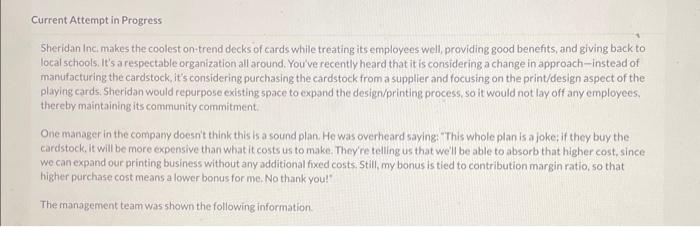

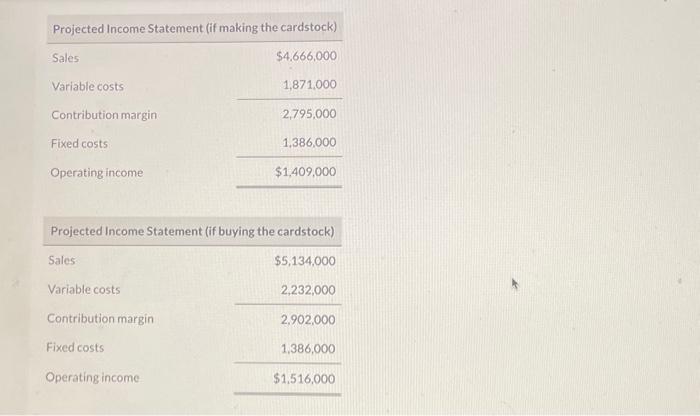

Sheridan Inc, makes the coolest on-trend decks of cards while treating its employees well, providing good benefits, and giving back to local schools. It's a respectable organization all around. You've recently heard that it is considering a change in approach-instead of manufacturing the cardstock, it's considering purchasing the cardstock from a supplier and focusing on the print/design aspect of the playing cards. Sheridan would repurpose existing space to expand the design/printing process, so it would not lay off any employees. thereby maintaining its community commitment. One manager in the company doesn't think this is a sound plan. He was overheard saying: "This whole plan is a joke: if they buy the cardstock, it will be more expensive than what it costs us to make. They're telling us that we'l be able to absorb that higher cost, since we can expand our printing business without any additional fixed costs. Still, my bonus is tied to contribution margin ratio, so that higher purchase cost means a lower bonus for me. No thank you!" The management team was shown the following information. Projected Income Statement (if making the cardstock) Sales Variable costs Contribution margin Fixed costs Operating income 54,666,000 2,795,0001,871,000 $1,409,0001,386,000 Projected Income Statement (if buying the cardstock) \begin{tabular}{lr} \hline Sales & $5,134,000 \\ Variable costs & 2,232,000 \\ \hline Contribution margin & 2,902,000 \end{tabular} Fixed costs $1,516,0001,386,000 (c) Assume Sheridan moves forward with buying the cardstock and achieves the projected income amounts for that scenario this year Suppose sales volume next year is expected to be 5% larger than it is this year, with no change in selling price. Further, since Sheridan will be producing a larger quantity, assume it will be able to secure better pricing for the cardstock. Due to that better pricing. projected variable costs for next year are the same in total as what they are for this year, even with the increase in volume. Fixed costs will be up slightly due to higher salaries and benefits (up 2% overall). Present a projected income statement for the upcoming year for Sheridan and determine if the manager is still going to be unhappy with his bonus. (Round contribution margin ratio to 2 decimal places, eg. 15.25% )