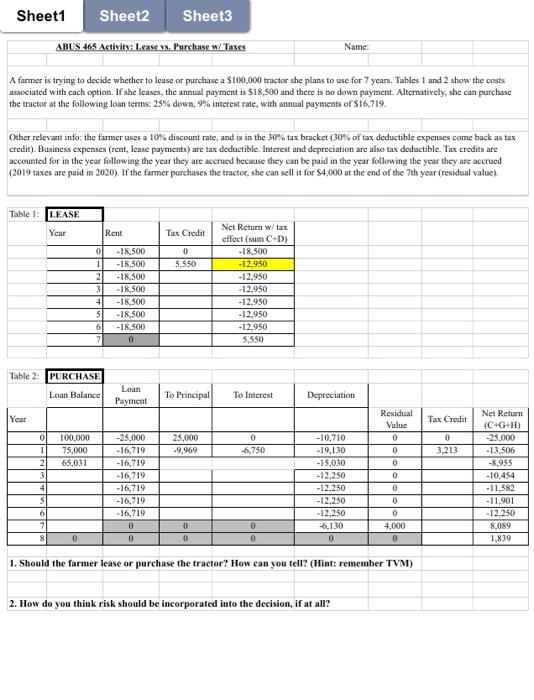

Sheet1 Sheet2 Sheet3 ABUS 465 Activity: Lease vs. Purchase w/ Taxes Name: A farmer is trying to decide whether to lease or purchase a $100,000 tractor she plans to use for 7 years. Tables 1 and 2 show the costs associated with each option. If she leases, the annual payment is $18,500 and there is no down payment. Alternatively, she can purchase the tractor at the following loan terms: 25% down, 9% interest rate, with annual payments of $16,719. Other relevant info: the farmer uses a 10% discount rate, and is in the 30% tax bracket (30% of tax deductible expenses come back as tax credit). Business expenses (rent, lease payments) are tax deductible. Interest and depreciation are also tax deductible. Tax credits are accounted for in the year following the year they are accrued because they can be paid in the year following the year they are accrued (2019 taxes are paid in 2020). If the farmer purchases the tractor, she can sell it for $4,000 at the end of the 7th year (residual value). Table 1: LEASE Year Rent Tax Credit Net Return w/ tax effect (sum C+D) -18,500 0 -18,500 -18,500 5,550 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 0 5,550 Loan To Interest Depreciation Payment Residual Value Net Return (C+G+H) -25,000 0 -10,710 0 -25,000 -16,719 -6,750 -19,130 0 -13,506 -16,719 -15,030 0 -8,955 -16,719 -12,250 0 -10,454 -16,719 -12,250 0 -11,582 -16,719 -12,250 0 -11,901 -16,719 -12.250 0 -12.250 7 0 -6,130 4,000 8,089 0 0 8 0 0 0 0 0 1,839 1. Should the farmer lease or purchase the tractor? How can you tell? (Hint: remember TVM) 2. How do you think risk should be incorporated into the decision, if at all? Table 2: Year 0 1 2 3 4 5 6 0 1 2 3 4 5 6 PURCHASE Loan Balance 100,000 75,000 65,031 To Principal 25,000 -9,969 0 Tax Credit 0 3,213 Sheet1 Sheet2 Sheet3 ABUS 465 Activity: Lease vs. Purchase w/ Taxes Name: A farmer is trying to decide whether to lease or purchase a $100,000 tractor she plans to use for 7 years. Tables 1 and 2 show the costs associated with each option. If she leases, the annual payment is $18,500 and there is no down payment. Alternatively, she can purchase the tractor at the following loan terms: 25% down, 9% interest rate, with annual payments of $16,719. Other relevant info: the farmer uses a 10% discount rate, and is in the 30% tax bracket (30% of tax deductible expenses come back as tax credit). Business expenses (rent, lease payments) are tax deductible. Interest and depreciation are also tax deductible. Tax credits are accounted for in the year following the year they are accrued because they can be paid in the year following the year they are accrued (2019 taxes are paid in 2020). If the farmer purchases the tractor, she can sell it for $4,000 at the end of the 7th year (residual value). Table 1: LEASE Year Rent Tax Credit Net Return w/ tax effect (sum C+D) -18,500 0 -18,500 -18,500 5,550 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 -18,500 -12,950 0 5,550 Loan To Interest Depreciation Payment Residual Value Net Return (C+G+H) -25,000 0 -10,710 0 -25,000 -16,719 -6,750 -19,130 0 -13,506 -16,719 -15,030 0 -8,955 -16,719 -12,250 0 -10,454 -16,719 -12,250 0 -11,582 -16,719 -12,250 0 -11,901 -16,719 -12.250 0 -12.250 7 0 -6,130 4,000 8,089 0 0 8 0 0 0 0 0 1,839 1. Should the farmer lease or purchase the tractor? How can you tell? (Hint: remember TVM) 2. How do you think risk should be incorporated into the decision, if at all? Table 2: Year 0 1 2 3 4 5 6 0 1 2 3 4 5 6 PURCHASE Loan Balance 100,000 75,000 65,031 To Principal 25,000 -9,969 0 Tax Credit 0 3,213