Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheffield Company manufactures power tools. The Electric Drill Division (an investment center) can purchase the motors for the drills from the Motor Division (another

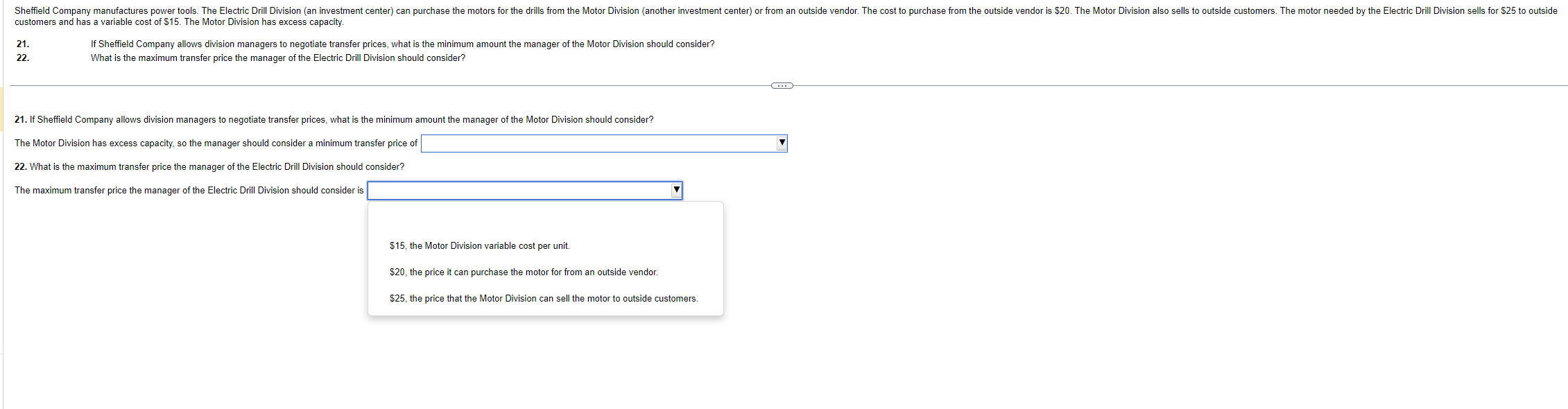

Sheffield Company manufactures power tools. The Electric Drill Division (an investment center) can purchase the motors for the drills from the Motor Division (another investment center) or from an outside vendor. The cost to purchase from the outside vendor is $20. The Motor Division also sells to outside customers. The motor needed by the Electric Drill Division sells for $25 to outside customers and has a variable cost of $15. The Motor Division has excess capacity. 21. 22. If Sheffield Company allows division managers to negotiate transfer prices, what is the minimum amount the manager of the Motor Division should consider? What is the maximum transfer price the manager of the Electric Drill Division should consider? 21. If Sheffield Company allows division managers to negotiate transfer prices, what is the minimum amount the manager of the Motor Division should consider? The Motor Division has excess capacity, so the manager should consider a minimum transfer price of 22. What is the maximum transfer price the manager of the Electric Drill Division should consider? The maximum transfer price the manager of the Electric Drill Division should consider is $15, the Motor Division variable cost per unit. $20, the price it can purchase the motor for from an outside vendor. $25, the price that the Motor Division can sell the motor to outside customers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started