Answered step by step

Verified Expert Solution

Question

1 Approved Answer

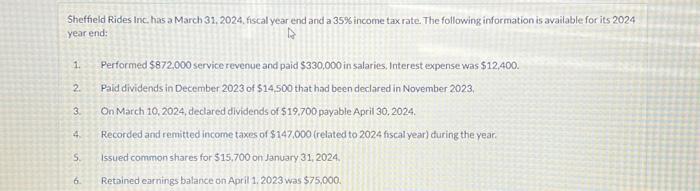

Sheffield Rides Inc. has a March 31, 2024, fiscal year end and a 35% income tax rate. The following information is available for its

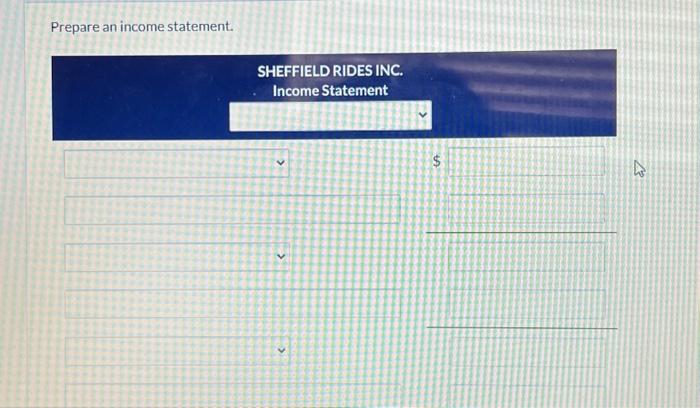

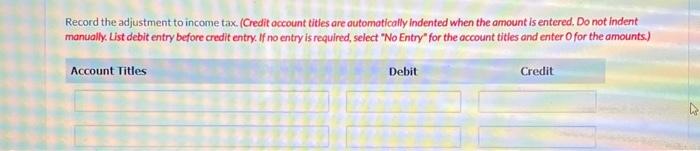

Sheffield Rides Inc. has a March 31, 2024, fiscal year end and a 35% income tax rate. The following information is available for its 2024 year end: A 1. 2. 3. 4. S. 6. Performed $872,000 service revenue and paid $330,000 in salaries, Interest expense was $12,400. Paid dividends in December 2023 of $14,500 that had been declared in November 2023, On March 10, 2024, declared dividends of $19.700 payable April 30, 2024. Recorded and remitted income taxes of $147,000 (related to 2024 fiscal year) during the year. Issued common shares for $15,700 on January 31, 2024, Retained earnings balance on April 1, 2023 was $75,000. Prepare an income statement. SHEFFIELD RIDES INC. Income Statement $ LA Record the adjustment to income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles Debit Credit k

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Youve provided images which seem to contain details about a company named Sheffield Rides Inc and relate to financial accounting tasks One image describes several financial transactions for Sheffield ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started