Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheila is employed by ABC Ltd. a CCPC, as a real estate salesperson. Sheila has requested your assistance in preparing her 2023 tax return

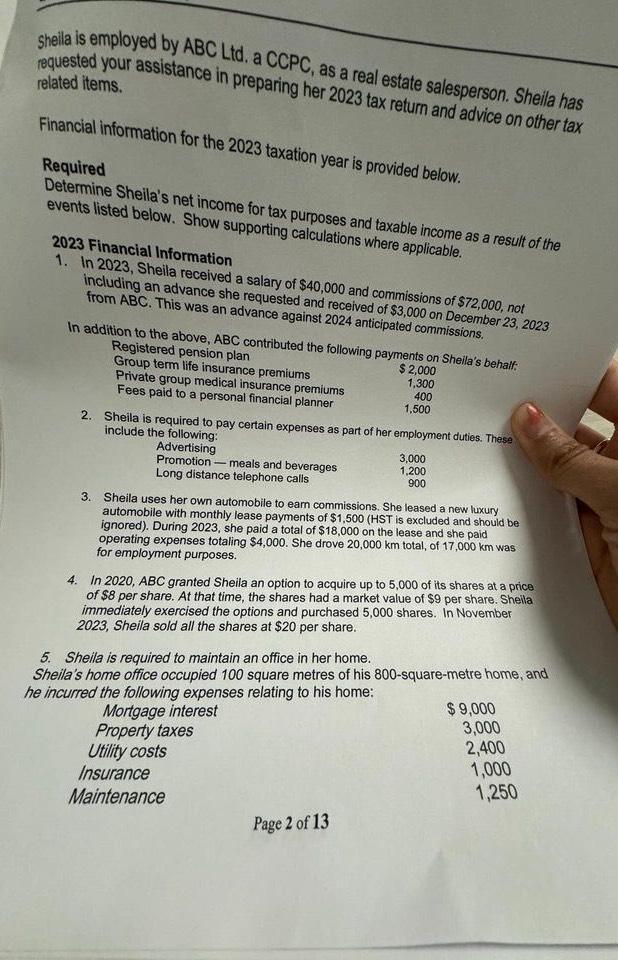

Sheila is employed by ABC Ltd. a CCPC, as a real estate salesperson. Sheila has requested your assistance in preparing her 2023 tax return and advice on other tax related items. Financial information for the 2023 taxation year is provided below. Required Determine Sheila's net income for tax purposes and taxable income as a result of the events listed below. Show supporting calculations where applicable. 2023 Financial Information 1. In 2023, Sheila received a salary of $40,000 and commissions of $72,000, not including an advance she requested and received of $3,000 on December 23, 2023 from ABC. This was an advance against 2024 anticipated commissions. In addition to the above, ABC contributed the following payments on Sheila's behalf: Registered pension plan $ 2,000 Group term life insurance premiums Private group medical insurance premiums Fees paid to a personal financial planner 2. Sheila is required to pay certain expenses as part of her employment duties. These include the following: Advertising Promotion meals and beverages Long distance telephone calls 1,300 400 1,500 3. Sheila uses her own automobile to earn commissions. She leased a new luxury automobile with monthly lease payments of $1,500 (HST is excluded and should be ignored). During 2023, she paid a total of $18,000 on the lease and she paid operating expenses totaling $4,000. She drove 20,000 km total, of 17,000 km was for employment purposes. 3,000 1,200 900 4. In 2020, ABC granted Sheila an option to acquire up to 5,000 of its shares at a price of $8 per share. At that time, the shares had a market value of $9 per share. Sheila immediately exercised the options and purchased 5,000 shares. In November 2023, Sheila sold all the shares at $20 per share. Mortgage interest Property taxes Utility costs Insurance Maintenance 5. Sheila is required to maintain an office in her home. Sheila's home office occupied 100 square metres of his 800-square-metre home, and he incurred the following expenses relating to his home: Page 2 of 13 $9,000 3,000 2,400 1,000 1,250

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate Sheilas net income for tax purposes and her taxable income based on the information p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started