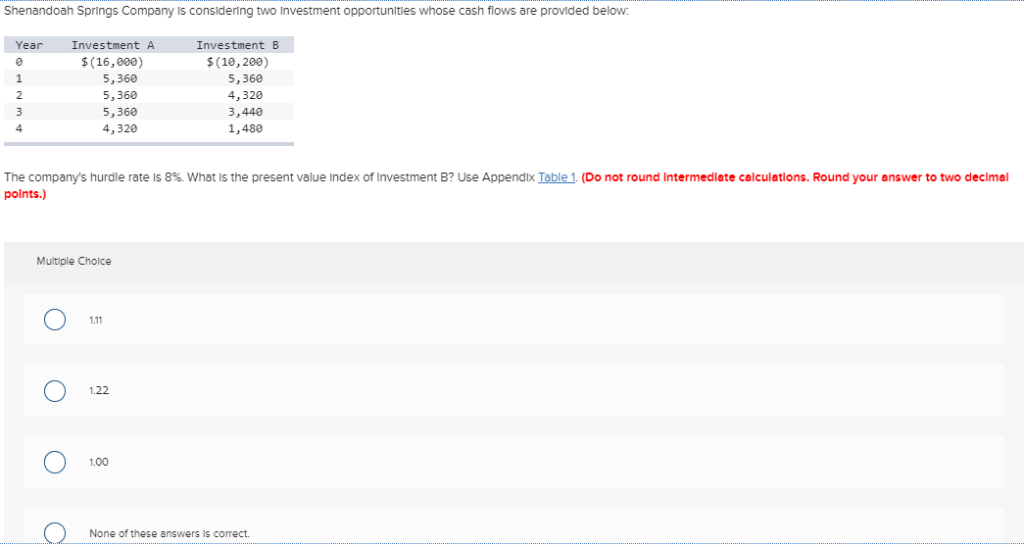

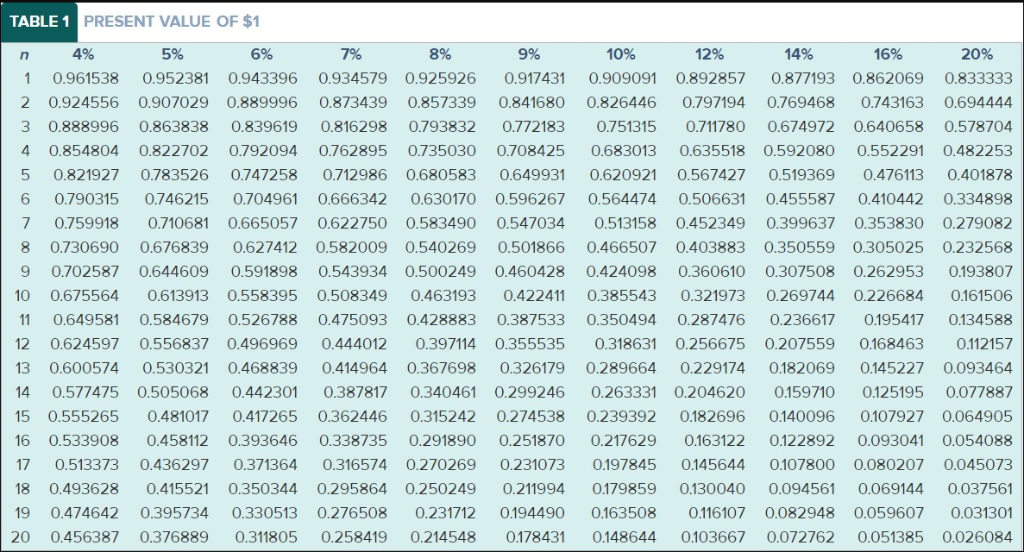

Shenandoah Springs Company is considering two investment opportunitles whose cash flows are provided below: TT Year Investment A Investment B $(16,000) $(10,200) 5,360 4,320 3,440 1 5,360 5,360 2 5,360 4,320 1,480 The company's hurdle rate is 8%. What Is the present value Index of Investment B? Use Append Ix Table 1. (Do not round intermediate calculations. Round your answer to two decimal polnts.) Multiple Choice 1.11 1.22 100 None of these answers Is correct TABLE 1 PRESENT VALUE OF $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% n 0.952381 1 0.961538 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 O.769468 0.743163 0.694444 0.674972 0.640658 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 O.711780 0.578704 O.735030 4 0.854804 0.822702 0.792094 0.762895 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 0.821927 0.680583 0.620921 0.401878 0.783526 0.747258 O.712986 0.649931 O.567427 0.519369 0.476113 O.746215 O.704961 0.666342 0.564474 0.410442 0.790315 0.630170 0.596267 0.506631 0.455587 0.334898 0.279082 0.759918 0.710681 7 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.676839 0.403883 O.730690 0.627412 0.582009 0.540269 0.501866 0.466507 0.350559 0.305025 0.232568 0.424098 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.307508 0.262953 0.360610 0.193807 0.675564 0.463193 0.226684 10 0.613913 0.558395 0.508349 0.422411 0.385543 0.321973 0.269744 0.161506 0.649581 0.584679 0.428883 0.287476 0.236617 0.195417 0.134588 11 0.526788 0.475093 0.387533 0.350494 0.207559 0.168463 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.112157 0.182069 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.145227 0.093464 0.125195 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 0.533908 0.458112 0.393646 0.163122 0.122892 O.093041 16 0.338735 0.291890 0.251870 0.217629 0.054088 0.436297 0.231073 0.197845 17 0.513373 0.371364 0.316574 0.270269 0.145644 0.107800 0.080207 O.045073 0.130040 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 O.179859 0.094561 0.069144 0.037561 0.116107 0.082948 0.059607 19 0.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.031301 0.051385 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.148644 O.103667 0.072762 0.026084