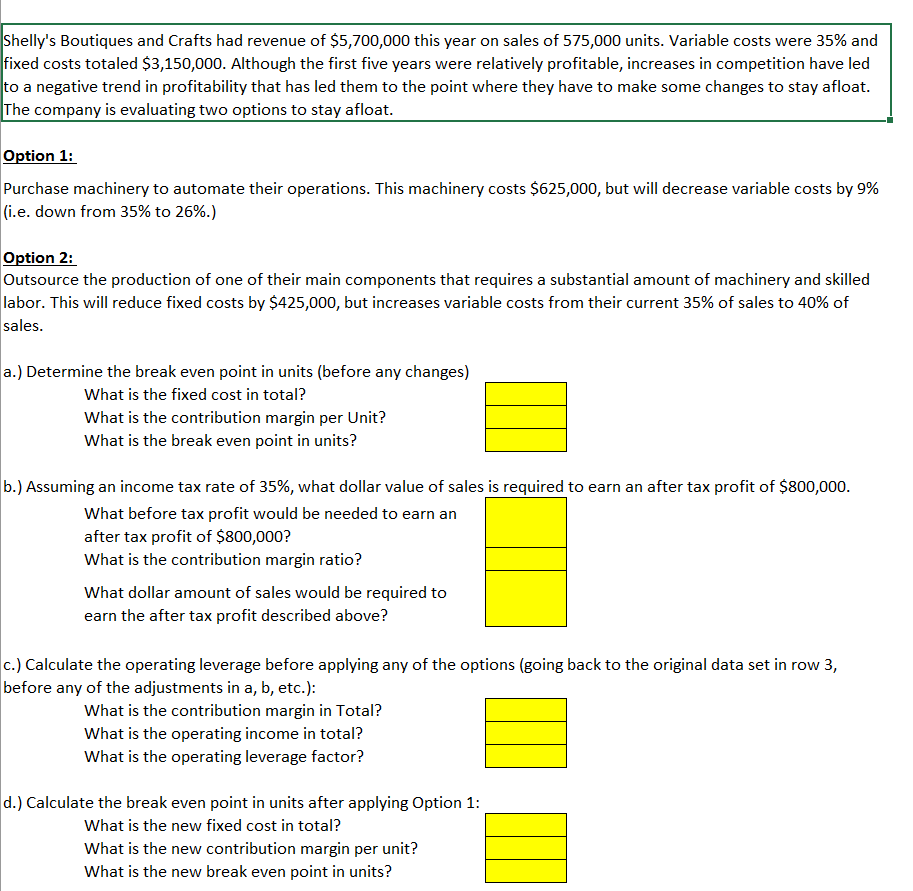

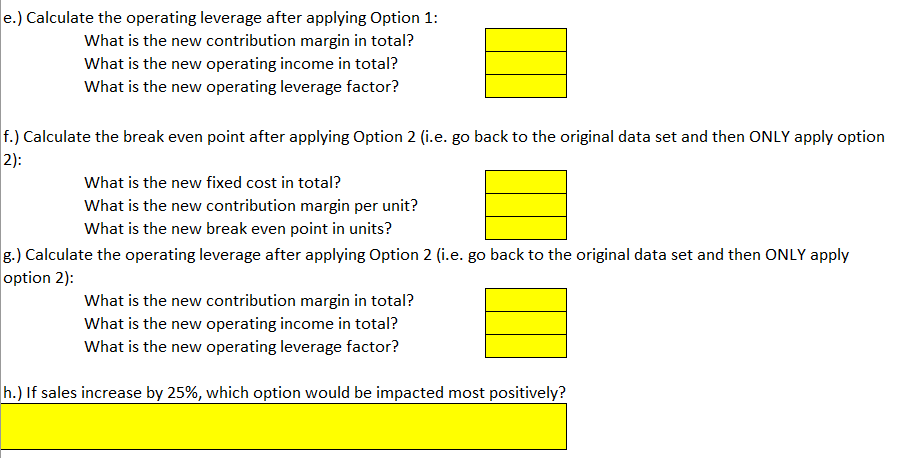

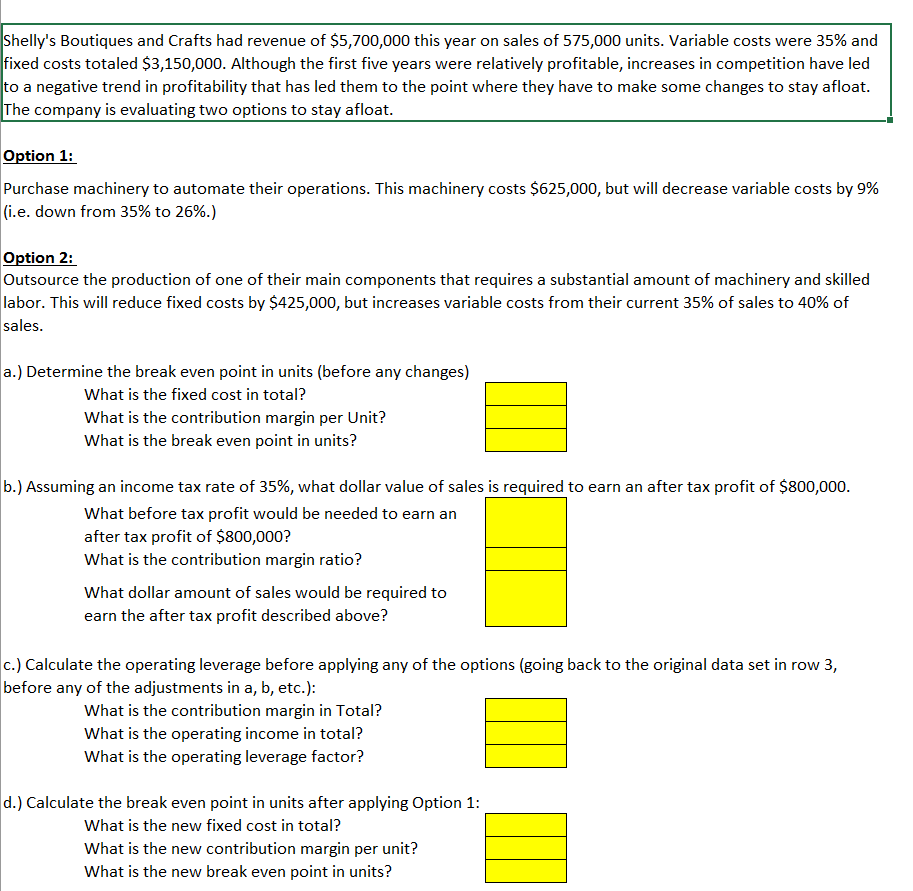

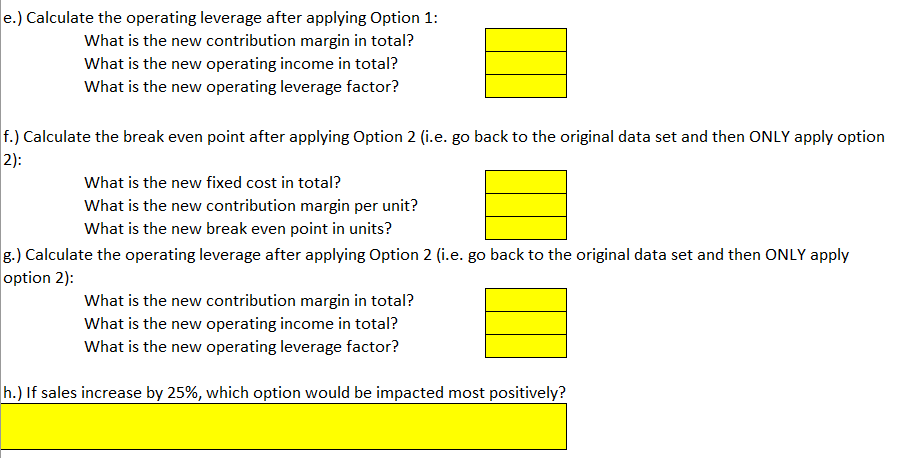

Shelly's Boutiques and Crafts had revenue of $5,700,000 this year on sales of 575,000 units. Variable costs were 35% and fixed costs totaled $3,150,000. Although the first five years were relatively profitable, increases in competition have led to a negative trend in profitability that has led them to the point where they have to make some changes to stay afloat. The company is evaluating two options to stay afloat. Option 1: Purchase machinery to automate their operations. This machinery costs $625,000, but will decrease variable costs by 9% (i.e. down from 35% to 26%.) Option 2: Outsource the production of one of their main components that requires a substantial amount of machinery and skilled labor. This will reduce fixed costs by $425,000, but increases variable costs from their current 35% of sales to 40% of sales. a.) Determine the break even point in units (before any changes) What is the fixed cost in total? What is the contribution margin per Unit? What is the break even point in units? b.) Assuming an income tax rate of 35%, what dollar value of sales is required to earn an after tax profit of $800,000. What before tax profit would be needed to earn an after tax profit of $800,000? What is the contribution margin ratio? What dollar amount of sales would be required to earn the after tax profit described above? c.) Calculate the operating leverage before applying any of the options (going back to the original data set in row 3, before any of the adjustments in a, b, etc.): What is the contribution margin in Total? What is the operating income in total? What is the operating leverage factor? d.) Calculate the break even point in units after applying Option 1: What is the new fixed cost in total? What is the new contribution margin per unit? What is the new break even point in units? e.) Calculate the operating leverage after applying Option 1: What is the new contribution margin in total? What is the new operating income in total? What is the new operating leverage factor? f.) Calculate the break even point after applying Option 2 (i.e. go back to the original data set and then ONLY apply option 2): What is the new fixed cost in total? What is the new contribution margin per unit? What is the new break even point in units? g.) Calculate the operating leverage after applying Option 2 (i.e. go back to the original data set and then ONLY apply option 2): What is the new contribution margin in total? What is the new operating income in total? What is the new operating leverage factor? h.) If sales increase by 25%, which option would be impacted most positively? Shelly's Boutiques and Crafts had revenue of $5,700,000 this year on sales of 575,000 units. Variable costs were 35% and fixed costs totaled $3,150,000. Although the first five years were relatively profitable, increases in competition have led to a negative trend in profitability that has led them to the point where they have to make some changes to stay afloat. The company is evaluating two options to stay afloat. Option 1: Purchase machinery to automate their operations. This machinery costs $625,000, but will decrease variable costs by 9% (i.e. down from 35% to 26%.) Option 2: Outsource the production of one of their main components that requires a substantial amount of machinery and skilled labor. This will reduce fixed costs by $425,000, but increases variable costs from their current 35% of sales to 40% of sales. a.) Determine the break even point in units (before any changes) What is the fixed cost in total? What is the contribution margin per Unit? What is the break even point in units? b.) Assuming an income tax rate of 35%, what dollar value of sales is required to earn an after tax profit of $800,000. What before tax profit would be needed to earn an after tax profit of $800,000? What is the contribution margin ratio? What dollar amount of sales would be required to earn the after tax profit described above? c.) Calculate the operating leverage before applying any of the options (going back to the original data set in row 3, before any of the adjustments in a, b, etc.): What is the contribution margin in Total? What is the operating income in total? What is the operating leverage factor? d.) Calculate the break even point in units after applying Option 1: What is the new fixed cost in total? What is the new contribution margin per unit? What is the new break even point in units? e.) Calculate the operating leverage after applying Option 1: What is the new contribution margin in total? What is the new operating income in total? What is the new operating leverage factor? f.) Calculate the break even point after applying Option 2 (i.e. go back to the original data set and then ONLY apply option 2): What is the new fixed cost in total? What is the new contribution margin per unit? What is the new break even point in units? g.) Calculate the operating leverage after applying Option 2 (i.e. go back to the original data set and then ONLY apply option 2): What is the new contribution margin in total? What is the new operating income in total? What is the new operating leverage factor? h.) If sales increase by 25%, which option would be impacted most positively