Answered step by step

Verified Expert Solution

Question

1 Approved Answer

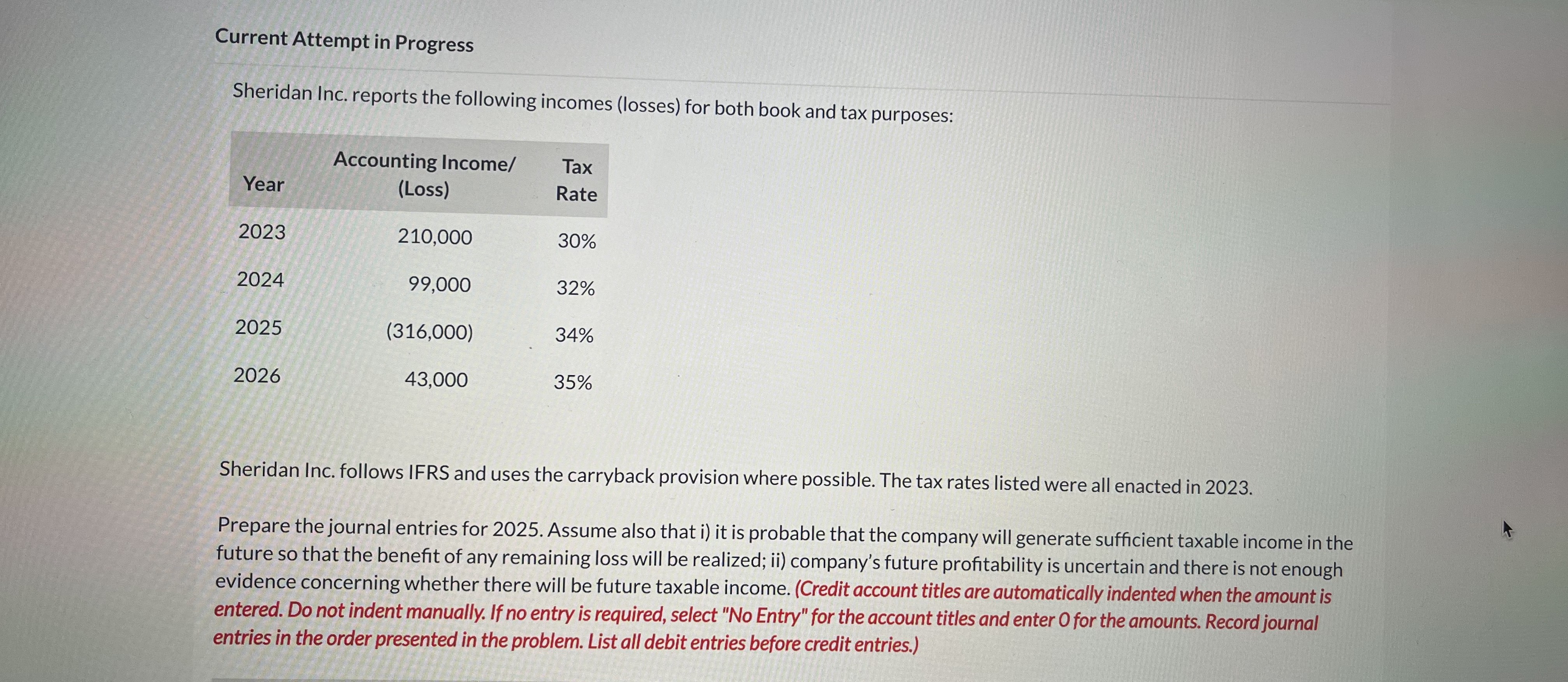

Sheridan Inc. reports the following incomes (losses) for both book and tax purposes: Sheridan Inc. follows IFRS and uses the carryback provision where possible. The

Sheridan Inc. reports the following incomes (losses) for both book and tax purposes: Sheridan Inc. follows IFRS and uses the carryback provision where possible. The tax rates listed were all enacted in 2023. Prepare the journal entries for 2025. Assume also that i) it is probable that the company will generate sufficient taxable income in the future so that the benefit of any remaining loss will be realized; ii) company's future profitability is uncertain and there is not enough evidence concerning whether there will be future taxable income. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Sheridan Inc. reports the following incomes (losses) for both book and tax purposes: Sheridan Inc. follows IFRS and uses the carryback provision where possible. The tax rates listed were all enacted in 2023. Prepare the journal entries for 2025. Assume also that i) it is probable that the company will generate sufficient taxable income in the future so that the benefit of any remaining loss will be realized; ii) company's future profitability is uncertain and there is not enough evidence concerning whether there will be future taxable income. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started