Shin Lee was a recent immigrant to Canada and current undergraduate student at the Telfer School of Management. He had some family money to invest and wanted to use the skills he was developing at Telfer wisely. He had heard a great deal about recent turmoil at Bombardier, and this news had piqued his interest. Lee knew often a company in trouble was a good buy, particularly if the future looked bright.

Did Bombardier provide a good investment opportunity? Lee started to do work on a DCF model for Bombardier. He made projections about the Free Cash Flow (FCF) and he was ready to take the present value of the FCF. To do that he realized that he needed to compute the company's Weighted Average Cost of Capital (WACC).

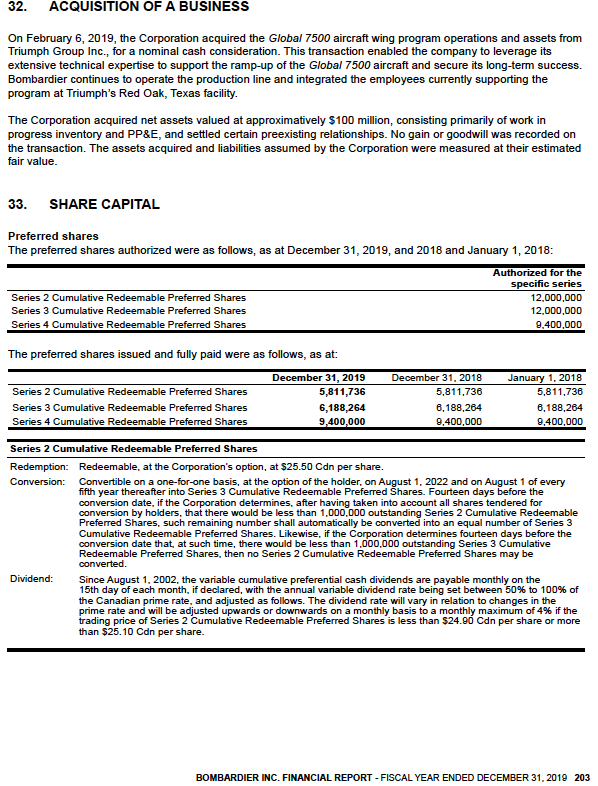

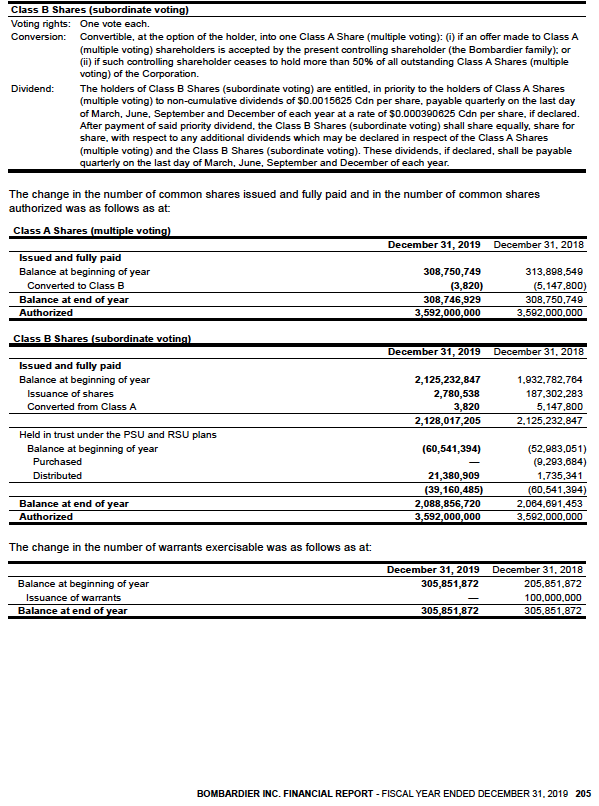

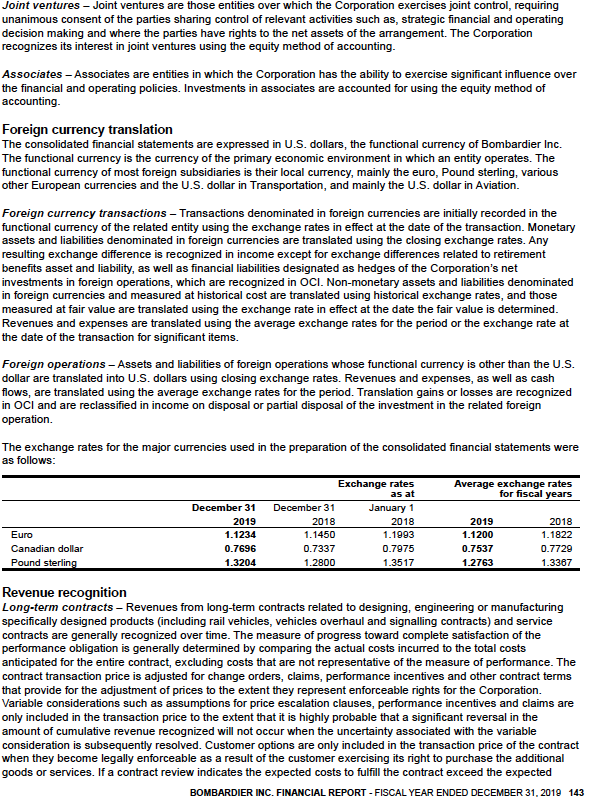

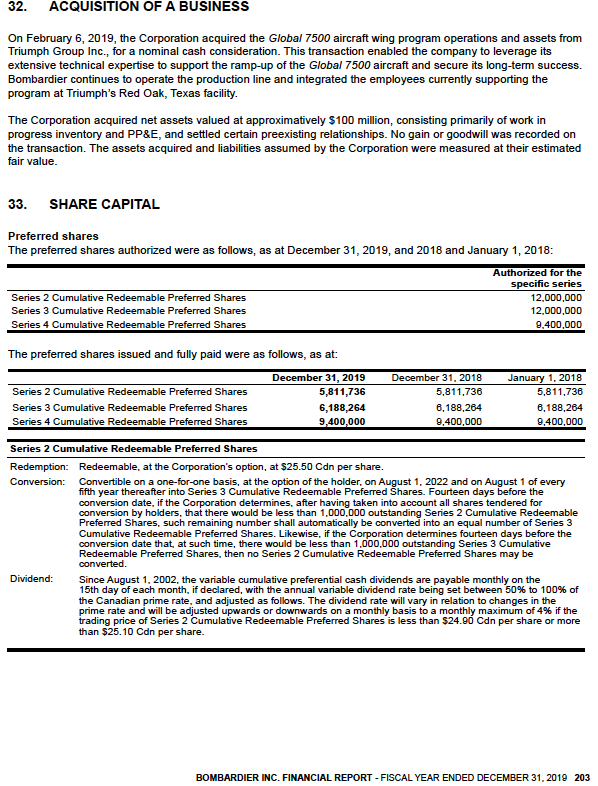

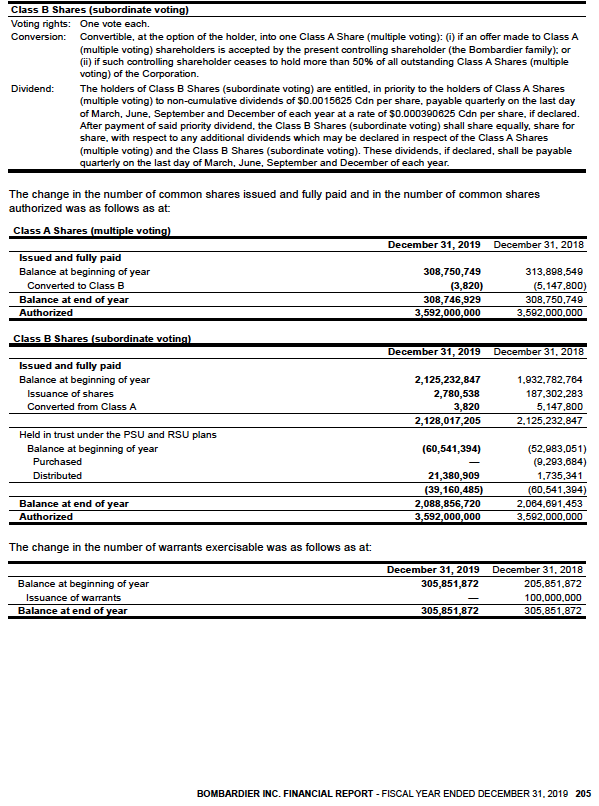

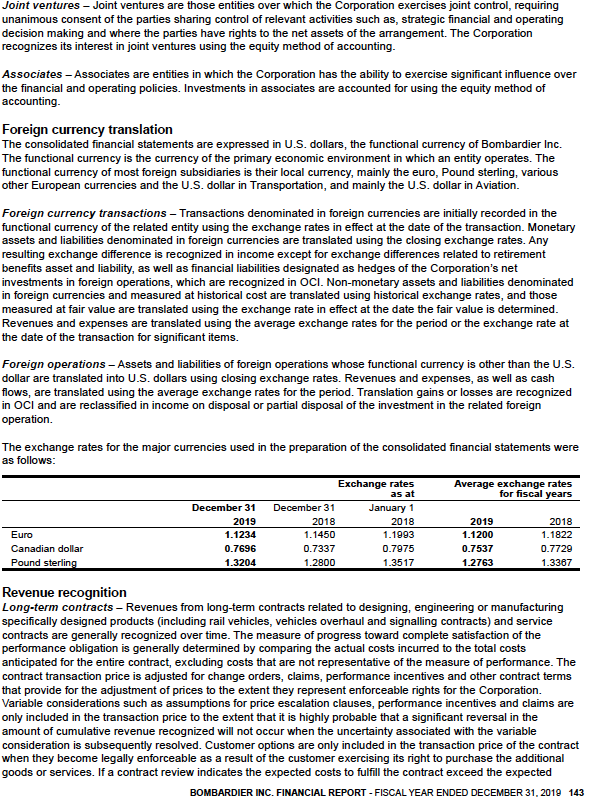

Lee's research indicated Bombardier's Beta was 2.30 and the Market Risk Premium was 5.23 per cent. He set out to calculate the weight of equity for Bombardier based on the closing share price as of December 31, 2019. Share price information was available at Bombardier Investor Relations (check out https://ir.bombardier.com/en/share-price for share price). By looking at the 2019 Annual Report (available also at the Investor Relations website), Lee could determine the number of shares outstanding of both preferred and common shares (see pages 203 and 205 of the Annual Report) and exchange rates (see page 143 of the Annual Report). The exchange rate is important because the values in the Annual Report are in USD whereas the share prices are in CAD. He will need then to convert the USD values to CAD. He assumed the company's effective tax rate was 19.13 per cent (an average of the last 4 years that Bombardier had a positive tax rate). For the same day, December 31, 2019, Lee researched the Canadian 10-year bond yield at the Bank of Canada, which would be necessary in calculating the cost of equity for Bombardier. He found that this yield was 1.70%.

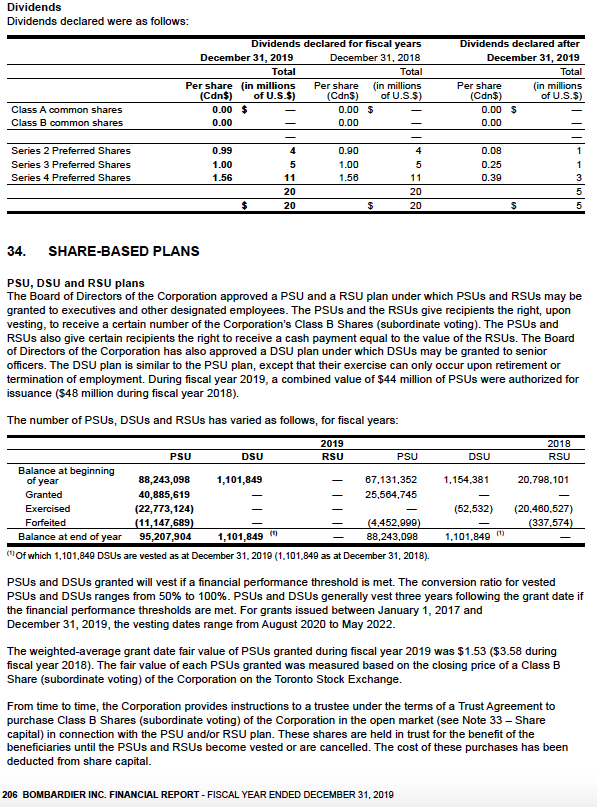

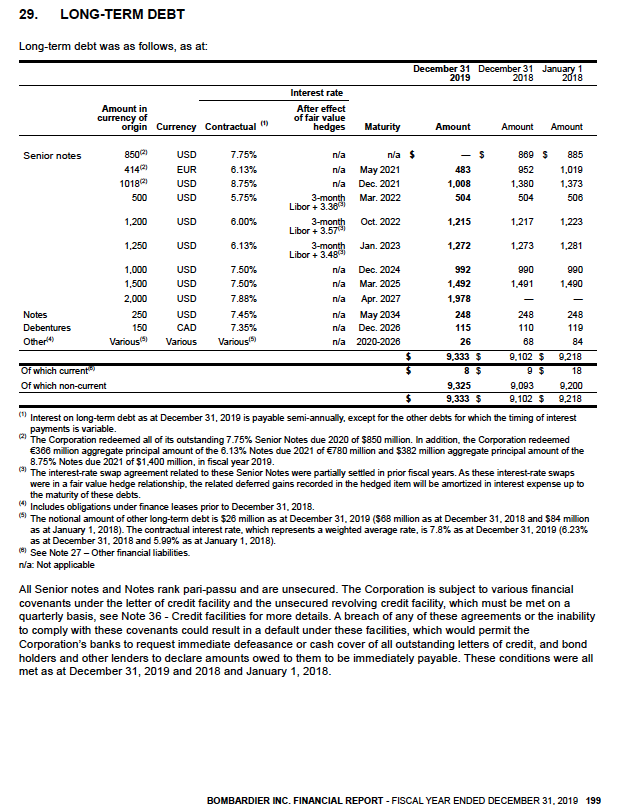

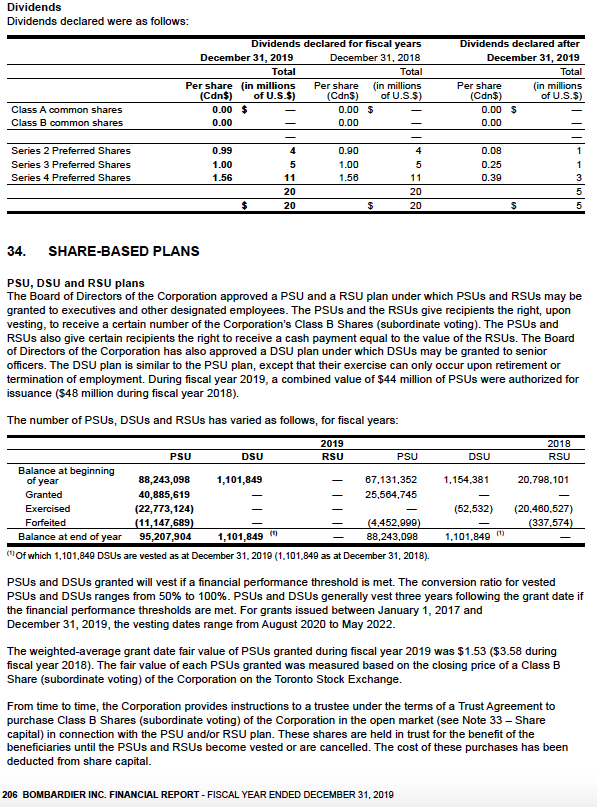

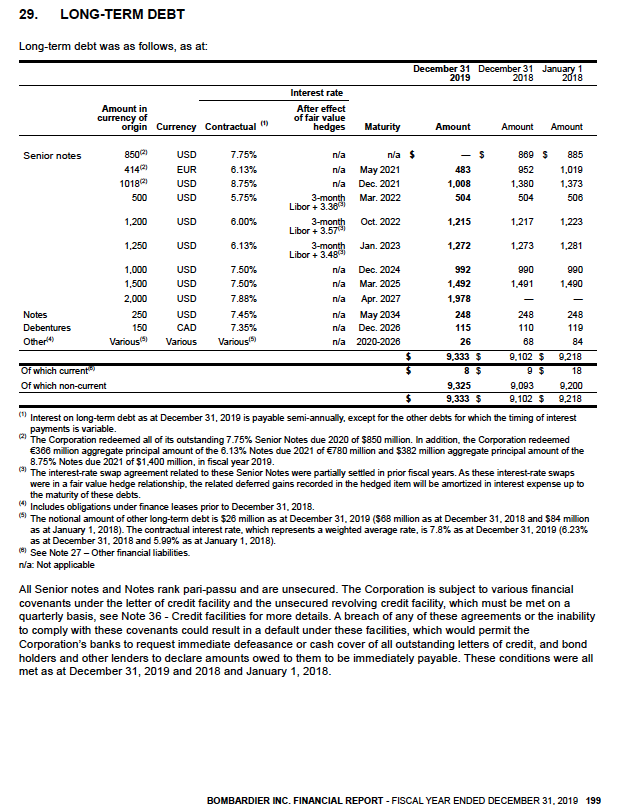

Lee expected to incorporate the range of preferred shares and their most recent dividend payouts (see page 206 of the Annual Report) into his cost of capital calculations. He assumes that the growth rate of the preferred shared dividends is zero. When calculating the cost of debt, he would include the company's long-term debt (see page 199 of the Annual Report). For the debt that has no value for December 31st, 2019 (it is represented as a dash) he assumes that the market value is 0 (i.e., it has been paid off). He further assumed that the amounts of long-term debt on page 199 of the Annual Report (the column with header December 31st, 2019) were the best estimates of the market values in USD. Finally, Lee's research on Bloomberg gave him the bond prices for all of Bombardier's long term debt (see Table 1; the face value is 100). The bond prices are necessary for the computation of the YTM of each bond with the exception of the "Other" entry, the cost of which for December 31st, 2019 was explained in a footnote (see page 199 of the Annual Report). One issue is how to handle fractional years for bond maturities. For simplicity, he decided to round the number of periods down when computing the YTM of each bond (for the December maturity it is assumed to be at the end of the month so there is no need to round down). So for example, for the May 2021 bond he assumed it has 2 semiannual periods to maturity. Using his knowledge of finance, he sat down to punch the numbers and calculate Bombardier's WACC.

Find the WACC for Bombardier at Dec 31, 2019. Use excel and provide all the necessary explanations.

Table 1 - Bombardier Bond Prices as of December 31, 2019

| Note | Price |

| May-21, 6.13% | $104.30 |

| Dec-21, 8.75% | $109.84 |

| Mar-22, 5.75% | $103.24 |

| Oct-22, 6% | $100.06 |

| Jan-23, 6.13% | $102.55 |

| Dec-24, 7.5% | $105.400 |

| Mar-25, 7.5% | $102.55 |

| Apr-27, 7.88% | $103.50 |

| May-34, 7.45% | $95.00 |

| Dec-26, 7.35% | $101.48 |

32. ACQUISITION OF A BUSINESS On February 6, 2019, the Corporation acquired the Global 7500 aircraft wing program operations and assets from Triumph Group Inc., for a nominal cash consideration. This transaction enabled the company to leverage its extensive technical expertise to support the ramp-up of the Global 7500 aircraft and secure its long-term success. Bombardier continues to operate the production line and integrated the employees currently supporting the program at Triumph's Red Oak, Texas facility. The Corporation acquired net assets valued at approximatively $100 million, consisting primarily of work in progress inventory and PP&E, and settled certain preexisting relationships. No gain or goodwill was recorded on the transaction. The assets acquired and liabilities assumed by the Corporation were measured at their estimated fair value. 33. SHARE CAPITAL Preferred shares The preferred shares authorized were as follows, as at December 31, 2019, and 2018 and January 1, 2018: Authorized for the specific series Series 2 Cumulative Redeemable Preferred Shares 12,000,000 Series 3 Cumulative Redeemable Preferred Shares 12.000.000 Series 4 Cumulative Redeemable Preferred Shares 9.400.000 The preferred shares issued and fully paid were as follows, as at: December 31, 2019 Series 2 Cumulative Redeemable Preferred Shares 5,811,736 Series 3 Cumulative Redeemable Preferred Shares 6,188,264 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 December 31, 2018 5,811,736 6,188,264 9.400,000 January 1, 2018 5.811,736 6,188,264 9,400,000 Series 2 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.50 Cdn per share. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 3 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 3 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, then no Series 2 Cumulative Redeemable Preferred Shares may be converted. Dividend: Since August 1, 2002, the variable cumulative preferential cash dividends are payable monthly on the 15th day of each month, if declared, with the annual variable dividend rate being set between 50% to 100% of the Canadian prime rate, and adjusted as follows. The dividend rate will vary in relation to changes in the prime rate and will be adjusted upwards or downwards on a monthly basis to a monthly maximum of 4% if the trading price of Series 2 Cumulative Redeemable Preferred Shares is less than $24.90 Cdn per share or more than $25.10 Cdn per share. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 203 Class B Shares (subordinate voting) Voting rights: One vote each. Conversion: Convertible, at the option of the holder, into one Class A Share (multiple voting): () if an offer made to Class A (multiple voting) shareholders is accepted by the present controlling shareholder (the Bombardier family): or (ii) if such controlling shareholder ceases to hold more than 50% of all outstanding Class A Shares (multiple voting) of the Corporation. Dividend: The holders of Class B Shares (subordinate voting) are entitled, in priority to the holders of Class A Shares (multiple voting) to non-cumulative dividends of $0.0015625 Cdn per share, payable quarterly on the last day of March, June, September and December of each year at a rate of $0.000390625 Cdn per share, if declared. After payment of said priority dividend, the Class B Shares (subordinate voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and the Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. The change in the number of common shares issued and fully paid and in the number of common shares authorized was as follows as at: Class A Shares (multiple voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year 308,750,749 313.898,549 Converted to Class B (3,820) (5.147.800) Balance at end of year 308,746,929 308.750.749 Authorized 3,592,000,000 3,592,000,000 December 31, 2019 December 31, 2018 Class B Shares (subordinate voting) Issued and fully paid Balance at beginning of year Issuance of shares Converted from Class A 2,125,232,847 2,780,538 3,820 2,128,017,205 1.932.782.764 187,302,283 5.147.800 2.125.232.847 Held in trust under the PSU and RSU plans Balance at beginning of year Purchased Distributed (60,541,394) (52.983,051) (9.293.684) 1,735,341 (60.541,394) 2.064.691,453 3.592.000.000 21,380,909 (39, 160,485) 2,088,856,720 3,592,000,000 Balance at end of year Authorized The change in the number of warrants exercisable was as follows as at: December 31, 2019 305,851,872 Balance at beginning of year Issuance of warrants Balance at end of year December 31, 2018 205,851.872 100.000.000 305.851,872 305,851,872 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 205 Joint ventures - Joint ventures are those entities over which the Corporation exercises joint control, requiring unanimous consent of the parties sharing control of relevant activities such as, strategic financial and operating decision making and where the parties have rights to the net assets of the arrangement. The Corporation recognizes its interest in joint ventures using the equity method of accounting. Associates - Associates are entities in which the Corporation has the ability to exercise significant influence over the financial and operating policies. Investments in associates are accounted for using the equity method of accounting Foreign currency translation The consolidated financial statements are expressed in U.S. dollars, the functional currency of Bombardier Inc. The functional currency is the currency of the primary economic environment in which an entity operates. The functional currency of most foreign subsidiaries is their local currency, mainly the euro, Pound sterling, various other European currencies and the U.S. dollar in Transportation, and mainly the U.S. dollar in Aviation. Foreign currency transactions - Transactions denominated in foreign currencies are initially recorded in the functional currency of the related entity using the exchange rates in effect at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated using the closing exchange rates. Any resulting exchange difference is recognized in income except for exchange differences related to retirement benefits asset and liability, as well as financial liabilities designated as hedges of the Corporation's net investments in foreign operations, which are recognized in OCI. Non-monetary assets and liabilities denominated in foreign currencies and measured at historical cost are translated using historical exchange rates, and those measured at fair value are translated using the exchange rate in effect at the date the fair value is determined. Revenues and expenses are translated using the average exchange rates for the period or the exchange rate at the date of the transaction for significant items. Foreign operations - Assets and liabilities of foreign operations whose functional currency is other than the U.S. dollar are translated into U.S. dollars using closing exchange rates. Revenues and expenses, as well as cash flows, are translated using the average exchange rates for the period. Translation gains or losses are recognized in OCI and are reclassified in income on disposal or partial disposal of the investment in the related foreign operation The exchange rates for the major currencies used in the preparation of the consolidated financial statements were as follows: Average exchange rates for fiscal years Exchange rates as at December 31 January 1 2018 2018 1.1450 1.1993 0.7337 0.7975 1.2800 1.3517 December 31 2019 1.1234 0.7696 1.3204 Euro Canadian dollar Pound sterling 2019 1.1200 0.7537 1.2763 2018 1.1822 0.7729 1.3367 Revenue recognition Long-term contracts - Revenues from long-term contracts related to designing, engineering or manufacturing specifically designed products (including rail vehicles, vehicles overhaul and signalling contracts) and service contracts are generally recognized over time. The measure of progress toward complete satisfaction of the performance obligation is generally determined by comparing the actual costs incurred to the total costs anticipated for the entire contract, excluding costs that are not representative of the measure of performance. The contract transaction price is adjusted for change orders, claims, performance incentives and other contract terms that provide for the adjustment of prices to the extent they represent enforceable rights for the Corporation. Variable considerations such as assumptions for price escalation clauses, performance incentives and claims are only included in the transaction price to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. Customer options are only included in the transaction price of the contract when they become legally enforceable as a result of the customer exercising its right to purchase the additional goods or services. If a contract review indicates the expected costs to fulfill the contract exceed the expected BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 143 Dividends Dividends declared were as follows: Dividends declared for fiscal years December 31, 2019 December 31, 2018 Total Total Per share (in millions Per share (in millions (Cdn$) of U.S.$) (Cdns) of U.S.S) 0.00 $ 0.00 $ 0.00 0.00 Dividends declared after December 31, 2019 Total Per share (in millions (Cdn$) of U.S.S) 0.00 $ 0.00 Class A common shares Class B common shares 4 Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares 0.99 1.00 1.56 5 11 20 0.90 1.00 1.56 4 5 11 20 20 0.08 0.25 0.39 $ 20 $ $ 34. SHARE-BASED PLANS 2019 RSU of year PSU, DSU and RSU plans The Board of Directors of the Corporation approved a PSU and a RSU plan under which PSUs and RSUs may be granted to executives and other designated employees. The PSUs and the RSUs give recipients the right, upon vesting, to receive a certain number of the Corporation's Class B Shares (subordinate voting). The PSUs and RSUs also give certain recipients the right to receive a cash payment equal to the value of the RSUS. The Board of Directors of the Corporation has also approved a DSU plan under which DSUs may be granted to senior officers. The DSU plan is similar to the PSU plan, except that their exercise can only occur upon retirement or termination of employment. During fiscal year 2019, a combined value of $44 million of PSUs were authorized for issuance (548 million during fiscal year 2018). The number of PSUs, DSUs and RSUs has varied as follows, for fiscal years: 2018 PSU DSU PSU DSU RSU Balance at beginning 88,243,098 1,101,849 67,131,352 1.154,381 20,798,101 Granted 40,885,619 25,564,745 Exercised (22,773,124) (52,532) (20.460,527) Forfeited (11 147,689) (4,452,999) (337.574) Balance at end of year 95,207,904 1,101,849 88,243,098 (of which 1,101,849 DSUs are vested as at December 31, 2019 (1,101,849 as at December 31, 2018). PSUs and DSUs granted will vest if a financial performance threshold is met. The conversion ratio for vested PSUs and DSUs ranges from 50% to 100%. PSUs and DSUs generally vest three years following the grant date if the financial performance thresholds are met. For grants issued between January 1, 2017 and December 31, 2019, the vesting dates range from August 2020 to May 2022. The weighted-average grant date fair value of PSUs granted during fiscal year 2019 was $1.53 ($3.58 during fiscal year 2018). The fair value of each PSUs granted was measured based on the closing price of a Class B Share (subordinate voting) of the Corporation on the Toronto Stock Exchange. From time to time, the Corporation provides instructions to a trustee under the terms of a Trust Agreement to purchase Class B Shares (subordinate voting) of the Corporation in the open market (see Note 33 - Share capital) in connection with the PSU and/or RSU plan. These shares are held in trust for the benefit of the beneficiaries until the PSUs and RSUs become vested or are cancelled. The cost of these purchases has been deducted from share capital. 1,101,849 1 206 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 29. LONG-TERM DEBT Long-term debt was as follows, as at: December 31 December 31 January 1 2019 2018 2018 Amount in currency of origin Currency Contractual Interest rate After effect of fair value hedges Maturity Amount Amount Amount nia Senior notes 8501 USD 7.75% n/a n/a $ $ 869 $ 885 EUR 6.13% na May 2021 483 952 1,019 101821 USD 8.75% n/a Dec. 2021 1,008 1,380 1,373 500 USD 5.75% 3-month Mar. 2022 504 504 506 Libor +3.38 1,200 USD 6.00% 3-month Oct. 2022 1,215 1.217 1,223 Libor +3.5701 1,250 USD 6.13% 3-month Jan. 2023 1,272 1.273 1,281 Libor + 3.48 1,000 USD 7.50% n/a Dec. 2024 992 990 990 1,500 USD 7.50% n/a Mar. 2025 1,492 1.491 1,490 2.000 USD 7.88% Apr. 2027 1.978 Notes 250 USD 7.45% n/a May 2034 248 248 248 Debentures 150 CAD 7.35% n/a Dec. 2026 115 110 119 Other" Various Various Various n/a 2020-2026 26 68 84 $ 9,333 $ 9.102 $ 9,218 Of which current $ 8 $ 9 $ 18 Of which non-current 9,325 9,093 9,200 $ 9,333 $ 9,102 $ 9,218 "Interest on long-term debt as at December 31, 2019 is payable semi-annually, except for the other debts for which the timing of interest payments is variable. The Corporation redeemed all of its outstanding 7.75% Senior Notes due 2020 of $850 million. In addition, the Corporation redeemed 368 million aggregate principal amount of the 6.13% Notes due 2021 of 780 million and $382 million aggregate principal amount of the 8.75% Notes due 2021 of $1,400 million, in fiscal year 2019 The interest-rate swap agreement related to these Senior Notes were partially settled in prior fiscal years. As these interest-rate swaps were in a fair value hedge relationship, the related deferred gains recorded in the hedged item will be amortized in interest expense up to the maturity of these debts. ** Includes obligations under finance leases prior to December 31, 2018. The notional amount of other long-term debt is $26 million as at December 31, 2019 ($68 million as at December 31, 2018 and $84 million as at January 1, 2018). The contractual interest rate which represents a weighted average rate, is 7.8% as at December 31, 2019 (6.23% as at December 31, 2018 and 5.99% as at January 1, 2018). See Note 27 - Other financial liabilities. n/a: Not applicable All Senior notes and Notes rank pari-passu and are unsecured. The Corporation is subject to various financial covenants under the letter of credit facility and the unsecured revolving credit facility, which must be met on a quarterly basis, see Note 36 - Credit facilities for more details. A breach of any of these agreements or the inability to comply with these covenants could result in a default under these facilities, which would permit the Corporation's banks to request immediate defeasance or cash cover of all outstanding letters of credit, and bond holders and other lenders to declare amounts owed to them to be immediately payable. These conditions were all met as at December 31, 2019 and 2018 and January 1, 2018. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 199 32. ACQUISITION OF A BUSINESS On February 6, 2019, the Corporation acquired the Global 7500 aircraft wing program operations and assets from Triumph Group Inc., for a nominal cash consideration. This transaction enabled the company to leverage its extensive technical expertise to support the ramp-up of the Global 7500 aircraft and secure its long-term success. Bombardier continues to operate the production line and integrated the employees currently supporting the program at Triumph's Red Oak, Texas facility. The Corporation acquired net assets valued at approximatively $100 million, consisting primarily of work in progress inventory and PP&E, and settled certain preexisting relationships. No gain or goodwill was recorded on the transaction. The assets acquired and liabilities assumed by the Corporation were measured at their estimated fair value. 33. SHARE CAPITAL Preferred shares The preferred shares authorized were as follows, as at December 31, 2019, and 2018 and January 1, 2018: Authorized for the specific series Series 2 Cumulative Redeemable Preferred Shares 12,000,000 Series 3 Cumulative Redeemable Preferred Shares 12.000.000 Series 4 Cumulative Redeemable Preferred Shares 9.400.000 The preferred shares issued and fully paid were as follows, as at: December 31, 2019 Series 2 Cumulative Redeemable Preferred Shares 5,811,736 Series 3 Cumulative Redeemable Preferred Shares 6,188,264 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 December 31, 2018 5,811,736 6,188,264 9.400,000 January 1, 2018 5.811,736 6,188,264 9,400,000 Series 2 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.50 Cdn per share. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 3 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 3 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, then no Series 2 Cumulative Redeemable Preferred Shares may be converted. Dividend: Since August 1, 2002, the variable cumulative preferential cash dividends are payable monthly on the 15th day of each month, if declared, with the annual variable dividend rate being set between 50% to 100% of the Canadian prime rate, and adjusted as follows. The dividend rate will vary in relation to changes in the prime rate and will be adjusted upwards or downwards on a monthly basis to a monthly maximum of 4% if the trading price of Series 2 Cumulative Redeemable Preferred Shares is less than $24.90 Cdn per share or more than $25.10 Cdn per share. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 203 Class B Shares (subordinate voting) Voting rights: One vote each. Conversion: Convertible, at the option of the holder, into one Class A Share (multiple voting): () if an offer made to Class A (multiple voting) shareholders is accepted by the present controlling shareholder (the Bombardier family): or (ii) if such controlling shareholder ceases to hold more than 50% of all outstanding Class A Shares (multiple voting) of the Corporation. Dividend: The holders of Class B Shares (subordinate voting) are entitled, in priority to the holders of Class A Shares (multiple voting) to non-cumulative dividends of $0.0015625 Cdn per share, payable quarterly on the last day of March, June, September and December of each year at a rate of $0.000390625 Cdn per share, if declared. After payment of said priority dividend, the Class B Shares (subordinate voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and the Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. The change in the number of common shares issued and fully paid and in the number of common shares authorized was as follows as at: Class A Shares (multiple voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year 308,750,749 313.898,549 Converted to Class B (3,820) (5.147.800) Balance at end of year 308,746,929 308.750.749 Authorized 3,592,000,000 3,592,000,000 December 31, 2019 December 31, 2018 Class B Shares (subordinate voting) Issued and fully paid Balance at beginning of year Issuance of shares Converted from Class A 2,125,232,847 2,780,538 3,820 2,128,017,205 1.932.782.764 187,302,283 5.147.800 2.125.232.847 Held in trust under the PSU and RSU plans Balance at beginning of year Purchased Distributed (60,541,394) (52.983,051) (9.293.684) 1,735,341 (60.541,394) 2.064.691,453 3.592.000.000 21,380,909 (39, 160,485) 2,088,856,720 3,592,000,000 Balance at end of year Authorized The change in the number of warrants exercisable was as follows as at: December 31, 2019 305,851,872 Balance at beginning of year Issuance of warrants Balance at end of year December 31, 2018 205,851.872 100.000.000 305.851,872 305,851,872 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 205 Joint ventures - Joint ventures are those entities over which the Corporation exercises joint control, requiring unanimous consent of the parties sharing control of relevant activities such as, strategic financial and operating decision making and where the parties have rights to the net assets of the arrangement. The Corporation recognizes its interest in joint ventures using the equity method of accounting. Associates - Associates are entities in which the Corporation has the ability to exercise significant influence over the financial and operating policies. Investments in associates are accounted for using the equity method of accounting Foreign currency translation The consolidated financial statements are expressed in U.S. dollars, the functional currency of Bombardier Inc. The functional currency is the currency of the primary economic environment in which an entity operates. The functional currency of most foreign subsidiaries is their local currency, mainly the euro, Pound sterling, various other European currencies and the U.S. dollar in Transportation, and mainly the U.S. dollar in Aviation. Foreign currency transactions - Transactions denominated in foreign currencies are initially recorded in the functional currency of the related entity using the exchange rates in effect at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated using the closing exchange rates. Any resulting exchange difference is recognized in income except for exchange differences related to retirement benefits asset and liability, as well as financial liabilities designated as hedges of the Corporation's net investments in foreign operations, which are recognized in OCI. Non-monetary assets and liabilities denominated in foreign currencies and measured at historical cost are translated using historical exchange rates, and those measured at fair value are translated using the exchange rate in effect at the date the fair value is determined. Revenues and expenses are translated using the average exchange rates for the period or the exchange rate at the date of the transaction for significant items. Foreign operations - Assets and liabilities of foreign operations whose functional currency is other than the U.S. dollar are translated into U.S. dollars using closing exchange rates. Revenues and expenses, as well as cash flows, are translated using the average exchange rates for the period. Translation gains or losses are recognized in OCI and are reclassified in income on disposal or partial disposal of the investment in the related foreign operation The exchange rates for the major currencies used in the preparation of the consolidated financial statements were as follows: Average exchange rates for fiscal years Exchange rates as at December 31 January 1 2018 2018 1.1450 1.1993 0.7337 0.7975 1.2800 1.3517 December 31 2019 1.1234 0.7696 1.3204 Euro Canadian dollar Pound sterling 2019 1.1200 0.7537 1.2763 2018 1.1822 0.7729 1.3367 Revenue recognition Long-term contracts - Revenues from long-term contracts related to designing, engineering or manufacturing specifically designed products (including rail vehicles, vehicles overhaul and signalling contracts) and service contracts are generally recognized over time. The measure of progress toward complete satisfaction of the performance obligation is generally determined by comparing the actual costs incurred to the total costs anticipated for the entire contract, excluding costs that are not representative of the measure of performance. The contract transaction price is adjusted for change orders, claims, performance incentives and other contract terms that provide for the adjustment of prices to the extent they represent enforceable rights for the Corporation. Variable considerations such as assumptions for price escalation clauses, performance incentives and claims are only included in the transaction price to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. Customer options are only included in the transaction price of the contract when they become legally enforceable as a result of the customer exercising its right to purchase the additional goods or services. If a contract review indicates the expected costs to fulfill the contract exceed the expected BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 143 Dividends Dividends declared were as follows: Dividends declared for fiscal years December 31, 2019 December 31, 2018 Total Total Per share (in millions Per share (in millions (Cdn$) of U.S.$) (Cdns) of U.S.S) 0.00 $ 0.00 $ 0.00 0.00 Dividends declared after December 31, 2019 Total Per share (in millions (Cdn$) of U.S.S) 0.00 $ 0.00 Class A common shares Class B common shares 4 Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares 0.99 1.00 1.56 5 11 20 0.90 1.00 1.56 4 5 11 20 20 0.08 0.25 0.39 $ 20 $ $ 34. SHARE-BASED PLANS 2019 RSU of year PSU, DSU and RSU plans The Board of Directors of the Corporation approved a PSU and a RSU plan under which PSUs and RSUs may be granted to executives and other designated employees. The PSUs and the RSUs give recipients the right, upon vesting, to receive a certain number of the Corporation's Class B Shares (subordinate voting). The PSUs and RSUs also give certain recipients the right to receive a cash payment equal to the value of the RSUS. The Board of Directors of the Corporation has also approved a DSU plan under which DSUs may be granted to senior officers. The DSU plan is similar to the PSU plan, except that their exercise can only occur upon retirement or termination of employment. During fiscal year 2019, a combined value of $44 million of PSUs were authorized for issuance (548 million during fiscal year 2018). The number of PSUs, DSUs and RSUs has varied as follows, for fiscal years: 2018 PSU DSU PSU DSU RSU Balance at beginning 88,243,098 1,101,849 67,131,352 1.154,381 20,798,101 Granted 40,885,619 25,564,745 Exercised (22,773,124) (52,532) (20.460,527) Forfeited (11 147,689) (4,452,999) (337.574) Balance at end of year 95,207,904 1,101,849 88,243,098 (of which 1,101,849 DSUs are vested as at December 31, 2019 (1,101,849 as at December 31, 2018). PSUs and DSUs granted will vest if a financial performance threshold is met. The conversion ratio for vested PSUs and DSUs ranges from 50% to 100%. PSUs and DSUs generally vest three years following the grant date if the financial performance thresholds are met. For grants issued between January 1, 2017 and December 31, 2019, the vesting dates range from August 2020 to May 2022. The weighted-average grant date fair value of PSUs granted during fiscal year 2019 was $1.53 ($3.58 during fiscal year 2018). The fair value of each PSUs granted was measured based on the closing price of a Class B Share (subordinate voting) of the Corporation on the Toronto Stock Exchange. From time to time, the Corporation provides instructions to a trustee under the terms of a Trust Agreement to purchase Class B Shares (subordinate voting) of the Corporation in the open market (see Note 33 - Share capital) in connection with the PSU and/or RSU plan. These shares are held in trust for the benefit of the beneficiaries until the PSUs and RSUs become vested or are cancelled. The cost of these purchases has been deducted from share capital. 1,101,849 1 206 BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 29. LONG-TERM DEBT Long-term debt was as follows, as at: December 31 December 31 January 1 2019 2018 2018 Amount in currency of origin Currency Contractual Interest rate After effect of fair value hedges Maturity Amount Amount Amount nia Senior notes 8501 USD 7.75% n/a n/a $ $ 869 $ 885 EUR 6.13% na May 2021 483 952 1,019 101821 USD 8.75% n/a Dec. 2021 1,008 1,380 1,373 500 USD 5.75% 3-month Mar. 2022 504 504 506 Libor +3.38 1,200 USD 6.00% 3-month Oct. 2022 1,215 1.217 1,223 Libor +3.5701 1,250 USD 6.13% 3-month Jan. 2023 1,272 1.273 1,281 Libor + 3.48 1,000 USD 7.50% n/a Dec. 2024 992 990 990 1,500 USD 7.50% n/a Mar. 2025 1,492 1.491 1,490 2.000 USD 7.88% Apr. 2027 1.978 Notes 250 USD 7.45% n/a May 2034 248 248 248 Debentures 150 CAD 7.35% n/a Dec. 2026 115 110 119 Other" Various Various Various n/a 2020-2026 26 68 84 $ 9,333 $ 9.102 $ 9,218 Of which current $ 8 $ 9 $ 18 Of which non-current 9,325 9,093 9,200 $ 9,333 $ 9,102 $ 9,218 "Interest on long-term debt as at December 31, 2019 is payable semi-annually, except for the other debts for which the timing of interest payments is variable. The Corporation redeemed all of its outstanding 7.75% Senior Notes due 2020 of $850 million. In addition, the Corporation redeemed 368 million aggregate principal amount of the 6.13% Notes due 2021 of 780 million and $382 million aggregate principal amount of the 8.75% Notes due 2021 of $1,400 million, in fiscal year 2019 The interest-rate swap agreement related to these Senior Notes were partially settled in prior fiscal years. As these interest-rate swaps were in a fair value hedge relationship, the related deferred gains recorded in the hedged item will be amortized in interest expense up to the maturity of these debts. ** Includes obligations under finance leases prior to December 31, 2018. The notional amount of other long-term debt is $26 million as at December 31, 2019 ($68 million as at December 31, 2018 and $84 million as at January 1, 2018). The contractual interest rate which represents a weighted average rate, is 7.8% as at December 31, 2019 (6.23% as at December 31, 2018 and 5.99% as at January 1, 2018). See Note 27 - Other financial liabilities. n/a: Not applicable All Senior notes and Notes rank pari-passu and are unsecured. The Corporation is subject to various financial covenants under the letter of credit facility and the unsecured revolving credit facility, which must be met on a quarterly basis, see Note 36 - Credit facilities for more details. A breach of any of these agreements or the inability to comply with these covenants could result in a default under these facilities, which would permit the Corporation's banks to request immediate defeasance or cash cover of all outstanding letters of credit, and bond holders and other lenders to declare amounts owed to them to be immediately payable. These conditions were all met as at December 31, 2019 and 2018 and January 1, 2018. BOMBARDIER INC. FINANCIAL REPORT - FISCAL YEAR ENDED DECEMBER 31, 2019 199