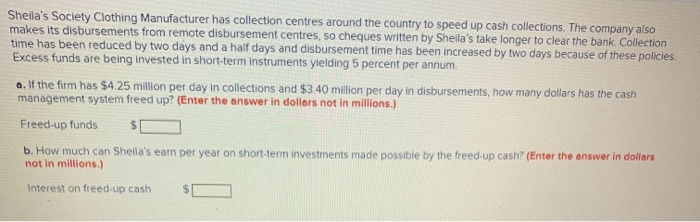

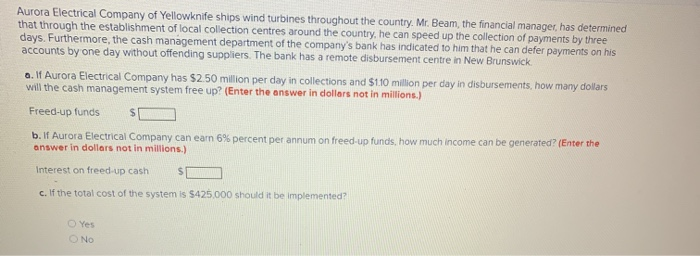

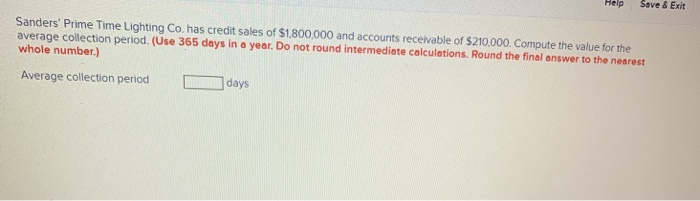

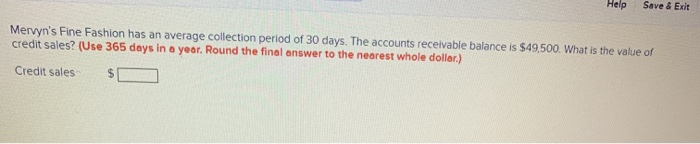

Shella's Society Clothing Manufacturer has collection centres around the country to speed up cash collections. The company also makes its disbursements from remote disbursement centres, so cheques written by Sheila's take longer to clear the bank Collection time has been reduced by two days and a half days and disbursement time has been increased by two days because of these policies. Excess funds are being invested in short-term Instruments yielding 5 percent per annum a. If the firm has $4.25 million per day in collections and $3.40 million per day in disbursements, how many dollars has the cash management system freed up? (Enter the answer in dollars not in millions.) Freed-up funds b. How much can Sheila's eam per year on short-term investments made possible by the freed-up cash? (Enter the answer in dollars not in millions.) Interest on freed-up cash Aurora Electrical Company of Yellowknife ships wind turbines throughout the country. Mr. Beam, the financial manager, has determined that through the establishment of local collection centres around the country, he can speed up the collection of payments by three days. Furthermore, the cash management department of the company's bank has indicated to him that he can defer payments on his accounts by one day without offending suppliers. The bank has a remote disbursement centre in New Brunswick a. If Aurora Electrical Company has $2.50 million per day in collections and $1.10 million per day in disbursements, how many dollars will the cash management system free up? (Enter the answer in dollars not in millions.) Freed-up funds b. If Aurora Electrical Company can earn 6% percent per annum on freed-up funds, how much income can be generated? (Enter the answer in dollars not in millions.) Interest on freed-up cash c. If the total cost of the system is $425,000 should it be implemented? Yes O NO Help Save & Exit Sanders' Prime Time Lighting Co. has credit sales of $1,800,000 and accounts receivable of $210,000. Compute the value for the average collection period. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole number.) Average collection period days Help Save & Exit Mervyn's Fine Fashion has an average collection period of 30 days. The accounts receivable balance is $49,500. What is the value of credit sales? (Use 365 days in a year. Round the final answer to the nearest whole dollar.) Credit sales $ Bugle Boy Company has an opportunity cost of funds of 10 percent and a credit policy based on net 45 days. If all of its customers adhere to the stated terms and annual sales increase from $4.14 million to $6.18 million, what will be the increased cost of funds tied up in accounts receivable? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Enter answer in whole dollar not in million.) Increased cost of fund