Question

Sheila, a single taxpayer, is a retired computer executive with a taxable income of $95,700 in 2020. She receives $33,800 per year in tax-exempt municipal

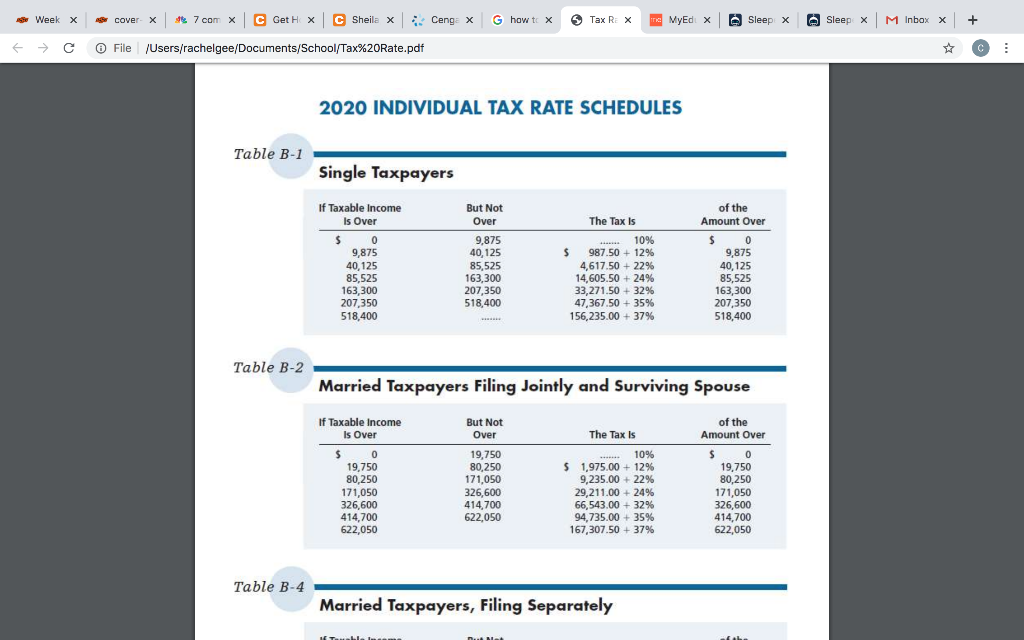

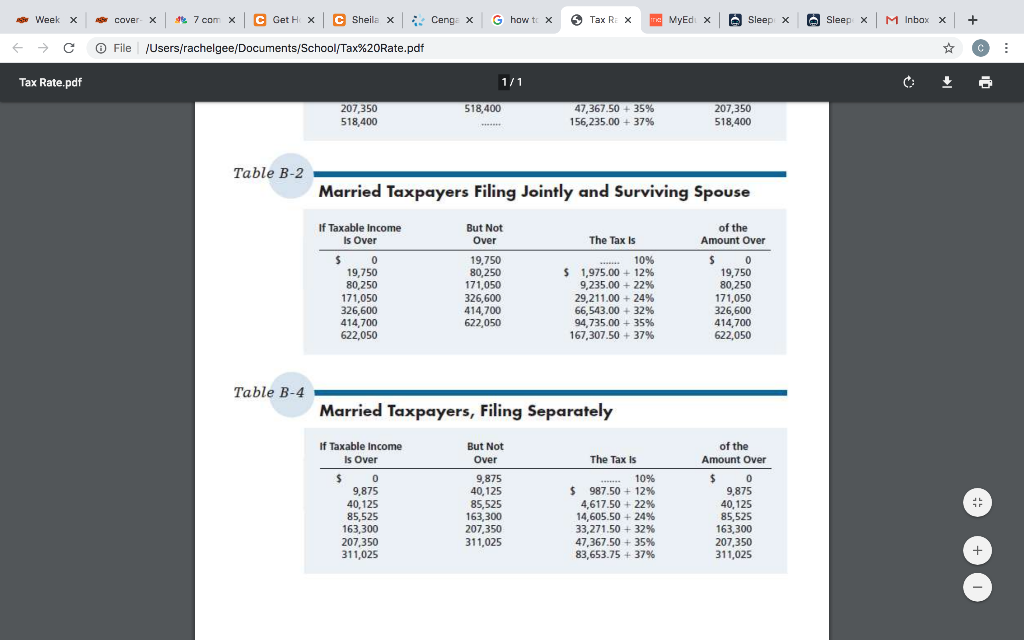

Sheila, a single taxpayer, is a retired computer executive with a taxable income of $95,700 in 2020. She receives $33,800 per year in tax-exempt municipal bond interest. Adam and Tanya are married and have no children. Adam and Tanya's 2020 taxable income is $95,700 which is comprised solely of wages they earn from their jobs. Refer to the tax rate schedule for calculations. Do not round intermediate computations. Round your final answers to two decimal places. Assume that Adam and Tanya file jointly. Sheila's tax is $ . Adam and Tanya's tax is $ . The difference in the tax rate schedules for single and married taxpayers reflects the greater ability to pay tax by single taxpayers at the same income level as married taxpayers. The tax rate structures do reflect the ability-to-pay concept.

Sheila, a single taxpayer, is a retired computer executive with a taxable income of $95,700 in 2020. She receives $33,800 per year in tax-exempt municipal bond interest. Adam and Tanya are married and have no children. Adam and Tanya's 2020 taxable income is $95,700 which is comprised solely of wages they earn from their jobs. Refer to the tax rate schedule for calculations. Do not round intermediate computations. Round your final answers to two decimal places. Assume that Adam and Tanya file jointly. Sheila's tax is $ . Adam and Tanya's tax is $ . The difference in the tax rate schedules for single and married taxpayers reflects the greater ability to pay tax by single taxpayers at the same income level as married taxpayers. The tax rate structures do reflect the ability-to-pay concept.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started