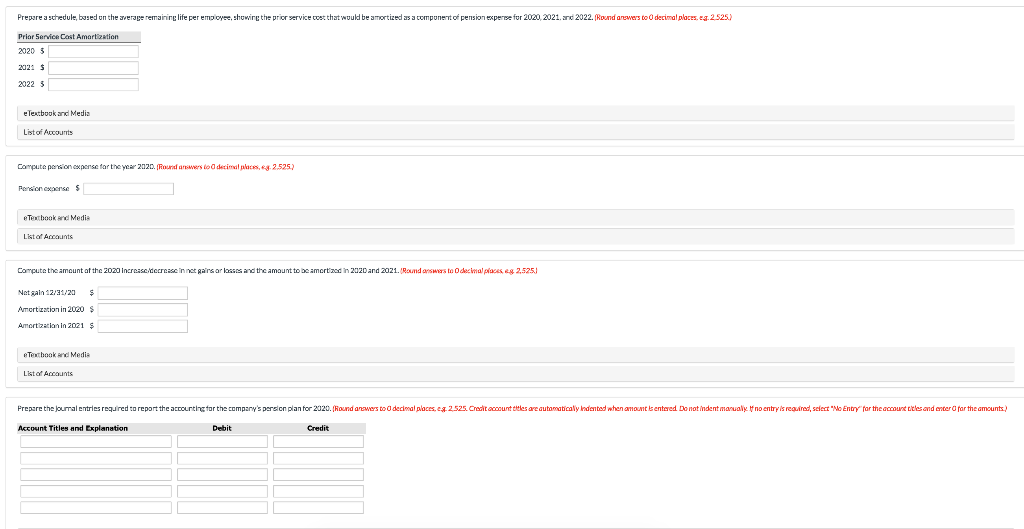

Question

Sheridan Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1997. Prior to 2020, cumulative net pension expense recognized equaled cumulative

Sheridan Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1997. Prior to 2020, cumulative net pension expense recognized equaled cumulative contributions to the plan. Other relevant information about the pension plan on January 1, 2020, is as follows.

| 1. | The company has 200 employees. All these employees are expected to receive benefits under the plan. The average remaining service life per employee is 12 years. | |

| 2. | The projected benefit obligation amounted to $4,903,000 and the fair value of pension plan assets was $2,946,000. The market-related asset value was also $2,946,000. Unrecognized prior service cost was $1,957,000. |

On December 31, 2020, the projected benefit obligation and the accumulated benefit obligation were $4,936,000 and $4,081,000, respectively. The fair value of the pension plan assets amounted to $4,048,000 at the end of the year. A 10% settlement rate and a 10% expected asset return rate were used in the actuarial present value computations in the pension plan. The present value of benefits attributed by the pension benefit formula to employee service in 2020 amounted to $201,000. The employers contribution to the plan assets amounted to $761,000 in 2020. This problem assumes no payment of pension benefits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started