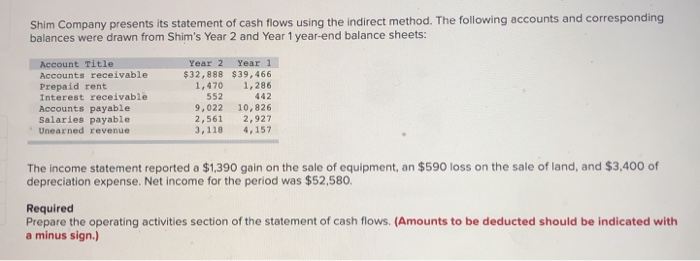

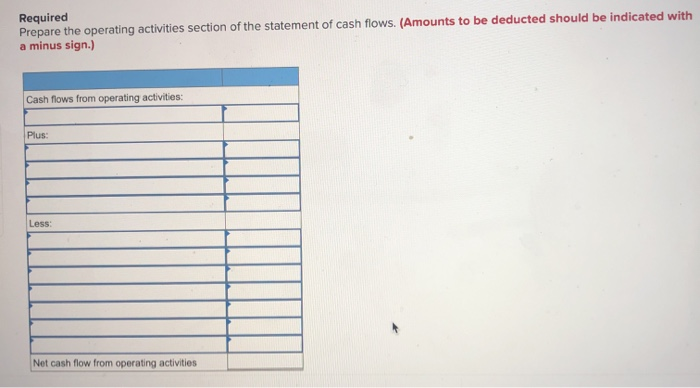

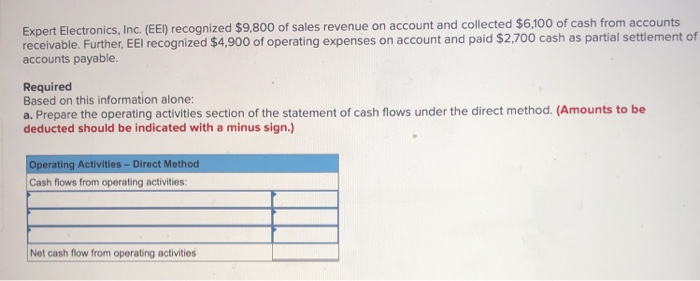

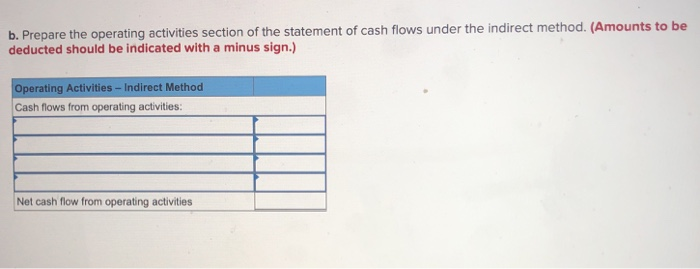

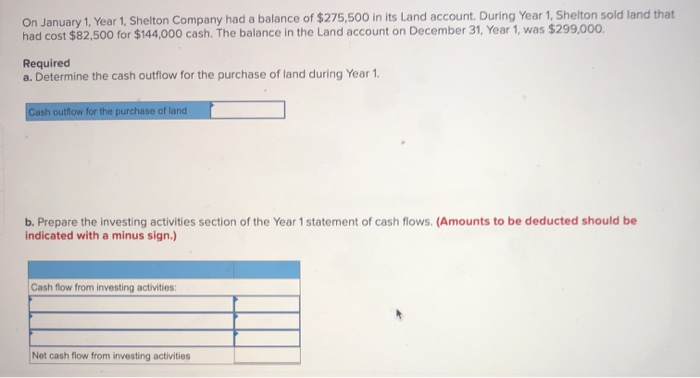

Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim's Year 2 and Year 1 year-end balance sheets: Account Title Accounts receivable Prepaid rent Interest receivable Accounts payable Salaries payable Unearned revenue Year 2 Year 1 $32,888 $39,466 1.470 1.286 552 442 9,022 10,826 2,561 2,927 3,110 4,157 The income statement reported a $1,390 gain on the sale of equipment, an $590 loss on the sale of land, and $3,400 of depreciation expense. Net income for the period was $52,580. Required Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) Required Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities: Plus: Less: Net cash flow from operating activities Expert Electronics, Inc. (EEI) recognized $9,800 of sales revenue on account and collected $6,100 of cash from accounts receivable. Further, EEl recognized $4,900 of operating expenses on account and paid $2,700 cash as partial settlement of accounts payable. Required Based on this information alone: a. Prepare the operating activities section of the statement of cash flows under the direct method. (Amounts to be deducted should be indicated with a minus sign.) Operating Activities - Direct Method Cash flows from operating activities: Net cash flow from operating activities b. Prepare the operating activities section of the statement of cash flows under the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Operating Activities - Indirect Method Cash flows from operating activities: Net cash flow from operating activities On January 1, Year 1, Shelton Company had a balance of $275,500 in its Land account. During Year 1, Shelton sold land that had cost $82,500 for $144,000 cash. The balance in the Land account on December 31, Year 1, was $299,000. Required a. Determine the cash outflow for the purchase of land during Year 1. Cash outflow for the purchase of land b. Prepare the investing activities section of the Year 1 statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) Cash flow from investing activities: Net cash flow from investing activities