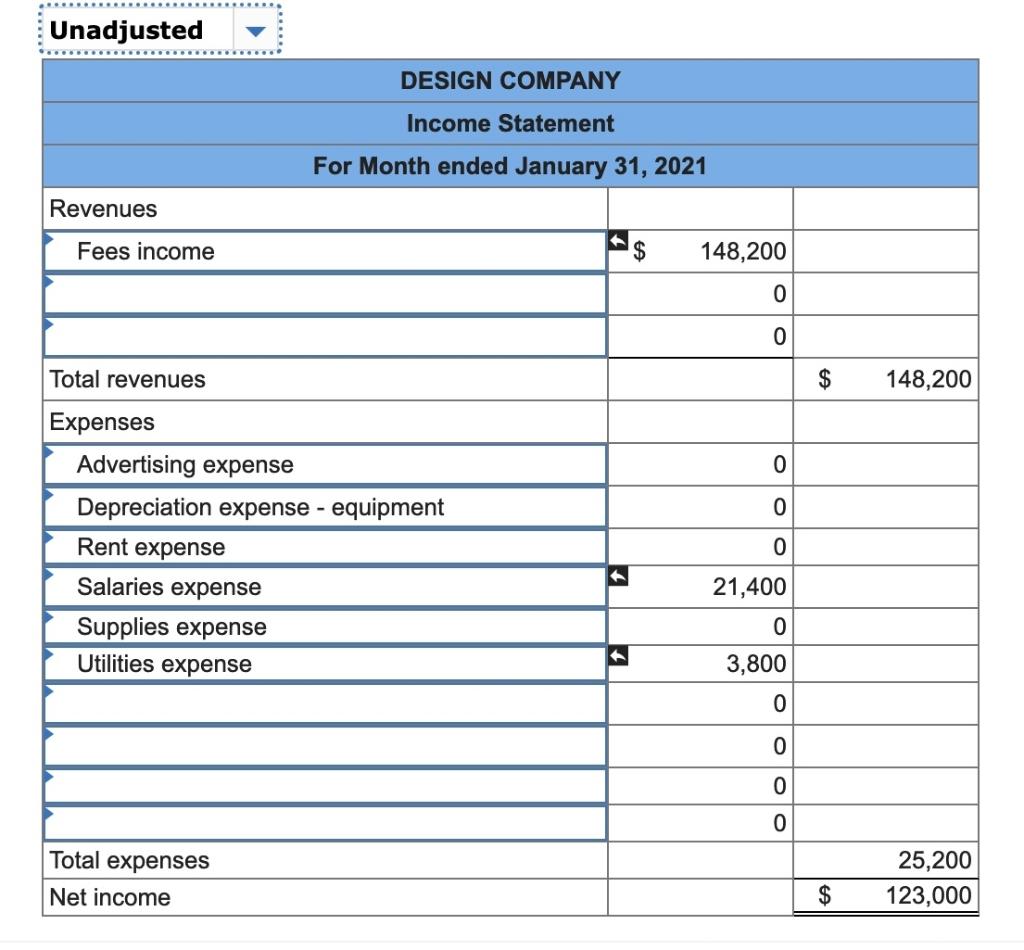

Shayla Green owns Design Company. The trial balance of the firm for January 31,2021 , the first month of operations, is included on the trial balance tab. End-of-the-month adjustments must account for the following items: a. Supplies were purchased on January 1, 2021; inventory of supplies on January 31,2021, is $3,200. b. The prepaid advertising contract was signed on January 1,2021 , and covers a four-month period. c. Rent of $4,200 expired during the month. d. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value. (26\% of available points) The adjusting entry process is critical to the accuracy of financial statements. We know that every adjusting entry affects one income statement account, one balance sheet account, but never cash. For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown.) Journal entry worksheet The prepaid advertising contract was signed on January 1, 2021, and covers a four-month period. Note: Enter debits before credits. Journal entry worksheet Rent of $4,200 expired during the month. Note: Enter debits before credits. Journal entry worksheet Supplies were purchased on January 1, 2021; inventory of supplies on January 31,2021 , is $3,200. Note: Enter debits before credits. Journal entry worksheet Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value. Note: Enter debits before credits. Unadjusted Unadjusted General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 2021 & & & 73,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 2021 & & & 27,200 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Supplies } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01,2021 & & & 19,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Prepaid advertising } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 2021 & & & 24,800 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Prepaid rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01,2021 & & & 50,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01,2021 & & & 67,200 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 0021 & & & 33,100 \\ \hline \end{tabular} Shayla Green, Capital \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Shayla Green, Drawings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 16,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Fees income } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 2021 & & & 148,200 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01,2021 & & & 21,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Utilities expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Jan 01, 2021 & & & 3,800 \\ \hline \end{tabular} Unadjusted DESIGN COMPANY Trial Balance January 01, 2021