Answered step by step

Verified Expert Solution

Question

1 Approved Answer

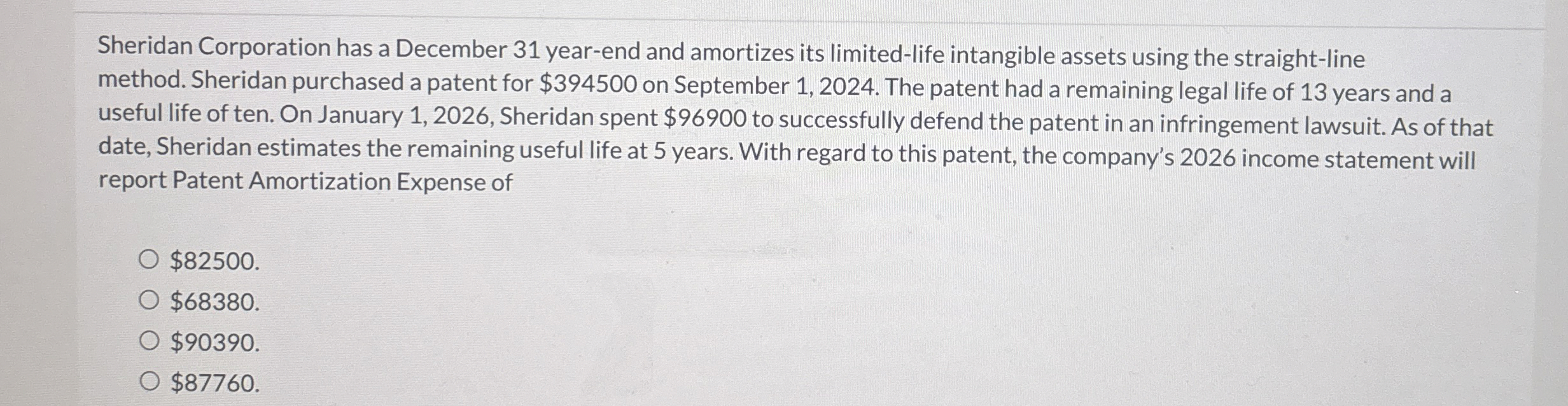

Sheridan Corporation has a December 3 1 year - end and amortizes its limited - life intangible assets using the straight - line method. Sheridan

Sheridan Corporation has a December yearend and amortizes its limitedlife intangible assets using the straightline method. Sheridan purchased a patent for $ on September The patent had a remaining legal life of years and a useful life of ten. On January Sheridan spent $ to successfully defend the patent in an infringement lawsuit. As of that date, Sheridan estimates the remaining useful life at years. With regard to this patent, the company's income statement will report Patent Amortization Expense of

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started