Answered step by step

Verified Expert Solution

Question

1 Approved Answer

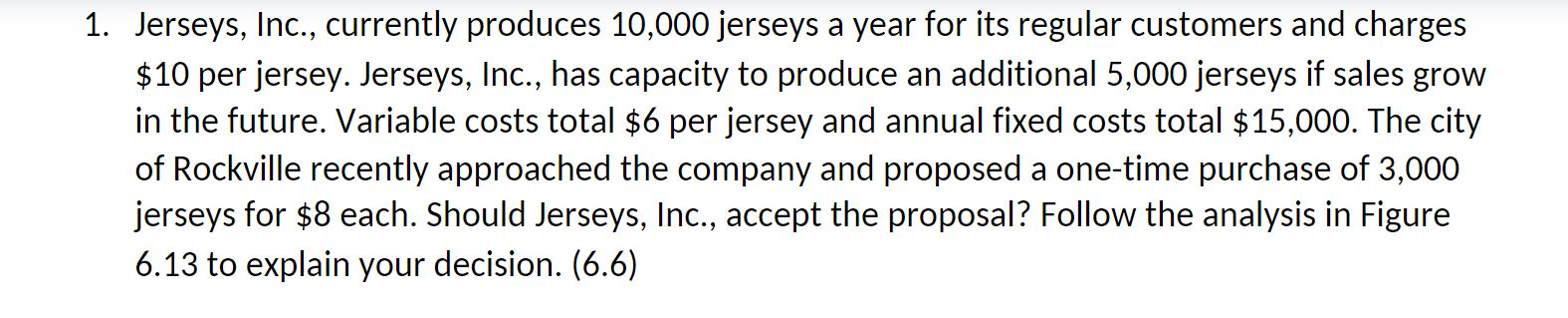

1. Jerseys, Inc., currently produces 10,000 jerseys a year for its regular customers and charges $10 per jersey. Jerseys, Inc., has capacity to produce

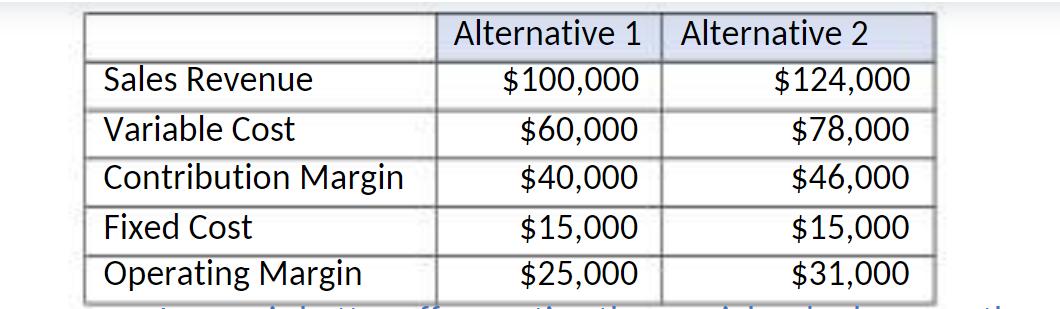

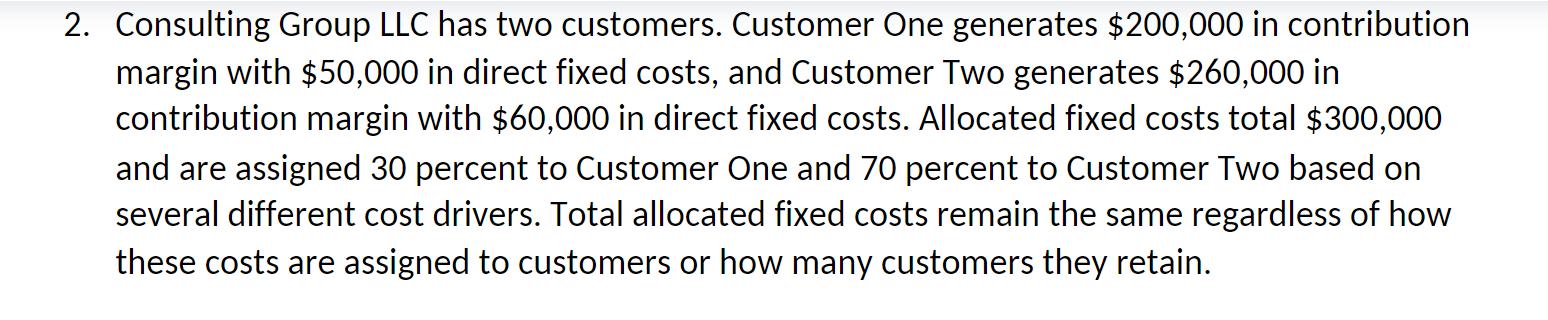

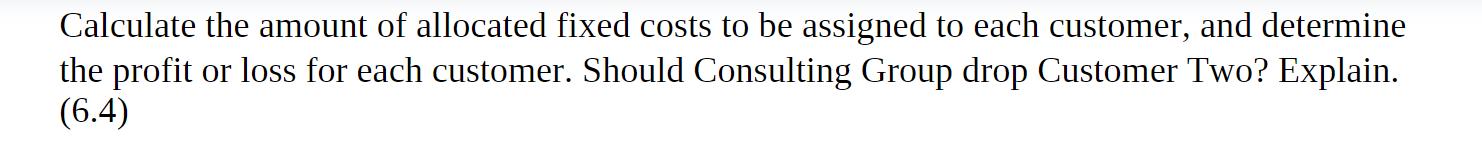

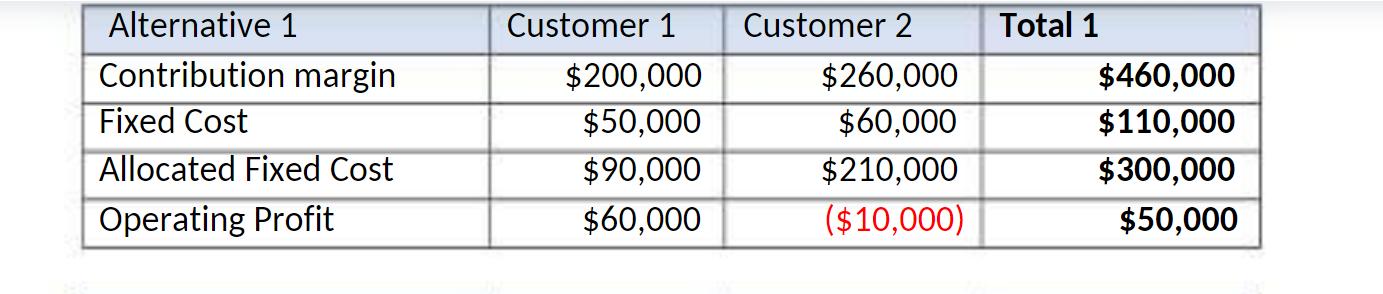

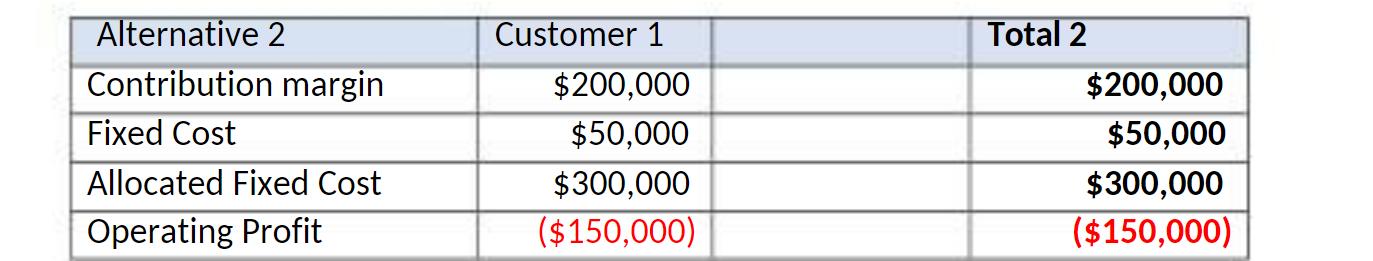

1. Jerseys, Inc., currently produces 10,000 jerseys a year for its regular customers and charges $10 per jersey. Jerseys, Inc., has capacity to produce an additional 5,000 jerseys if sales grow in the future. Variable costs total $6 per jersey and annual fixed costs total $15,000. The city of Rockville recently approached the company and proposed a one-time purchase of 3,000 jerseys for $8 each. Should Jerseys, Inc., accept the proposal? Follow the analysis in Figure 6.13 to explain your decision. (6.6) Alternative 1 Alternative 2 Sales Revenue $100,000 $124,000 Variable Cost $60,000 $78,000 Contribution Margin $40,000 $46,000 Fixed Cost $15,000 $15,000 Operating Margin $25,000 $31,000 2. Consulting Group LLC has two customers. Customer One generates $200,000 in contribution margin with $50,000 in direct fixed costs, and Customer Two generates $260,000 in contribution margin with $60,000 in direct fixed costs. Allocated fixed costs total $300,000 and are assigned 30 percent to Customer One and 70 percent to Customer Two based on several different cost drivers. Total allocated fixed costs remain the same regardless of how these costs are assigned to customers or how many customers they retain. Calculate the amount of allocated fixed costs to be assigned to each customer, and determine the profit or loss for each customer. Should Consulting Group drop Customer Two? Explain. (6.4) Alternative 1 Customer 1 Customer 2 Total 1 Contribution margin $200,000 $260,000 $460,000 Fixed Cost $50,000 $60,000 $110,000 Allocated Fixed Cost $90,000 $210,000 $300,000 Operating Profit $60,000 ($10,000) $50,000 Alternative 2 Contribution margin Fixed Cost Allocated Fixed Cost Operating Profit Customer 1 Total 2 $200,000 $50,000 $300,000 ($150,000) $200,000 $50,000 $300,000 ($150,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Jerseys Inc Decision Analysis 66 Following Figure 613 lets analyze Jerseys Incs decision to accept the citys proposal Identify Relevant Costs V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started