Answered step by step

Verified Expert Solution

Question

1 Approved Answer

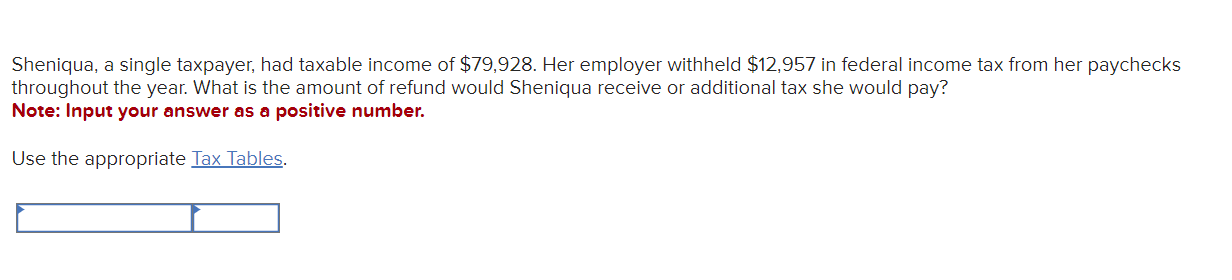

Sheniqua, a single taxpayer, had taxable income of $79,928. Her employer withheld $12,957 in federal income tax from her paychecks throughout the year. What is

Sheniqua, a single taxpayer, had taxable income of $79,928. Her employer withheld $12,957 in federal income tax from her paychecks throughout the year. What is the amount of refund would Sheniqua receive or additional tax she would pay?

Note: Input your answer as a positive number.

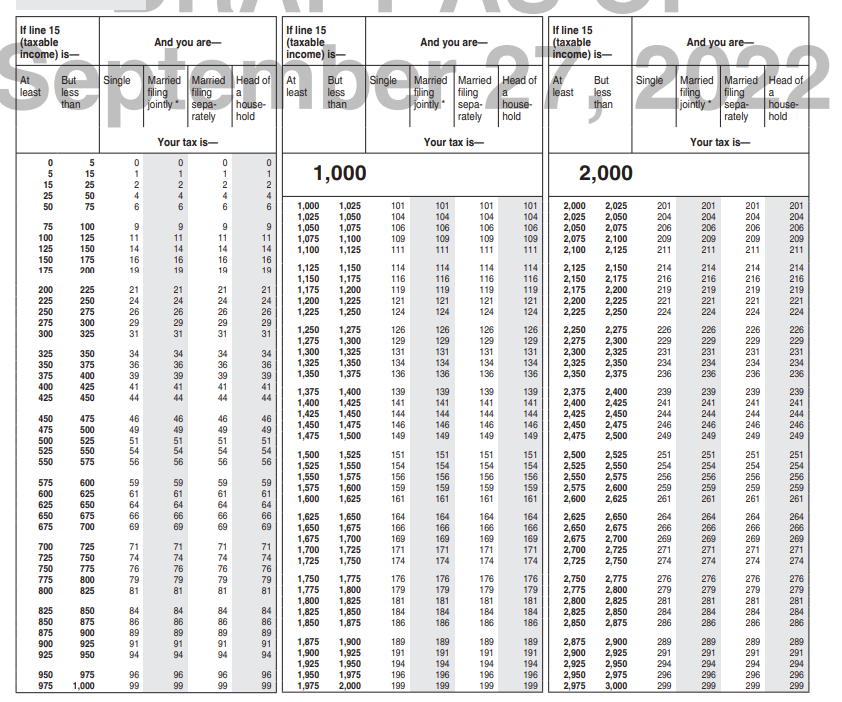

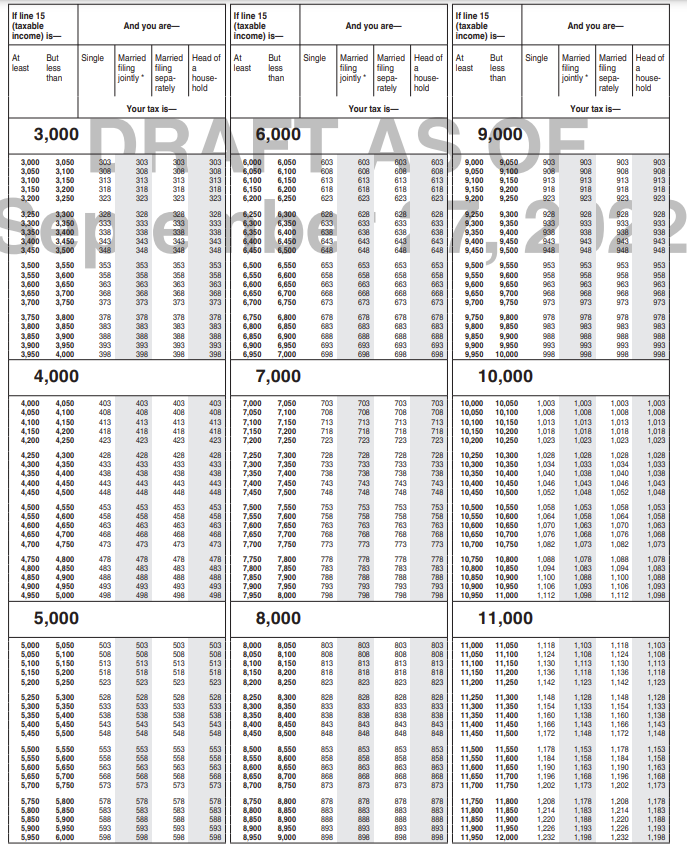

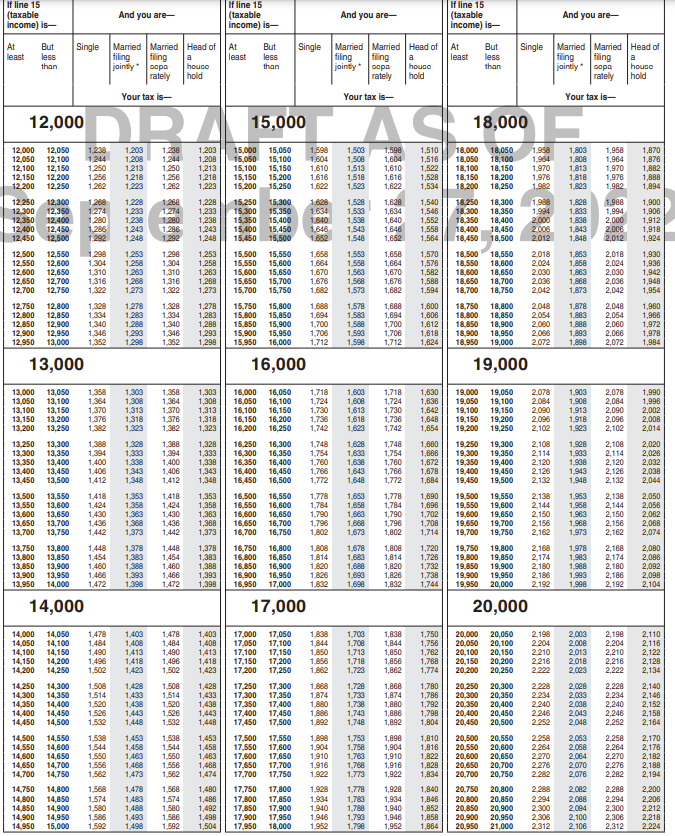

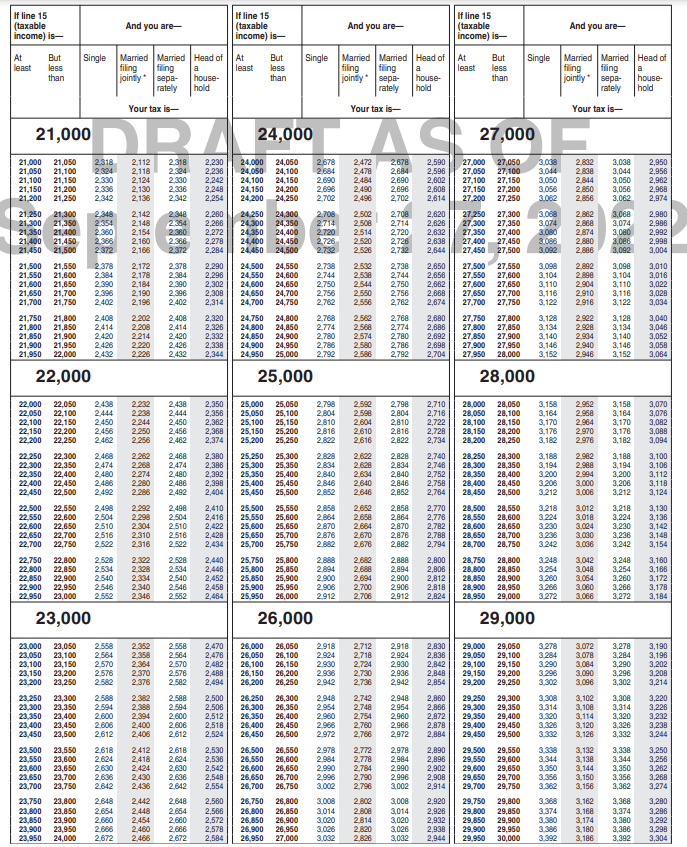

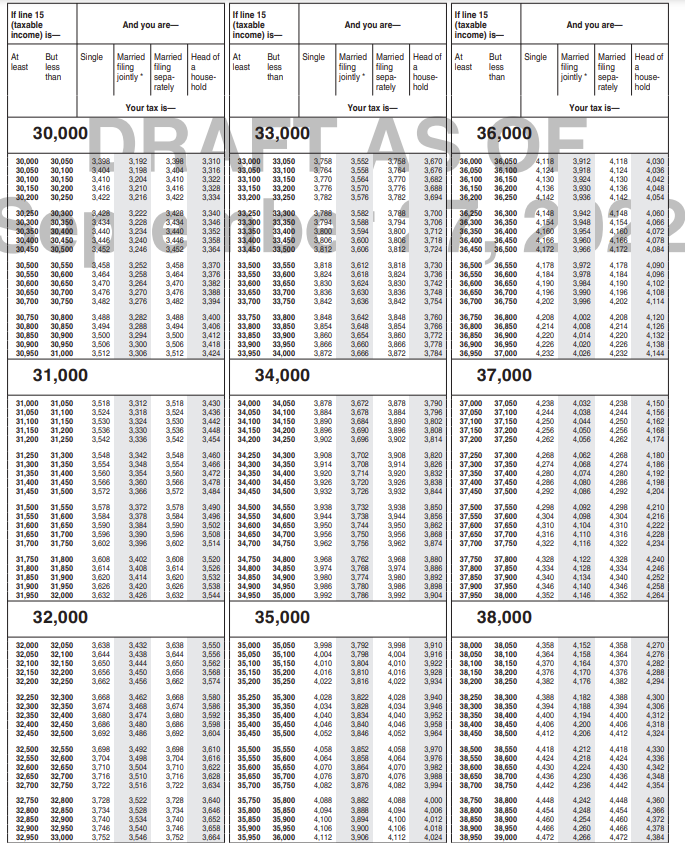

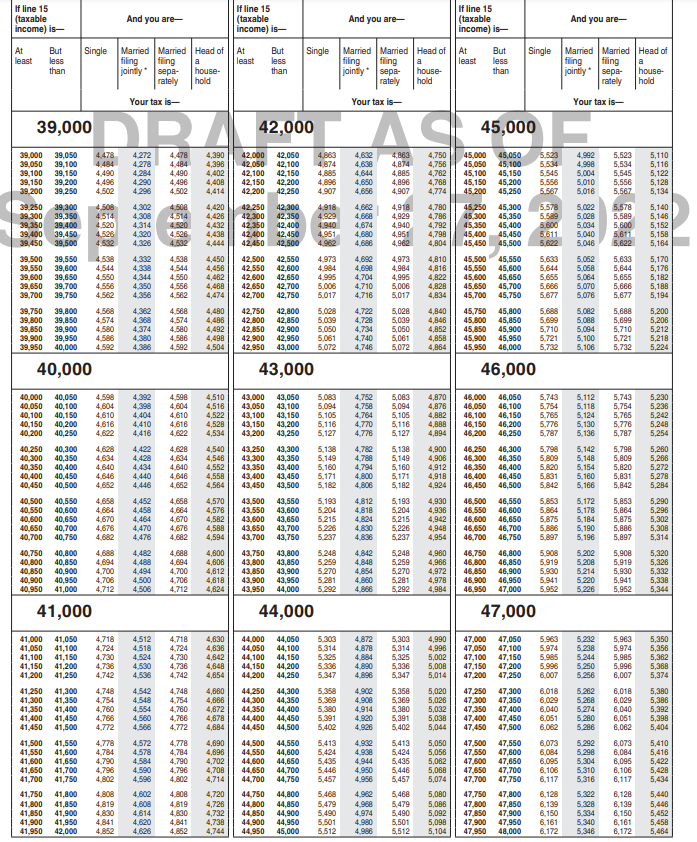

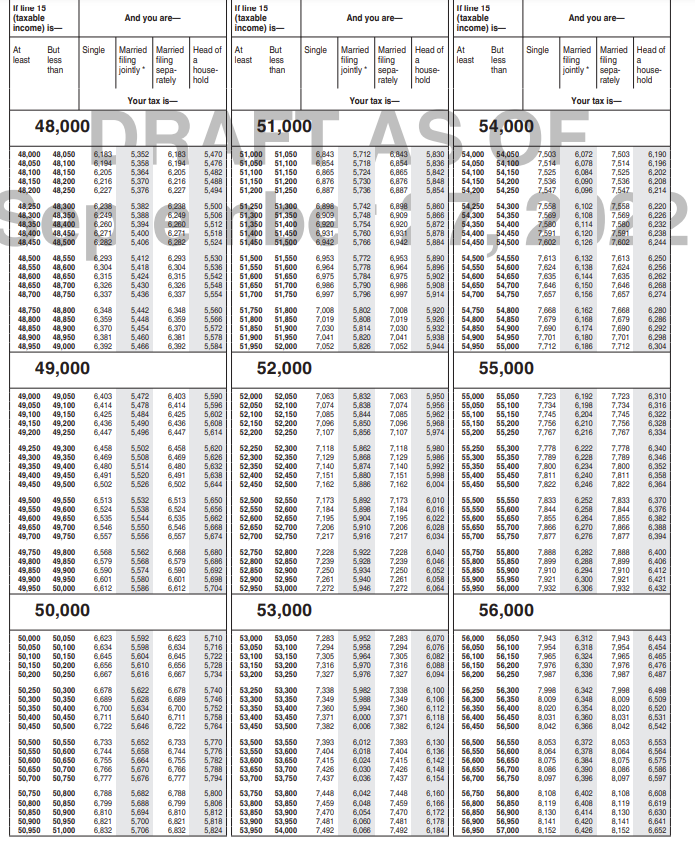

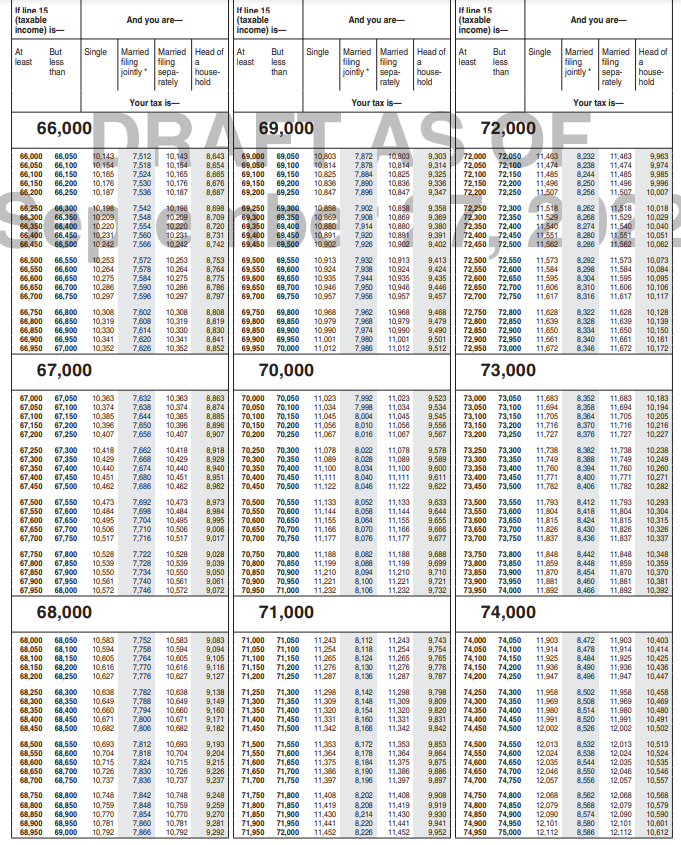

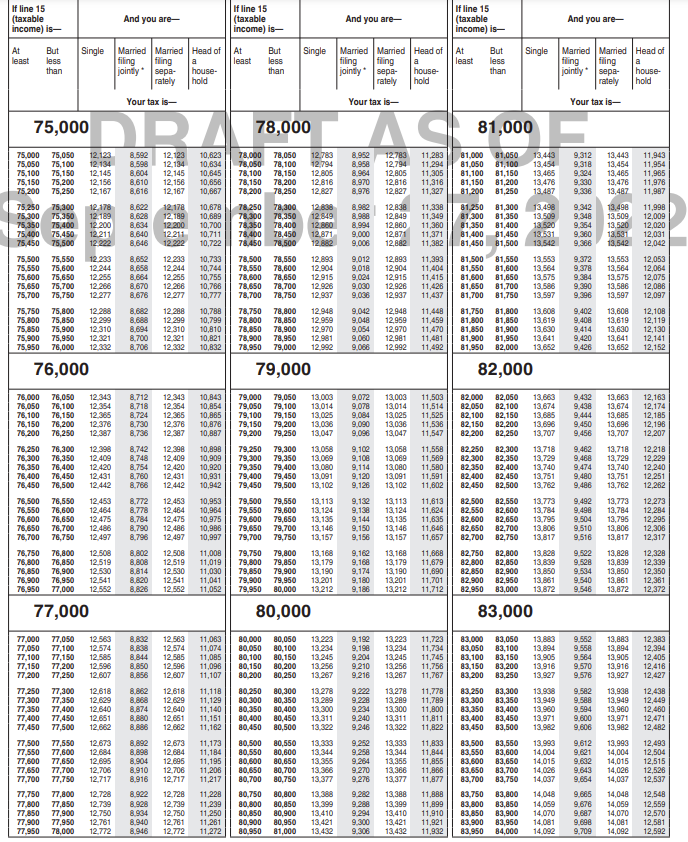

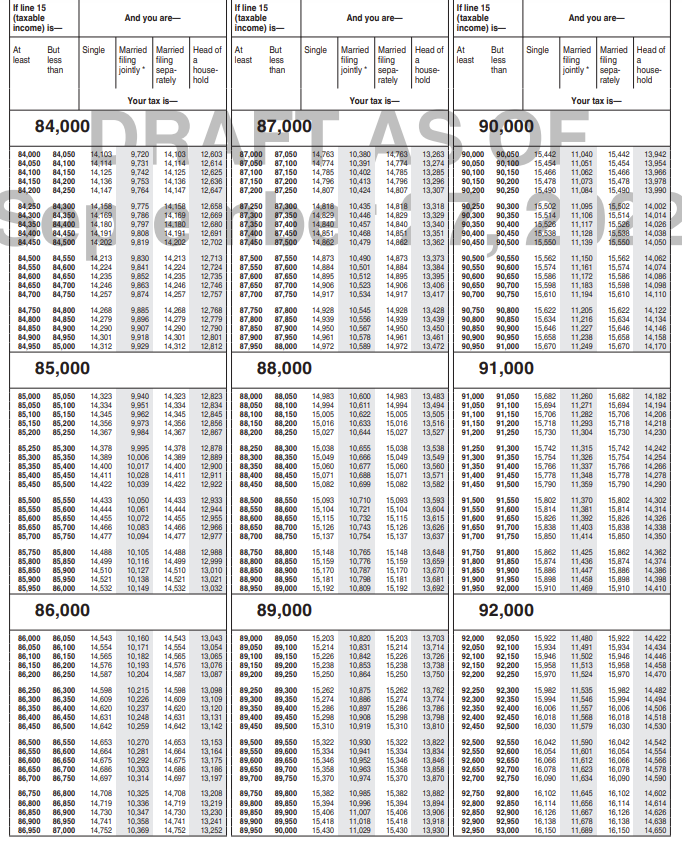

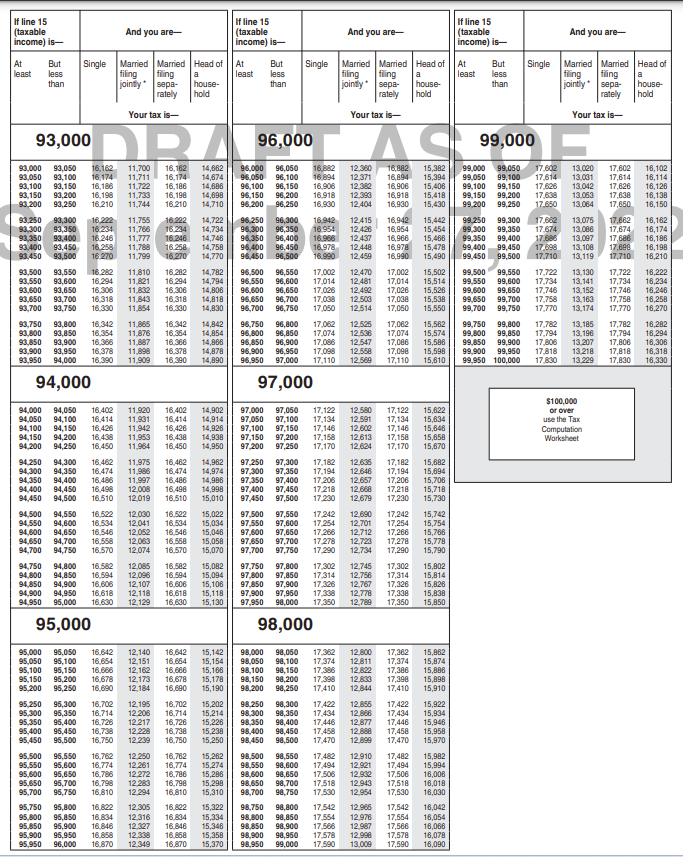

Use the appropriate Tax Tables.

Sheniqua, a single taxpayer, had taxable income of \\( \\$ 79,928 \\). Her employer withheld \\( \\$ 12,957 \\) in federal income tax from her paychecks throughout the year. What is the amount of refund would Sheniqua receive or additional tax she would pay? Note: Input your answer as a positive number. Use the appropriate Tax Tables

Sheniqua, a single taxpayer, had taxable income of \\( \\$ 79,928 \\). Her employer withheld \\( \\$ 12,957 \\) in federal income tax from her paychecks throughout the year. What is the amount of refund would Sheniqua receive or additional tax she would pay? Note: Input your answer as a positive number. Use the appropriate Tax Tables Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started