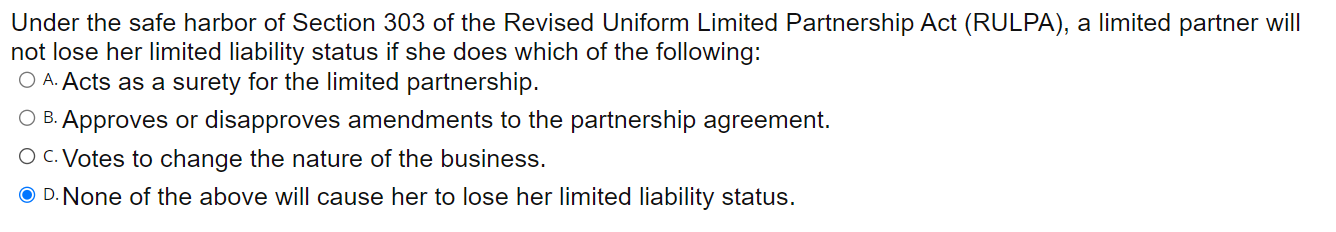

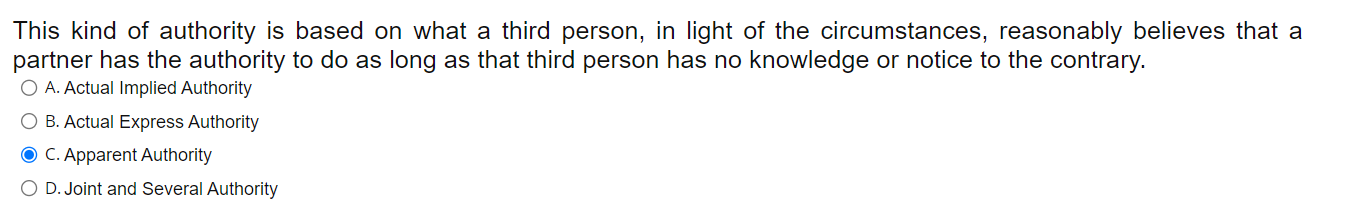

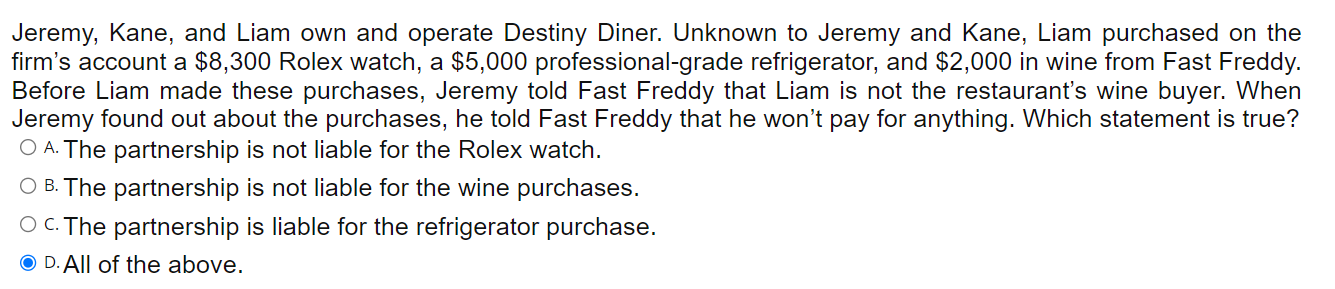

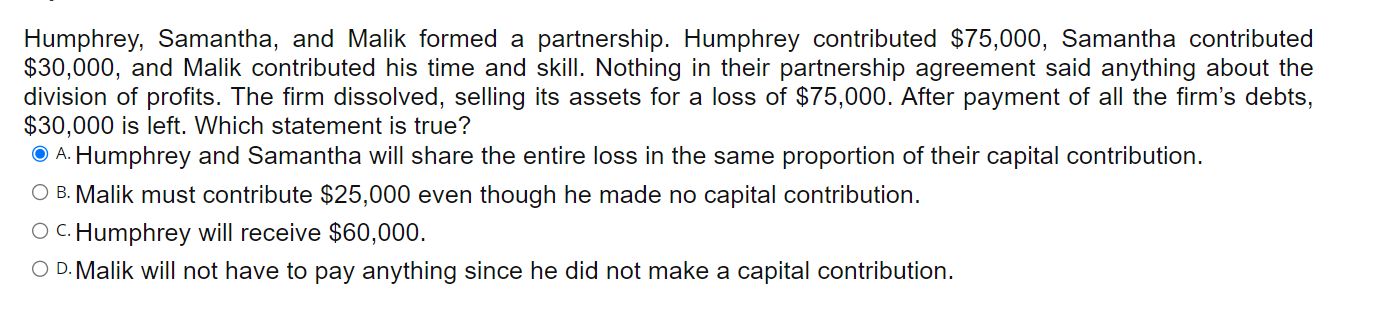

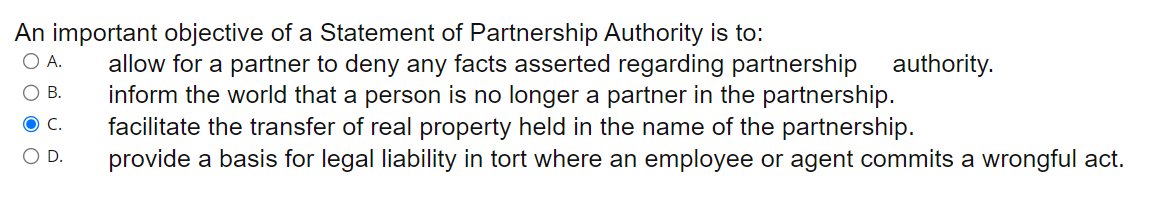

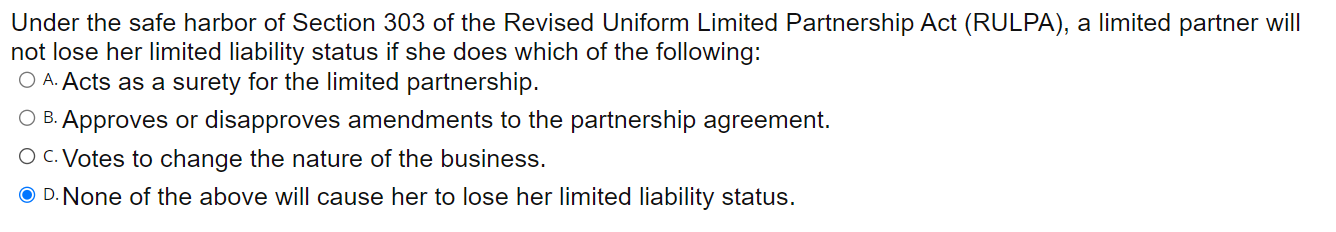

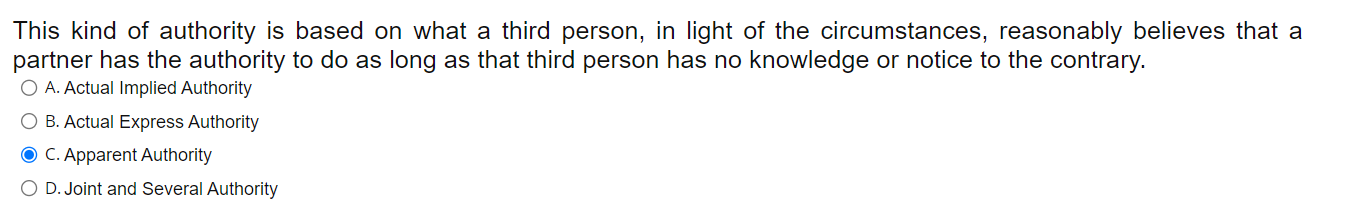

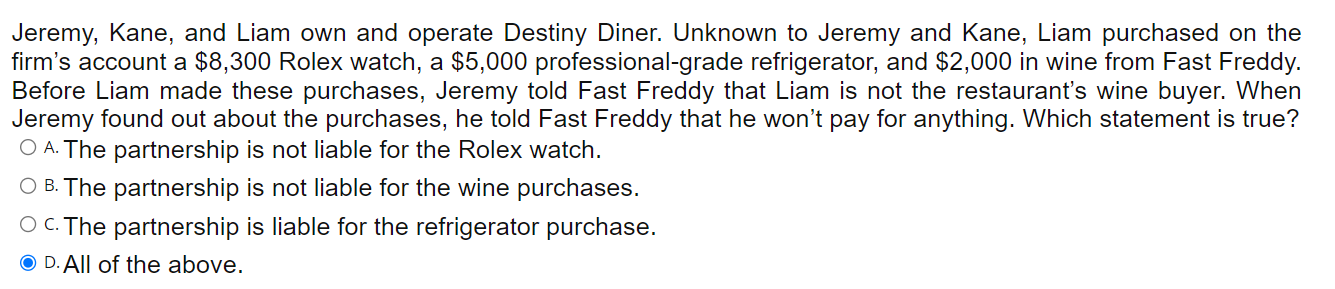

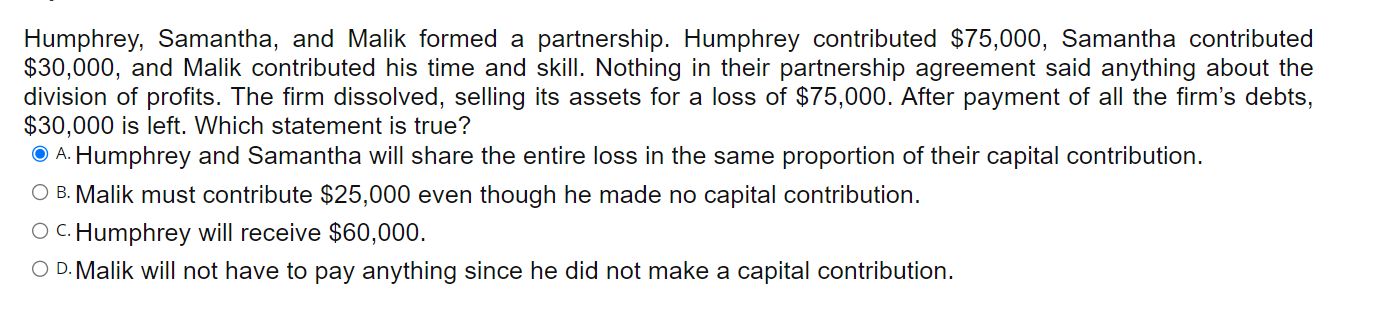

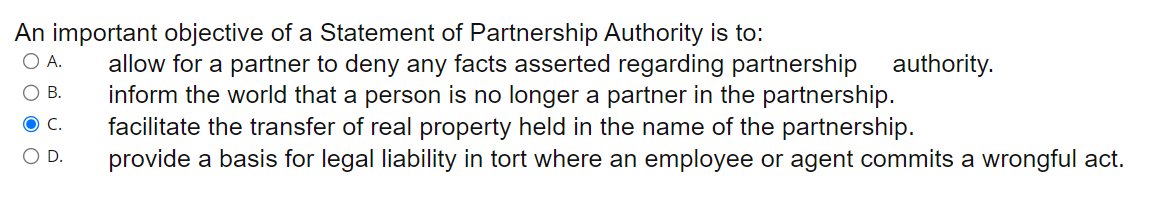

Under the safe harbor of Section 303 of the Revised Uniform Limited Partnership Act (RULPA), a limited partner will not lose her limited liability status if she does which of the following: A. Acts as a surety for the limited partnership. B. Approves or disapproves amendments to the partnership agreement. c. Votes to change the nature of the business. D. None of the above will cause her to lose her limited liability status. This kind of authority is based on what a third person, in light of the circumstances, reasonably believes that a partner has the authority to do as long as that third person has no knowledge or notice to the contrary. A. Actual Implied Authority B. Actual Express Authority C. Apparent Authority D. Joint and Several Authority Jeremy, Kane, and Liam own and operate Destiny Diner. Unknown to Jeremy and Kane, Liam purchased on the firm's account a $8,300 Rolex watch, a $5,000 professional-grade refrigerator, and $2,000 in wine from Fast Freddy. Before Liam made these purchases, Jeremy told Fast Freddy that Liam is not the restaurant's wine buyer. When Jeremy found out about the purchases, he told Fast Freddy that he won't pay for anything. Which statement is true? A. The partnership is not liable for the Rolex watch. B. The partnership is not liable for the wine purchases. c. The partnership is liable for the refrigerator purchase. D. All of the above. Humphrey, Samantha, and Malik formed a partnership. Humphrey contributed $75,000, Samantha contributed $30,000, and Malik contributed his time and skill. Nothing in their partnership agreement said anything about the division of profits. The firm dissolved, selling its assets for a loss of $75,000. After payment of all the firm's debts, $30,000 is left. Which statement is true? A. Humphrey and Samantha will share the entire loss in the same proportion of their capital contribution. B. Malik must contribute $25,000 even though he made no capital contribution. c. Humphrey will receive $60,000. D. Malik will not have to pay anything since he did not make a capital contribution. An important objective of a Statement of Partnership Authority is to: A. allow for a partner to deny any facts asserted regarding partnership authority. B. inform the world that a person is no longer a partner in the partnership. c. facilitate the transfer of real property held in the name of the partnership. D. provide a basis for legal liability in tort where an employee or agent commits a wrongful act. Under the safe harbor of Section 303 of the Revised Uniform Limited Partnership Act (RULPA), a limited partner will not lose her limited liability status if she does which of the following: A. Acts as a surety for the limited partnership. B. Approves or disapproves amendments to the partnership agreement. c. Votes to change the nature of the business. D. None of the above will cause her to lose her limited liability status. This kind of authority is based on what a third person, in light of the circumstances, reasonably believes that a partner has the authority to do as long as that third person has no knowledge or notice to the contrary. A. Actual Implied Authority B. Actual Express Authority C. Apparent Authority D. Joint and Several Authority Jeremy, Kane, and Liam own and operate Destiny Diner. Unknown to Jeremy and Kane, Liam purchased on the firm's account a $8,300 Rolex watch, a $5,000 professional-grade refrigerator, and $2,000 in wine from Fast Freddy. Before Liam made these purchases, Jeremy told Fast Freddy that Liam is not the restaurant's wine buyer. When Jeremy found out about the purchases, he told Fast Freddy that he won't pay for anything. Which statement is true? A. The partnership is not liable for the Rolex watch. B. The partnership is not liable for the wine purchases. c. The partnership is liable for the refrigerator purchase. D. All of the above. Humphrey, Samantha, and Malik formed a partnership. Humphrey contributed $75,000, Samantha contributed $30,000, and Malik contributed his time and skill. Nothing in their partnership agreement said anything about the division of profits. The firm dissolved, selling its assets for a loss of $75,000. After payment of all the firm's debts, $30,000 is left. Which statement is true? A. Humphrey and Samantha will share the entire loss in the same proportion of their capital contribution. B. Malik must contribute $25,000 even though he made no capital contribution. c. Humphrey will receive $60,000. D. Malik will not have to pay anything since he did not make a capital contribution. An important objective of a Statement of Partnership Authority is to: A. allow for a partner to deny any facts asserted regarding partnership authority. B. inform the world that a person is no longer a partner in the partnership. c. facilitate the transfer of real property held in the name of the partnership. D. provide a basis for legal liability in tort where an employee or agent commits a wrongful act