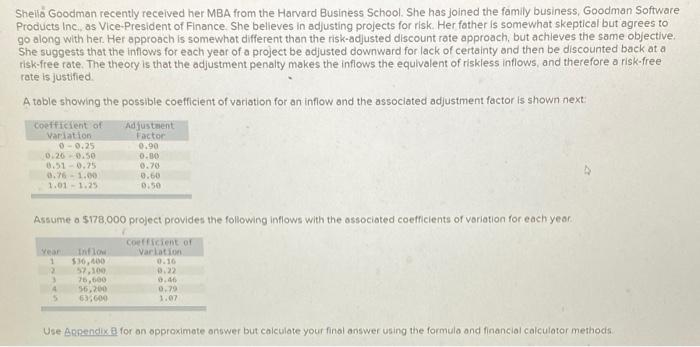

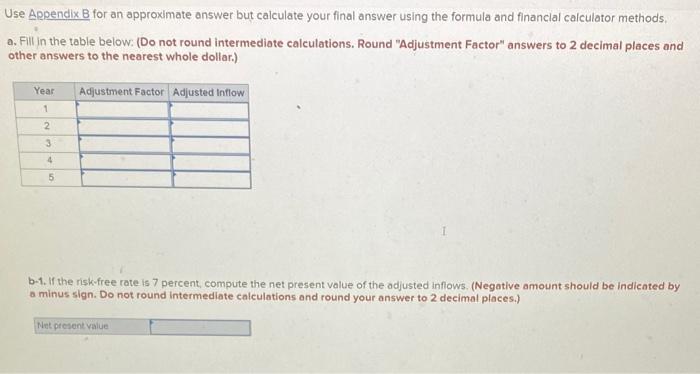

Sheila Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc. as Vice-President of Finance She believes in adjusting projects for risk. Her father is somewhat skeptical but agrees to go along with her. Her approach is somewhat different than the risk-adjusted discount rate approach, but achieves the same objective She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-free rate. The theory is that the adjustment penalty makes the inflows the equivalent of riskless Intlows, and therefore a risk-free rate is justified A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next: Coefficient of adjustment Variation Factor 0 -0.25 0.26 0.50 0.51 0.25 0.75 -1.00 1.01 -1.25 0.90 0.00 0.70 0.60 0.50 Assume o 5178,000 project provides the following inflows with the associated coefficients of variation for each year. Coefficient or Inflow 57.100 0.2 Year 1 $30,000 Varlation 0.16 4 5 15,600 56,200 63,600 0.00 0.70 1.07 Use Appendix & for an approximate ontwer but calculate your final answer using the formula and financial calculator methods Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods a. Fill in the table below: (Do not round intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar.) Year Adjustment Factor Adjusted Inflow 1 2 3 4 5 b-1. If the risk-free rate is 7 percent, compute the net present value of the adjusted inflows. (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places.) Net present value b.1. If the risk-free rate is 7 percent, compute the net present value of the adjusted Inflows. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Met present value b-2. Should this project be accepted? Yes NO Sheila Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc. as Vice-President of Finance She believes in adjusting projects for risk. Her father is somewhat skeptical but agrees to go along with her. Her approach is somewhat different than the risk-adjusted discount rate approach, but achieves the same objective She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-free rate. The theory is that the adjustment penalty makes the inflows the equivalent of riskless Intlows, and therefore a risk-free rate is justified A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next: Coefficient of adjustment Variation Factor 0 -0.25 0.26 0.50 0.51 0.25 0.75 -1.00 1.01 -1.25 0.90 0.00 0.70 0.60 0.50 Assume o 5178,000 project provides the following inflows with the associated coefficients of variation for each year. Coefficient or Inflow 57.100 0.2 Year 1 $30,000 Varlation 0.16 4 5 15,600 56,200 63,600 0.00 0.70 1.07 Use Appendix & for an approximate ontwer but calculate your final answer using the formula and financial calculator methods Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods a. Fill in the table below: (Do not round intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar.) Year Adjustment Factor Adjusted Inflow 1 2 3 4 5 b-1. If the risk-free rate is 7 percent, compute the net present value of the adjusted inflows. (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places.) Net present value b.1. If the risk-free rate is 7 percent, compute the net present value of the adjusted Inflows. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Met present value b-2. Should this project be accepted? Yes NO