Question

Sherlin, a successful young entrepreneur, is contemplating to reinvest her savings which she has kept in bank fixed deposits so far. She wants to generate

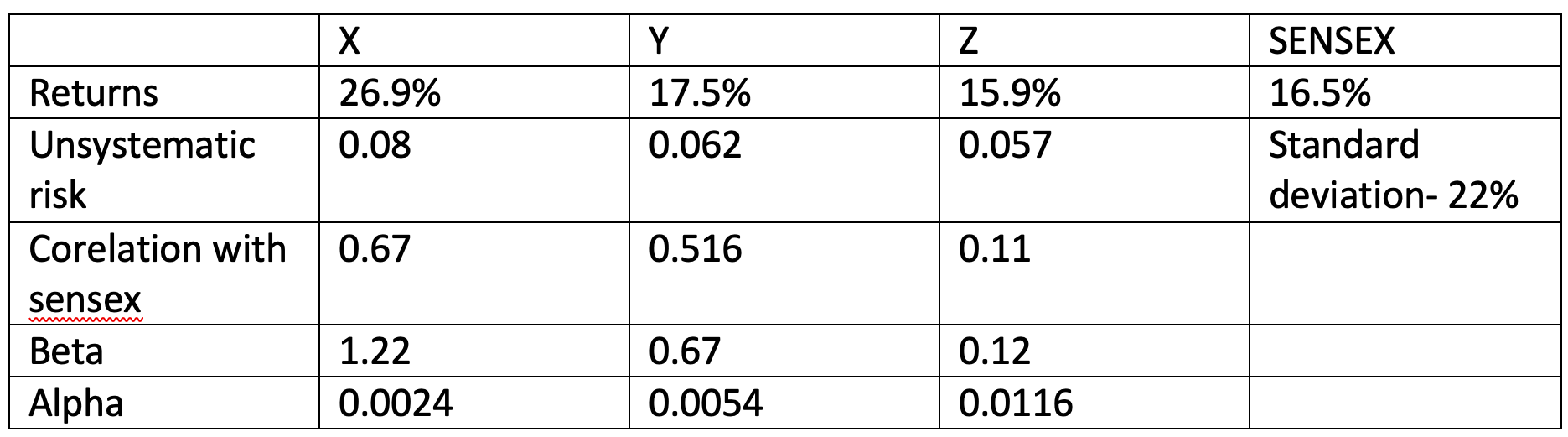

Sherlin, a successful young entrepreneur, is contemplating to reinvest her savings which she has kept in bank fixed deposits so far. She wants to generate higher returns than those given to her by the FDs. She has been reading that equity markets have on an average given a return of 14-15% and she is tempted to invest in equity. On the basis of her research and help of a management student, John, her neighbour, she decides to choose three stocks out of the stocks that comprise S&P BSE SENSEX. Randomly she chooses stock X, Y and Z and decides to spread her funds equally across them. John has downloaded data related to these three stocks and SENSEX for a period from January 2001 through December 2005. He comes up with the foll owing information about the three stocks and SENSEX:

Based on above data-

Q- Compute- i. Portfolio return, ii. Portfolio Risk

Q- Explain Alpha is perceived as a portfolio managers aptitude. Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started