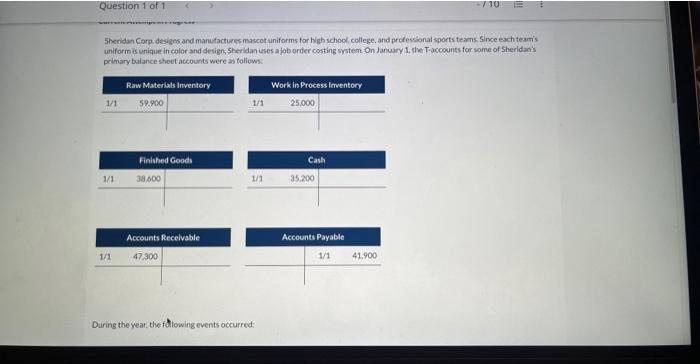

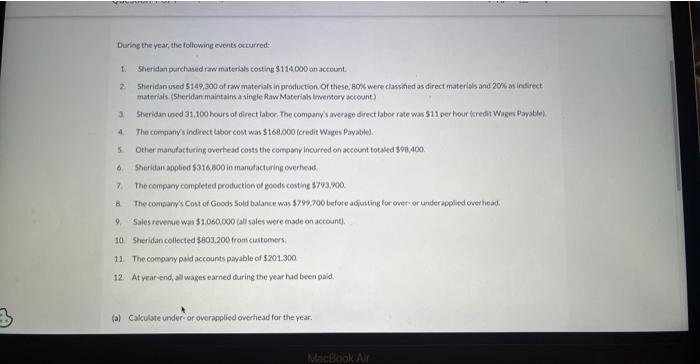

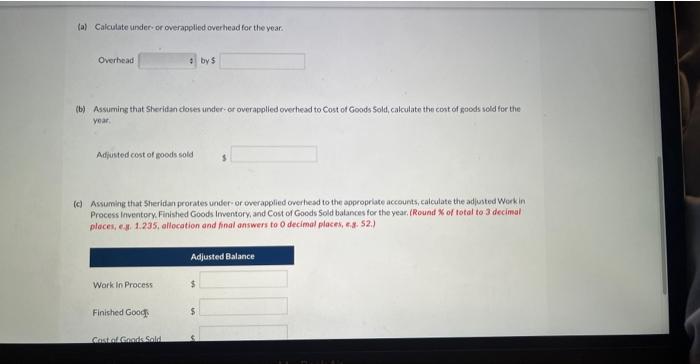

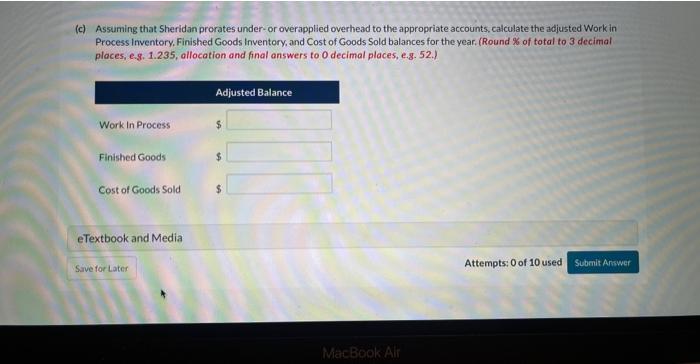

Sheridan Corp. desiges and manufactures mascot uniforms for Wigh school, college. and protesibonal sports teams, Since esch tearris uniform is unique in color and design, Sheridan uses a job order costing system. On danuary 1 , the T-accounts for some of Sheridaris peinary balance sheet accounts were as foliows: During the year. the following events occurred: Duriog the year, the following events occurred: 1. Sheridan purchased rarw materiats costing $114.000 on account 2. 5heridan used 5149,300 of rww materials in production. Of these. 800 were classithed as direct materials and 205 as insirect materiaks (Sheridan maint ains a single Raw Materiak imentery zecount) 1. Sheridan uned 31,100hours of direct laboe. The company's meeage direct labor rate was 511 per hour (credit Wages Payable) 4. The compatiy indiect beor cost was $168,000 (credit Wages Payable). 5. Other marufacturing orertead costs the company incurred on acceunt totaled 398,400. 6. Sherkan apptied 5316.800 in manudacturing everfead. 7. The company completed production of goods costine 9793.900. 8 The conganys' Cost of Goods Sold balance was $799,700 before agiuting for over or underapplied onethead. 9. Sales revenue was $1.060000 (all saleswere made on accoant). 10. Sheridan collected $803,200 from cuntemers. 11. The company paid accounts payable of $201.300 12. At yearsend, all wages earned during the year had been paid, (a) Calculate underror overapplied owerhead for the year. (a) Caiculate under of overapplied overhead for the yoar. Overhead by' (b) Assumine that Sherifan cioses under-or overapplied overhead to Cost ot Goods Sold, calculate the cont of goods sold for the year, Adiusted cost of goods solid (c) Assuming that Sheridan prorates voder- or overapplied orerhesd to the approprlate accounts, calculate the adjusted Workin Process inventory. Finished Goods Imventory, and Cost of Goods Sold balances tor the year. (Round % of totd to 3 decimal places, e.g. 1.235, allocation and final answers to 0 decimal places, e.s. 52.) Assuming that Sheridan prorates under-or overapplied overhead to the appropriate accounts, calculate the adjusted Work in Process Inventory. Finished Goods Inventory, and Cost of Goods Sold balances for the year. (Round % of total to 3 decimal places, e.g. 1.235, allocation and final answers to 0 decimal places, e.g. 52.)