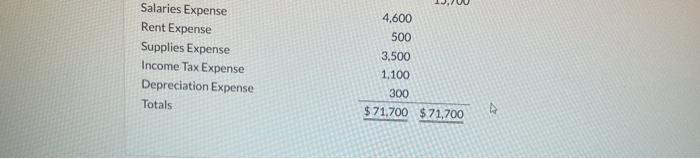

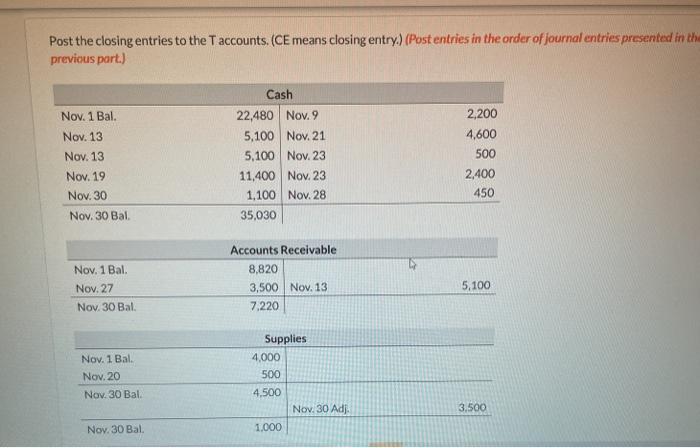

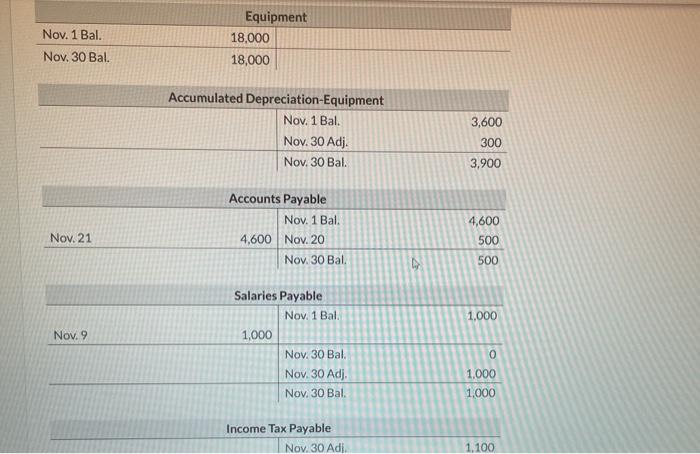

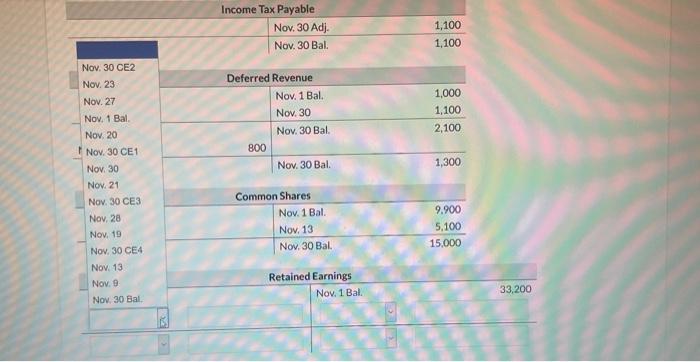

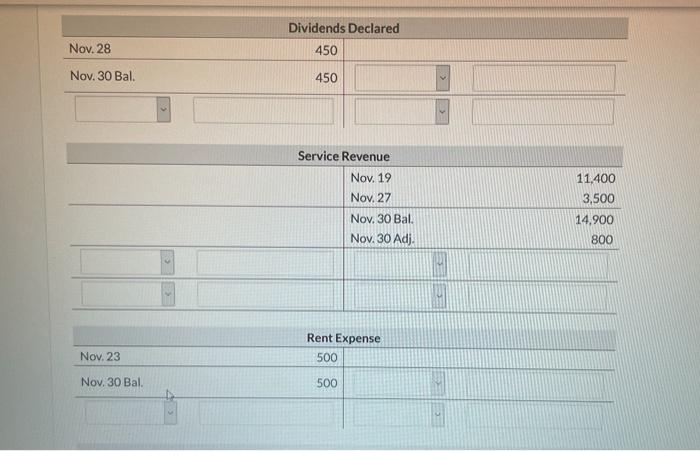

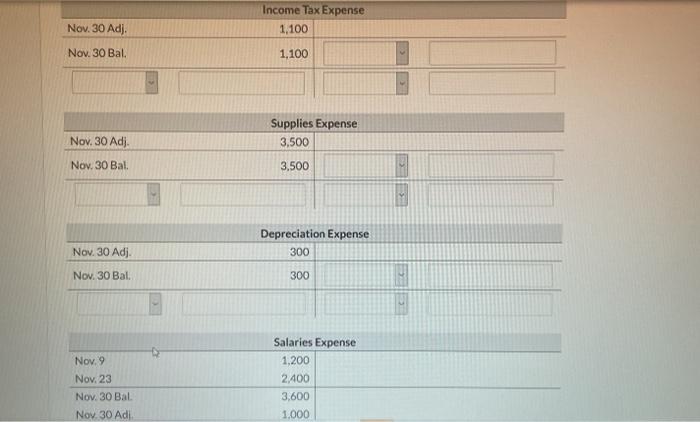

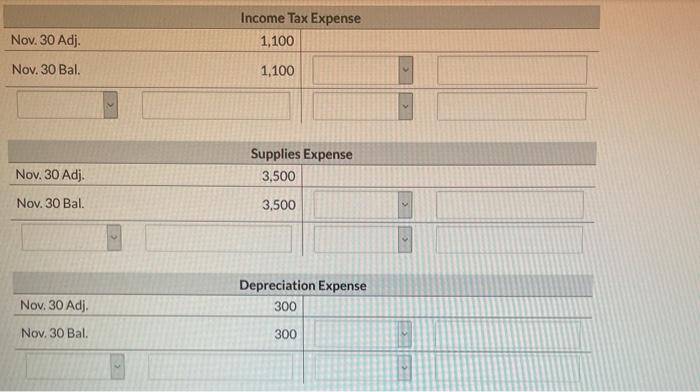

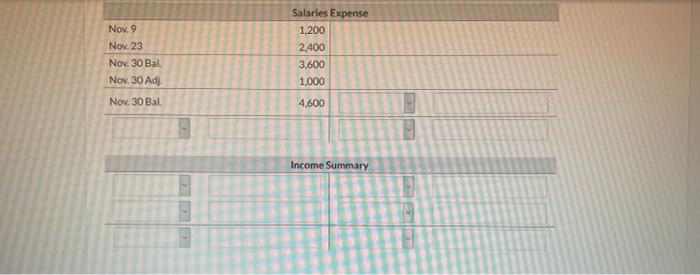

SHEFFIELD EQUIPMENT REPAIR CORP. Trial Balance November 30, 2021 After Adjustment Debit Credit Cash $35,030 Accounts Receivable 7,220 Supplies 1,000 Equipment 18,000 Accumulated Depreciation - Equipment $3,900 Accounts Payable 500 Salaries Payable 1,000 Income Tax Payable 1.100 Deferred Revenue 1,300 Common Shares 15,000 Retained Earnings 33.200 Dividends Declared 450 Service Revenue 15.700 Salaries Expense 4,600 Rent Expense 500 Supplies Expense 3,500 Income Tax Expense 1.100 4,600 500 Salaries Expense Rent Expense Supplies Expense Income Tax Expense Depreciation Expense Totals 3.500 1.100 300 $ 71,700 $71,700 Post the closing entries to the Taccounts. (CE means closing entry) (Post entries in the order of journal entries presented in the previous part.) Nov. 1 Bal. Nov. 13 Nov. 13 Nov. 19 Nov. 30 Nov. 30 Bal Cash 22,480 Nov. 9 5,100 Nov. 21 5,100 Nov. 23 11,400 Nov. 23 1,100 Nov. 28 35,030 2,200 4,600 500 2,400 450 Nov. 1 Bal. Nov. 27 Nov. 30 Bal. Accounts Receivable 8,820 3,500 Nov. 13 7.220 5,100 Nov. 1 Bal. Nov. 20 Nov. 30 Bal. Supplies 4,000 500 4.500 Nov. 30 Ads 1.000 3,500 Nov. 30 Bal. Nov. 1 Bal. Nov. 30 Bal. Equipment 18,000 18,000 Accumulated Depreciation Equipment Nov. 1 Bal. Nov. 30 Adj. Nov. 30 Bal. 3,600 300 3,900 Accounts Payable Nov. 1 Bal 4,600 Nov. 20 Nov. 30 Bal Nov. 21 4,600 500 500 1,000 Nov.9 Salaries Payable Nov. 1 Bal 1,000 Nov. 30 Bal Nov. 30 Adj. Nov. 30 Bal. 0 1,000 1,000 Income Tax Payable Nov. 30 Adi. 1.100 Income Tax Payable Nov. 30 Adj. Nov. 30 Bal. 1,100 1,100 Nov. 30 CE2 Nov. 23 Nov. 27 Nov. 1 Bal Deferred Revenue Nov. 1 Bal. Nov. 30 Nov. 30 Bal. 1,000 1.100 2,100 800 Nov. 30 Bal. 1,300 Nov. 20 Nov. 30 CE1 Nov. 30 Nov. 21 Nov. 30 CE3 Nov, 28 Nov, 19 Nov. 30 CE4 Nov. 13 Nov. Nov. 30 Bal Common Shares Nov. 1 Bal Nov. 13 Nov. 30 Bal. 9.900 5.100 15.000 - Retained Earnings Nov. 1 Bal 33,200 Dividends Declared 450 Nov. 28 Nov. 30 Bal. 450 Service Revenue Nov. 19 Nov. 27 Nov. 30 Bal. Nov. 30 Adj. 11,400 3,500 14,900 800 Rent Expense 500 Nov. 23 Nov. 30 Bal. 500 Income Tax Expense 1.100 Nov. 30 Adj. Nov. 30 Bal. 1,100 Nov. 30 Adi Supplies Expense 3.500 Nov. 30 Bal. 3.500 Depreciation Expense 300 Nov. 30 Adj. Nov. 30 Bal 300 Nov. 9 Nov. 23 Nov. 30 Bal Nov. 30 Adi Salaries Expense 1,200 2,400 3,600 1.000 Income Tax Expense 1,100 Nov. 30 Adj. Nov. 30 Bal. 1,100 Supplies Expense 3,500 Nov. 30 Adj. Nov. 30 Bal. 3,500 Depreciation Expense 300 Nov. 30 Adj. Nov. 30 Bal. 300 Nov 9 Nov. 23 Nov. 30 Bal Nov. 30 Adi Salaries Expense 1.200 2,400 3,600 1,000 Nov. 30 Bal. 4,600 Income Summary GIL