Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2023. She estimates her 2023

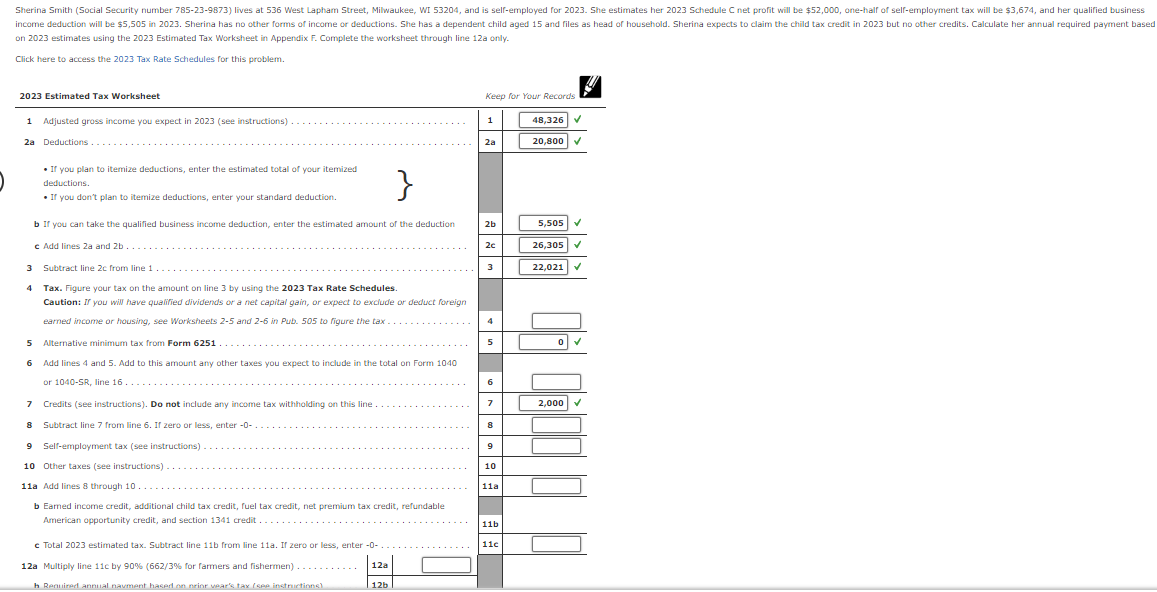

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2023. She estimates her 2023 Schedule C net profit will be $52,000, one-half of self-employment tax will be $3,674, and her qualified business income deduction will be $5,505 in 2023. Sherina has no other forms of income or deductions. She has a dependent child aged 15 and files as head of household. Sherina expects to claim the child tax credit in 2023 but no other credits. Calculate her annual required payment based on 2023 estimates using the 2023 Estimated Tax Worksheet in Appendix F. Complete the worksheet through line 12a only. Click here to access the 2023 Tax Rate Schedules for this problem. 2023 Estimated Tax Worksheet 1 Adjusted gross income you expect in 2023 (see instructions). 2a Deductions.. Keep for Your Records 1 48,326 V 2a 20,800 If you plan to itemize deductions, enter the estimated total of your itemized deductions. If you don't plan to itemize deductions, enter your standard deduction. } b If you can take the qualified business income deduction, enter the estimated amount of the deduction c Add lines 2a and 2b. 2b 5,505 2c 26,305 3 Subtract line 2c from line 1 4 Tax. Figure your tax on the amount on line 3 by using the 2023 Tax Rate Schedules. 3 22,021 Caution: If you will have qualified dividends or a net capital gain, or expect to exclude or deduct foreign earned income or housing, see Worksheets 2-5 and 2-6 in Pub. 505 to figure the tax. 4 5 Alternative minimum tax from Form 6251 5 6 Add lines 4 and 5. Add to this amount any other taxes you expect to include in the total on Form 1040 or 1040-SR, line 16... 6 7 Credits (see instructions). Do not include any income tax withholding on this line. 8 Subtract line 7 from line 6. If zero or less, enter -0- 9 Self-employment tax (see instructions). 10 Other taxes (see instructions) 11a Add lines 8 through 10.. 7 2,000 8 9 10 11a b Earned income credit, additional child tax credit, fuel tax credit, net premium tax credit, refundable American opportunity credit, and section 1341 credit.. 11b Total 2023 estimated tax. Subtract line 11b from line 11a. If zero or less, enter -0- 11c 12a Multiply line 11c by 90% (662/3% for farmers and fishermen). 12a h. Required annual navment hased on prior year's tax (see instructions) 12b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started