Question

Sherry took Skinner Industries public nine years ago when they were just three years old. 1,200,000 shares of common stock were issued at a price

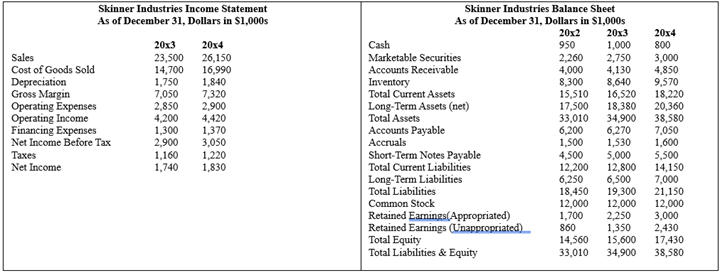

Sherry took Skinner Industries public nine years ago when they were just three years old. 1,200,000 shares of common stock were issued at a price of $10 per share through the mid-Atlantic regional exchange. The company has continued to prosper and enjoy a good growth rate as the motorsports craze has mushroomed. In 20x3 the Skinner Industries growth rate in earnings was 6% and in 20x4 the growth rate was 5%. Sherry does not want the company to become too large, as she still likes the feeling of a down home business. At the same time, the business is virtually guaranteed to grow just because of the motor sport market itself. Sherry is happy with the current 5% growth rate and to support that projection she is planning on a $3,000,000 capital expansion program in 20x5. She is currently close to capacity with many of the operations and without the continued expansion the desired growth could be in jeopardy. So far, Sherry has been able to maintain a reasonable increase in long-term assets without having to initiate subsequent issues of stock. She would like to continue funding growth through both the company profits and with favorable bank loans. The company wants to maintain a target equity ratio of 70% of total capital, which includes long-term liabilities plus equity. Currently, the cost of borrowing is 7.5% before corporate taxes of 22%. Sherry has also determined that the cost of equity is 10%. When Sherry started the business, she was able to work out an attractive lending agreement for $5,000,000 in long-term bonds with a 15 year maturity. Part of the agreement with the bank was that Sherry establishes a sinking fund that would have to match the $5,000,000 in bonds one year prior to maturity. This provision would guarantee the bank collateral on the bonds but allow Skinner to earn some interest on marketable securities. As of the end of the current year, that fund has grown to $3,000,000 and Sherry is planning on adding $1,000,000 in each of the next two years. The bank also required that Sherry establish an appropriated retained earnings account equal to the amount of the collateral sinking funds so that she would be limited in the amount of dividends that could be declared and paid in any given year. To supplement some of the recent expansion, Sherry had funded the increase in long-term assets with additional long-term notes. This funding has grown by $2,000,000 at the end of the current year. The financial institution providing these funds has identified some constraints on potential dividend payments based on the overall financial performance of Skinner. The company must maintain a current ratio of at least 1.2 times, a times interest earned ratio of at least 3.0 times, and a debt/total capital ratio no greater than 60%. While the company is growing and there continues to be a need for capital expansion, Sherry also recognizes the need for dividends, and has established a once a year dividend payment at the end of the year. The investors seem to like their dividend bonus that comes in early February just before the start of racing season. Many of the investors are value conscious and want a return on their investment from both dividends and stock price appreciation. Since this is a regional company focusing on a very specific market, a large number of investors are motor sport fans from the mid-Atlantic area. Sherry has always believed in a significant dividend, last year it was $700,000, and the dividend yield is over 6.0%. The company has also maintained a pretty consistent dividend payout ratio through 20x3. While everything seems to be going right for the company, with a reasonable growth rate in an exploding market plus an attractive dividend, Sherry is puzzled on why the market price of the stock at around $8.75 per share seems so low. Perhaps the overall economy, which is struggling and filled with uncertainty, is causing the price decline. Also, Sherry believes that the job market in North and South Carolina has suffered with many textile and similar jobs going overseas. In an effort to support the price of the stock and maintain the confidence of the investors, Sherry thinks it is important to retain and possibly even increase the current dividend per share for 20x4. Sherry has just received the financial statements as of December 31, 20x4 without the inclusion of a 20x4 dividend payment. She needs to determine what annual dividend payment the company should make for 20x4. She also wanted to see what happened last year so she obtained the income statement and balance sheet from 20x3 along with the balance sheet figures at the end of 20x2. The corporate tax rate is 22%

QUESTION 3: Should Skinner buy back stock at $8.75? If yes, cite two reasons why. If no, cite two reasons why not.

QUESTION 4: If you were Sherry Skinner what is the number one issue that would be keeping you up at night?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started