sheets that ar already prepared:

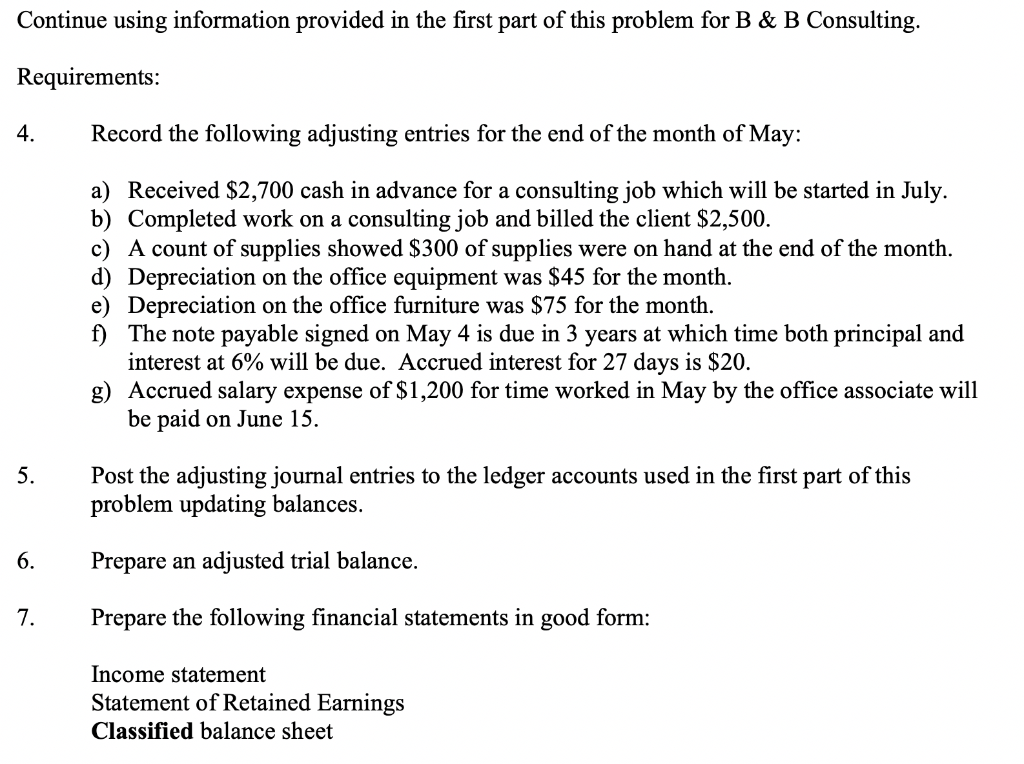

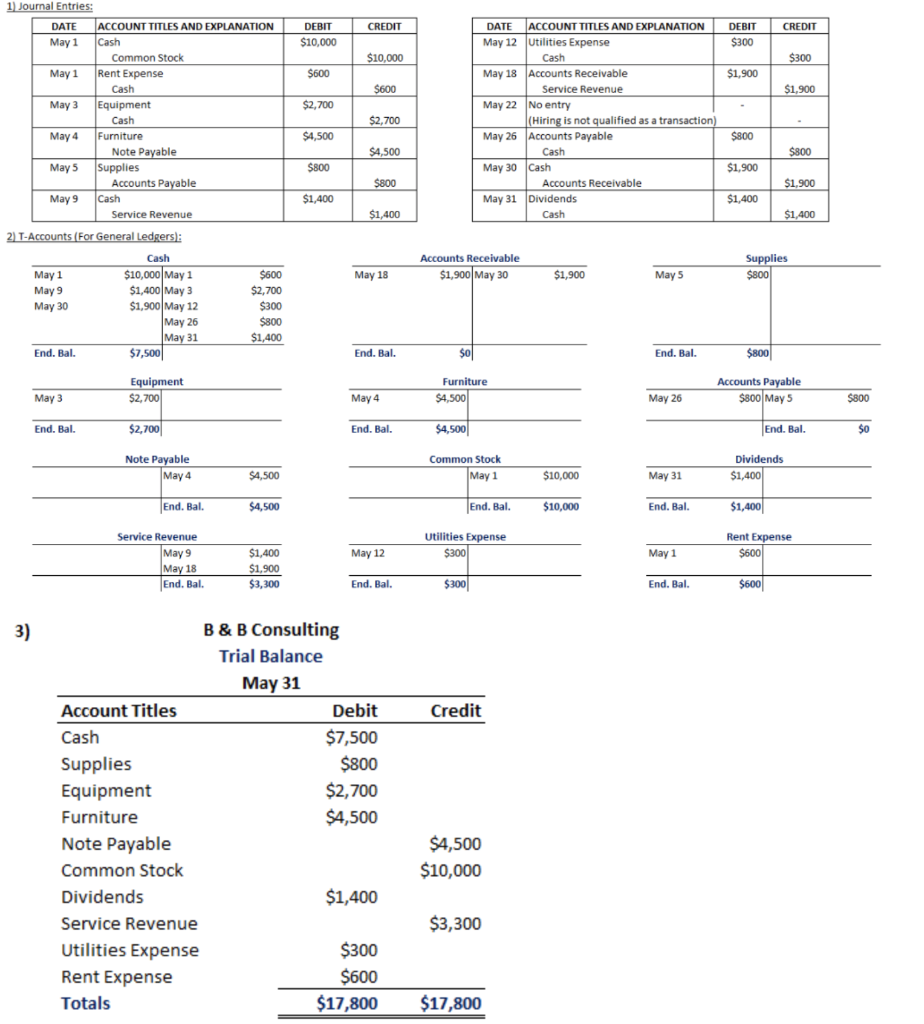

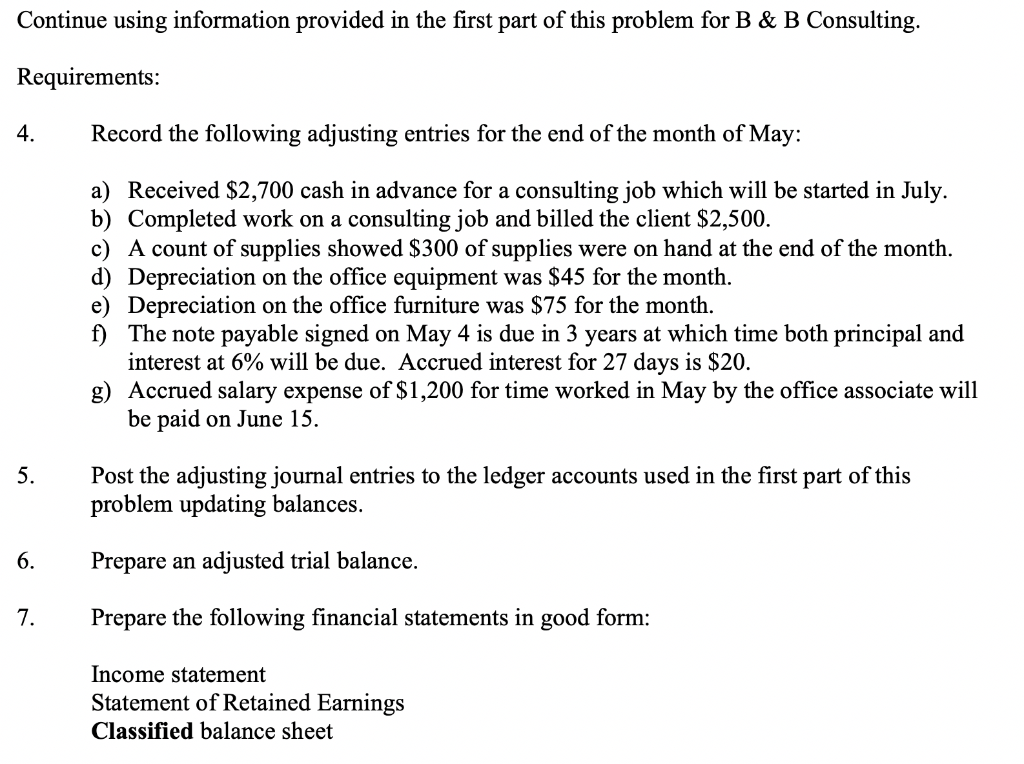

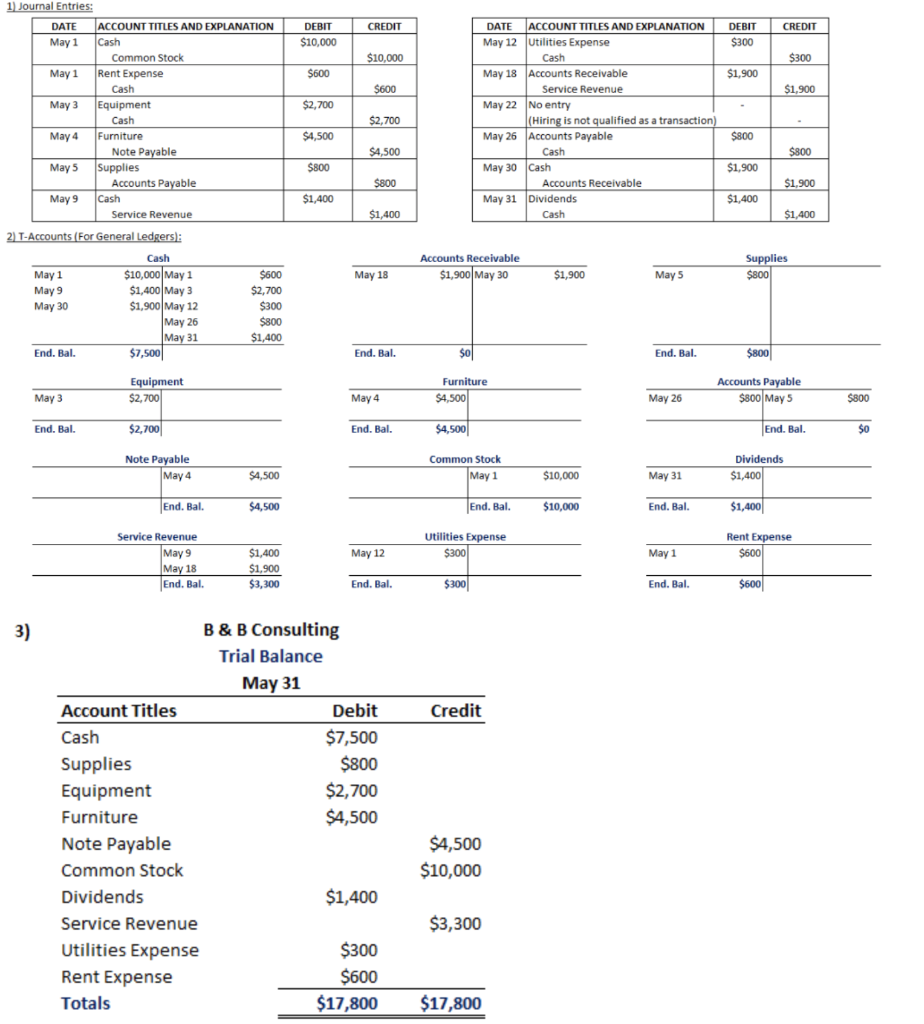

Continue using information provided in the first part of this problem for B & B Consulting. Requirements: 4. Record the following adjusting entries for the end of the month of May: a) Received $2,700 cash in advance for a consulting job which will be started in July b) Completed work on a consulting job and billed the client $2,500 c) A count of supplies showed $300 of supplies d) Depreciation on the office equipment e) Depreciation f) The note payable signed interest at 6% will be due. Accrued interest for 27 days is $20 g) Accrued salary expense of $1,200 for time worked in May by the office associate will be paid were on hand at the end of the month. was $45 for the month. on the office furniture was $75 for the month May 4 is due in 3 years at which time both principal and on on June 15, Post the adjusting journal entries to the ledger accounts used in the first part of this 5. problem updating balances. 6. Prepare an adjusted trial balance. 7. Prepare the following financial statements in good form: Income statement Statement of Retained Earnings Classified balance sheet 1 Journal Entries: ACCOUNT TITLES AND EXPLANATION Cash ACCOUNT TITLES AND EXPLANATION CREDIT DATE CREDIT DEBIT DATE DEBIT Utilities Expense $10,000 May 1 May 12 S300 $10.000 Cash $300 Common Stock Rent Expense May 18 Accounts Receivable May 1 $600 $1.900 $600 $1.900 Cash Service Revenue Equipment May 3 $2,700 May 22 No entry (Hiring is not qualified as a transaction) $2,700 Cash Furniture $800 $4.500 Accounts Payable May 4 May 26 Note Payable Supplies $4,500 Cash $800 Cash May 5 $800 May 30 $1,900 Accounts Payable Cash $800 $1.900 Accounts Receivable May 31 Dividends $1,400 $1,400 May 9 Cash $1.400 $1.400 Service Revenue 2) T-Accounts (For General Ledgers): Cash Supplies $800 Accounts Receivable $10,000 May 1 $1,400 May 3 $1,900 May 12 $600 $1,900 May 30 May 18 $1,900 May 5 May 1 $2,700 May 9 May 30 $300 May 26 May 31 $800 $1,400 $7,500 $0 $800 End. Bal. End. Bal. End. Bal. Accounts Payable Equipment $2,700 Furniture $800 May 5 $4.500 May 26 $800 May 3 May 4 $2,700 $4.500 End. Bal. S0 End. Bal. End, Bal. Note Payable Common Stock Dividends May 4 May 1 $4.500 $10,000 May 31 $1.400 $1,400 End. Bal. End, Bal. End. Bal. $4,500 $10,000 Service Revenue Utilities Expense $300 Rent Expense May 9 May 18 $600 $1.400 May 12 May 1 $1.900 End. Bal. $300 $600 $3,300 End. Bal. End. Bal. B & B Consulting 3) Trial Balance May 31 Debit Credit Account Titles $7,500 Cash $800 Supplies $2,700 Equipment $4,500 Furniture $4,500 Note Payable $10,000 Common Stock $1,400 Dividends $3,300 Service Revenue Utilities Expense $300 $600 Rent Expense $17,800 $17,800 Totals