Answered step by step

Verified Expert Solution

Question

1 Approved Answer

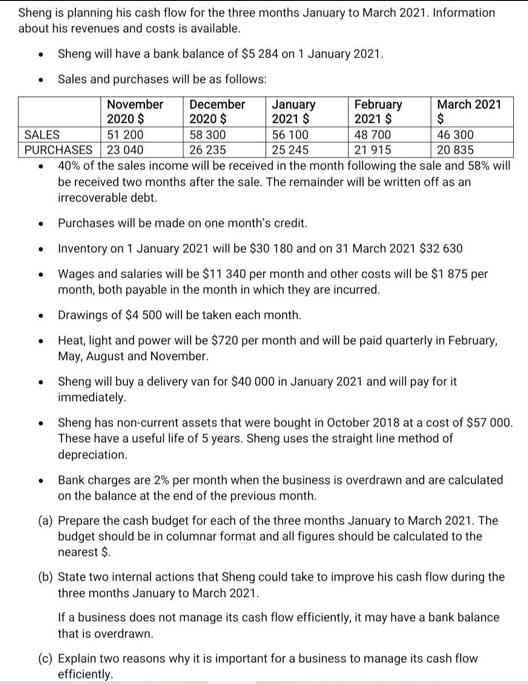

Sheng is planning his cash flow for the three months January to March 2021. Information about his revenues and costs is available. Sheng will

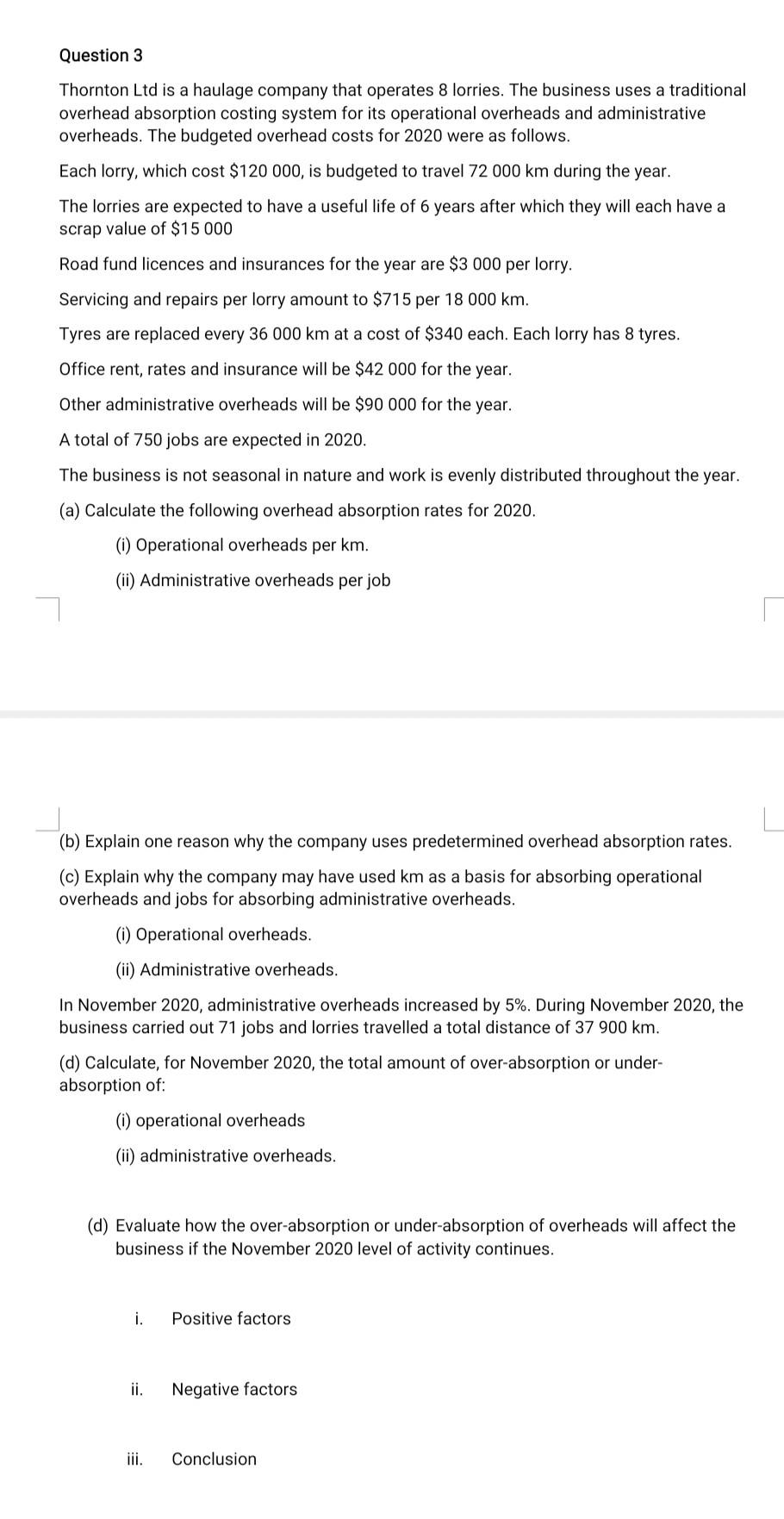

Sheng is planning his cash flow for the three months January to March 2021. Information about his revenues and costs is available. Sheng will have a bank balance of $5 284 on 1 January 2021. Sales and purchases will be as follows: November 2020 $ December 2020 $ 58 300 26 235 January 2021 $ 51 200 SALES PURCHASES 23 040 40% of the sales income will be received in the month following the sale and 58% will be received two months after the sale. The remainder will be written off as an irrecoverable debt. February 2021 $ 48 700 21 915 56 100 25 245 March 2021 $ 46 300 20 835 Purchases will be made on one month's credit. Inventory on 1 January 2021 will be $30 180 and on 31 March 2021 $32 630 Wages and salaries will be $11 340 per month and other costs will be $1 875 per month, both payable in the month in which they are incurred. Drawings of $4 500 will be taken each month. Heat, light and power will be $720 per month and will be paid quarterly in February, May, August and November. Sheng will buy a delivery van for $40 000 in January 2021 and will pay for it immediately. Sheng has non-current assets that were bought in October 2018 at a cost of $57 000. These have a useful life of 5 years. Sheng uses the straight line method of depreciation. Bank charges are 2% per month when the business is overdrawn and are calculated on the balance at the end of the previous month. (a) Prepare the cash budget for each of the three months January to March 2021. The budget should be in columnar format and all figures should be calculated to the nearest $. (b) State two internal actions that Sheng could take to improve his cash flow during the three months January to March 2021. If a business does not manage its cash flow efficiently, it may have a bank balance that is overdrawn. (c) Explain two reasons why it is important for a business to manage its cash flow efficiently. Question 3 Thornton Ltd is a haulage company that operates 8 lorries. The business uses a traditional overhead absorption costing system for its operational overheads and administrative overheads. The budgeted overhead costs for 2020 were as follows. Each lorry, which cost $120 000, is budgeted to travel 72 000 km during the year. The lorries are expected to have a useful life of 6 years after which they will each have a scrap value of $15 000 Road fund licences and insurances for the year are $3 000 per lorry. Servicing and repairs per lorry amount to $715 per 18 000 km. Tyres are replaced every 36 000 km at a cost of $340 each. Each lorry has 8 tyres. Office rent, rates and insurance will be $42 000 for the year. Other administrative overheads will be $90 000 for the year. A total of 750 jobs are expected in 2020. The business is not seasonal in nature and work is evenly distributed throughout the year. (a) Calculate the following overhead absorption rates for 2020. (i) Operational overheads per km. (ii) Administrative overheads per job (b) Explain one reason why the company uses predetermined overhead absorption rates. (c) Explain why the company may have used km as a basis for absorbing operational overheads and jobs for absorbing administrative overheads. (i) Operational overheads. (ii) Administrative overheads. In November 2020, administrative overheads increased by 5%. During November 2020, the business carried out 71 jobs and lorries travelled a total distance of 37 900 km. (d) Calculate, for November 2020, the total amount of over-absorption or under- absorption of: (i) operational overheads (ii) administrative overheads. (d) Evaluate how the over-absorption or under-absorption of overheads will affect the business if the November 2020 level of activity continues. i. ii. Positive factors Negative factors Conclusion

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Cash Budget for January to March 2021 January February March Revenues Sales January 22400 Sales December 23320 22920 Sales November 20480 21480 2098...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started