Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheridan Corporation issued $5 million of 10-year, 6% callable convertible subordinated debentures on January 2, 2020. The debentures have a face value of $1,000,

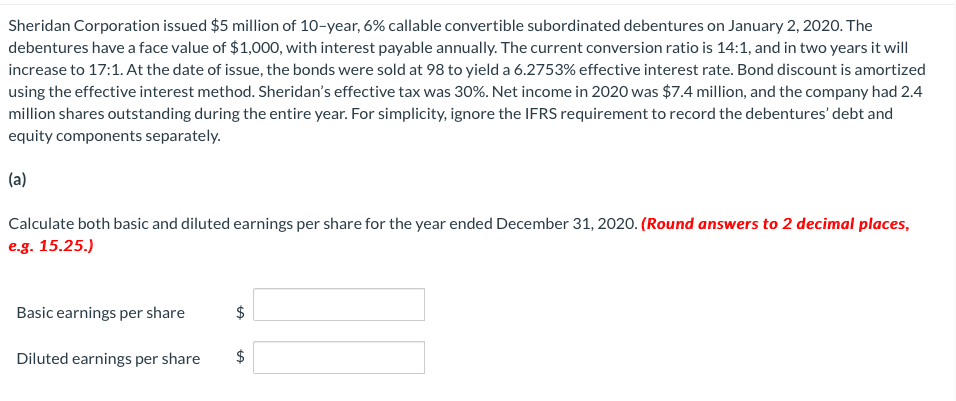

Sheridan Corporation issued $5 million of 10-year, 6% callable convertible subordinated debentures on January 2, 2020. The debentures have a face value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in two years it will increase to 17:1. At the date of issue, the bonds were sold at 98 to yield a 6.2753% effective interest rate. Bond discount is amortized using the effective interest method. Sheridan's effective tax was 30%. Net income in 2020 was $7.4 million, and the company had 2.4 million shares outstanding during the entire year. For simplicity, ignore the IFRS requirement to record the debentures' debt and equity components separately. (a) Calculate both basic and diluted earnings per share for the year ended December 31, 2020. (Round answers to 2 decimal places, e.g. 15.25.) Basic earnings per share Diluted earnings per share

Step by Step Solution

★★★★★

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Basic earnings per share Basic earning per share ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started