Answered step by step

Verified Expert Solution

Question

1 Approved Answer

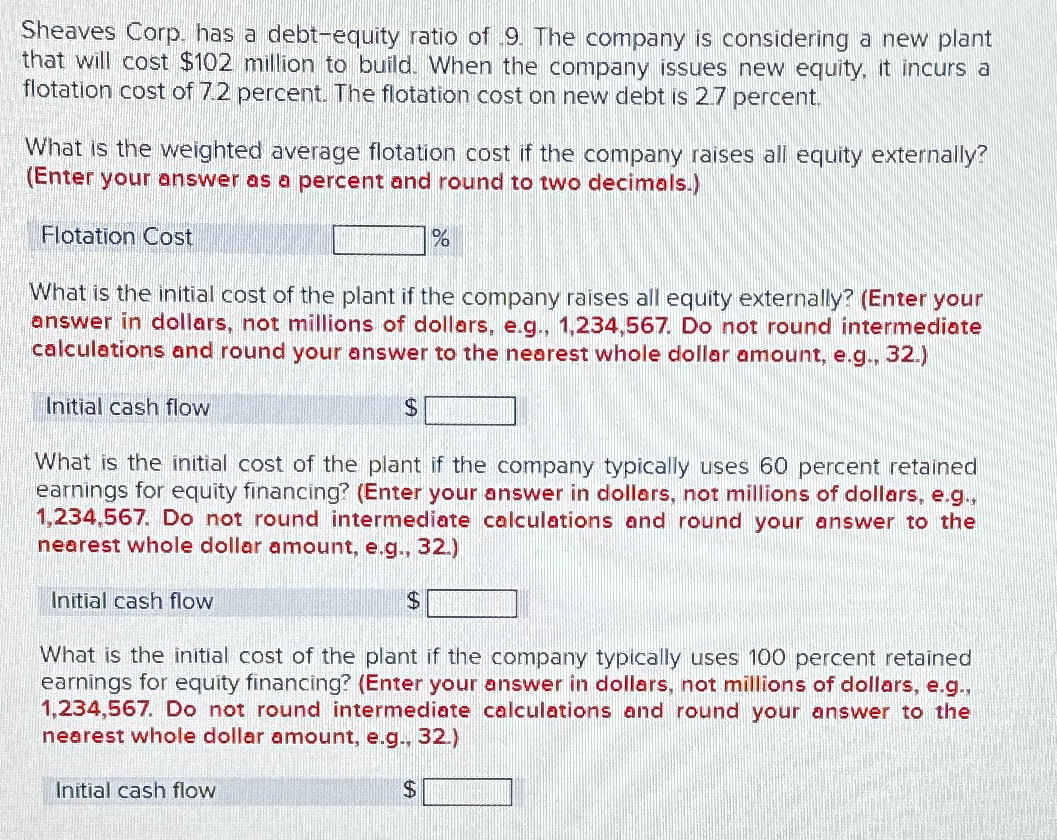

Sheaves Corp. has a debt - equity ratio of 9 . The company is considering a new plant that will cost $ 1 0 2

Sheaves Corp. has a debtequity ratio of The company is considering a new plant that will cost $ million to build. When the company issues new equity, it incurs a flotation cost of percent. The flotation cost on new debt is percent.

What is the weighted average flotation cost if the company raises all equity externally? Enter your answer as a percent and round to two decimals.

Flotation Cost

What is the initial cost of the plant if the company raises all equity externally? Enter your answer in dollars, not millions of dollars, eg Do not round intermediate calculations and round your answer to the nearest whole dollar amount, eg

Initial cash flow

$

What is the initial cost of the plant if the company typically uses percent retained earnings for equity financing? Enter your answer in dollars, not millions of dollars, eg Do not round intermediate calculations and round your answer to the nearest whole dollar amount, eg

Initial cash flow

$

What is the initial cost of the plant if the company typically uses percent retained earnings for equity financing? Enter your answer in dollars, not millions of dollars, eg Do not round intermediate calculations and round your answer to the nearest whole dollar amount, eg

Initial cash flow

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started