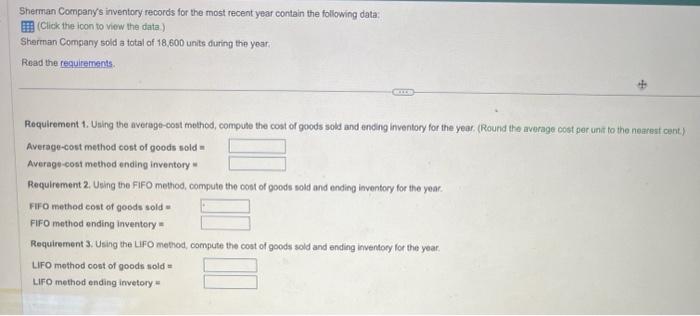

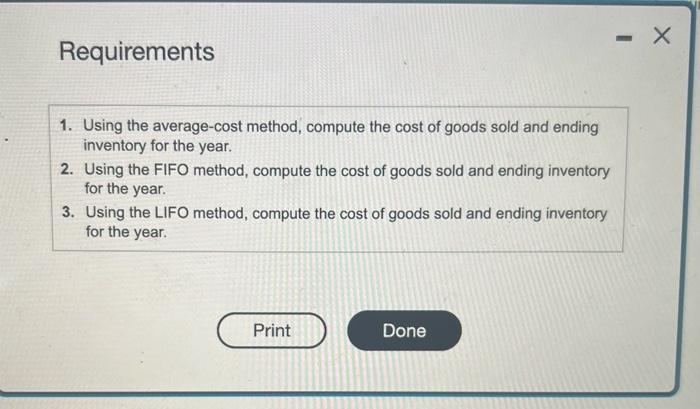

Sheman Company's inventory records for the most recent year contain the following data (Ctick the iconto viow the diata) Sharman Company sold a total of 18,600 units during the year. Read the requirements. Requirement 1. Using the average-cost mothod, compute the cost of goods sold and ending inventory for the year, (Round the average cost per unit to the nearest cant.) Average-cost method cont of goods sold = Average-cost method ending inventory = Requirement 2. Using the FIFO method, compute the cost of poods sold and ending inventory for the year. FiFO method cost of goods sold = FFro method ending inventory = Requirement 3. Using the LiFO mehod, compute the cost of goods sold and ending inventory lor the year. LFO mothod cont of goods sold = LIFO method ending invetory = Requirements 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. 3. Using the LIFO method, compute the cost of goods sold and ending inventory for the year. Sheman Company's inventory records for the most recent year contain the following data (Ctick the iconto viow the diata) Sharman Company sold a total of 18,600 units during the year. Read the requirements. Requirement 1. Using the average-cost mothod, compute the cost of goods sold and ending inventory for the year, (Round the average cost per unit to the nearest cant.) Average-cost method cont of goods sold = Average-cost method ending inventory = Requirement 2. Using the FIFO method, compute the cost of poods sold and ending inventory for the year. FiFO method cost of goods sold = FFro method ending inventory = Requirement 3. Using the LiFO mehod, compute the cost of goods sold and ending inventory lor the year. LFO mothod cont of goods sold = LIFO method ending invetory = Requirements 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. 3. Using the LIFO method, compute the cost of goods sold and ending inventory for the year