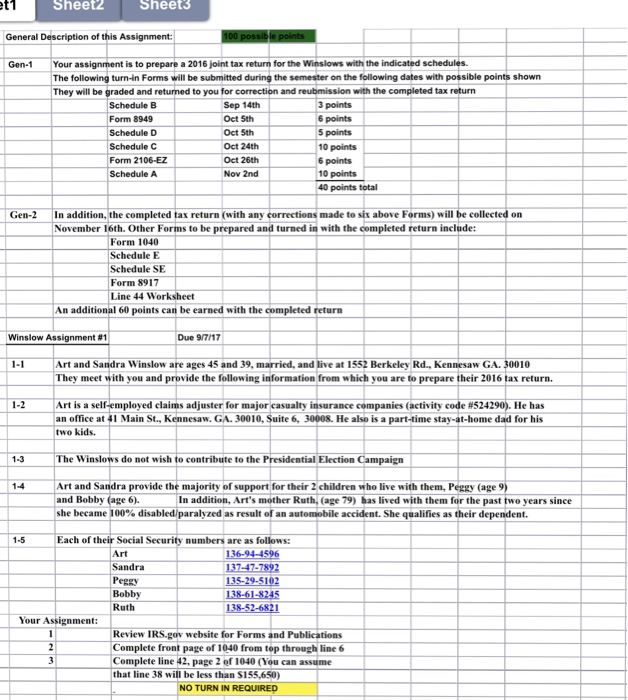

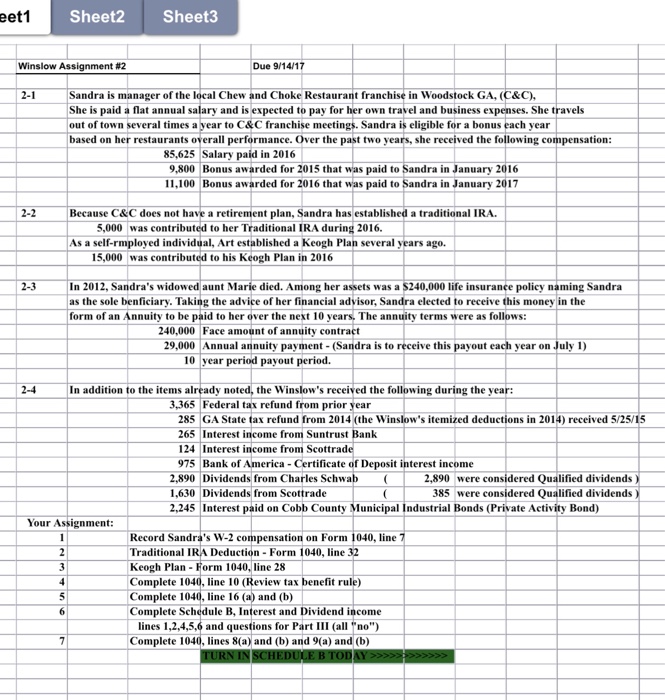

Sheet Sheet3 General Description of this Assignment: Your assignment is to prepare a 2016 joint tax return for the Winslows with the indicated schedules. The following turn-in Forms will be submitted during the semester on the following dates with possible points shown They will be graded and retumed to you for correction and reubmission with the completed tax return Gen-1 Schedule B Form 8949 Schedule D Schedule C Form 2106-EZ Schedule A Sep 14th Oct 5th Oct 5th Oct 24th Oct 26th Nov 2nd 3 points 6 points 5 points 10 points 6 points 10 points 40 points total n addition, the completed tax return (with any corrections made to six above Forms) will be collected on November 16th. Other Forms to be prepared and turned in with the completed return include: Gen-2I Form 1040 Schedule E Schedule SE Form 8917 Line 44 Worksheet An additional 60 points can be earned with the completed return Winslow Assignment #1 Due 9/7/17 1-1 Art and Sandra Winslow are ages 45 and 39, married, and live at 1552 Berkeley Rd., Kennesaw GA. 30010 They meet with you and provide the following information from which you are to prepare their 2016 tax return Art is a self-employed claims adjuster for major casualty insurance companies (activity code #524290). He has an office at 41 Main St, Kennesaw. GA. 30010, Suite 6,30008. He also is a part-time stay-at-home dad for his 1-2 two kids. 1-3 The Winslows do not wish to contribute to the Presidential Election 1-4 Art and Sandra provide the majority of support for their 2 children who live with them, Peggy (age 9 and Bobby (age 6) she became 100% disabled/paralyzed as result of an automobile accident. She qualifies as their dependent. In addition, Art's mother Ruth, (age79) bas lived with them for the past two years sinee 1-5 Each of their Social Security numbers are as follows Art Sandra Peggy Bobby Ruth 16944596 37-47-7892 135-29 5193 51-4821 Your Assignment: Review IRS.gov website for Forms and Publications Complete front page of 1040 from top through line 6 Complete line 42, page 2 of 1040 (You can assume that line 38 will be less than $155,650) NO TURN IN REQUIRED Sheet Sheet3 General Description of this Assignment: Your assignment is to prepare a 2016 joint tax return for the Winslows with the indicated schedules. The following turn-in Forms will be submitted during the semester on the following dates with possible points shown They will be graded and retumed to you for correction and reubmission with the completed tax return Gen-1 Schedule B Form 8949 Schedule D Schedule C Form 2106-EZ Schedule A Sep 14th Oct 5th Oct 5th Oct 24th Oct 26th Nov 2nd 3 points 6 points 5 points 10 points 6 points 10 points 40 points total n addition, the completed tax return (with any corrections made to six above Forms) will be collected on November 16th. Other Forms to be prepared and turned in with the completed return include: Gen-2I Form 1040 Schedule E Schedule SE Form 8917 Line 44 Worksheet An additional 60 points can be earned with the completed return Winslow Assignment #1 Due 9/7/17 1-1 Art and Sandra Winslow are ages 45 and 39, married, and live at 1552 Berkeley Rd., Kennesaw GA. 30010 They meet with you and provide the following information from which you are to prepare their 2016 tax return Art is a self-employed claims adjuster for major casualty insurance companies (activity code #524290). He has an office at 41 Main St, Kennesaw. GA. 30010, Suite 6,30008. He also is a part-time stay-at-home dad for his 1-2 two kids. 1-3 The Winslows do not wish to contribute to the Presidential Election 1-4 Art and Sandra provide the majority of support for their 2 children who live with them, Peggy (age 9 and Bobby (age 6) she became 100% disabled/paralyzed as result of an automobile accident. She qualifies as their dependent. In addition, Art's mother Ruth, (age79) bas lived with them for the past two years sinee 1-5 Each of their Social Security numbers are as follows Art Sandra Peggy Bobby Ruth 16944596 37-47-7892 135-29 5193 51-4821 Your Assignment: Review IRS.gov website for Forms and Publications Complete front page of 1040 from top through line 6 Complete line 42, page 2 of 1040 (You can assume that line 38 will be less than $155,650) NO TURN IN REQUIRED