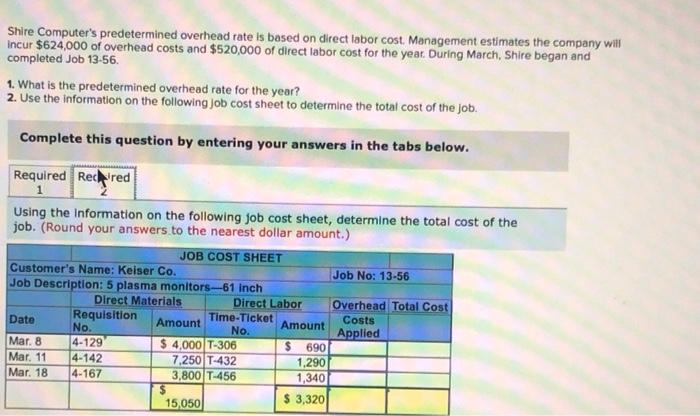

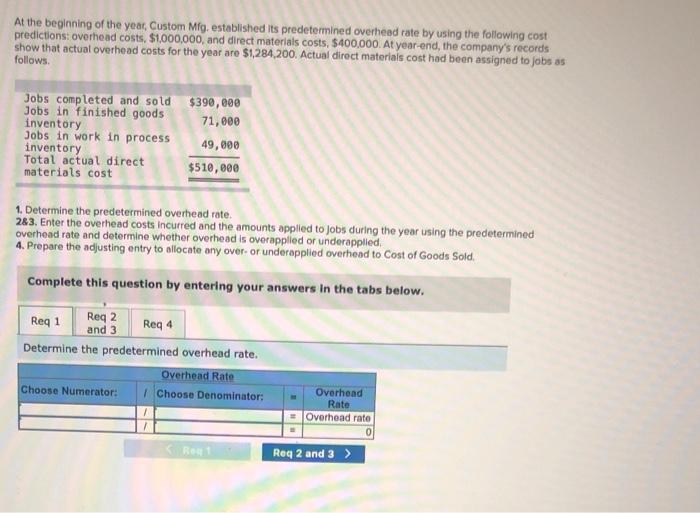

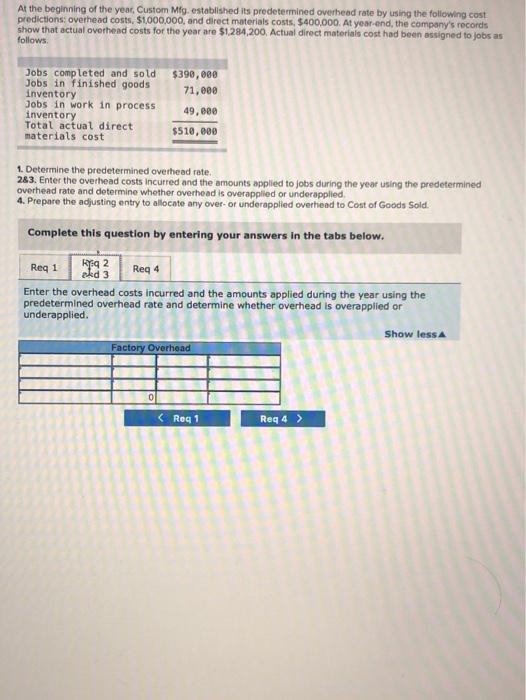

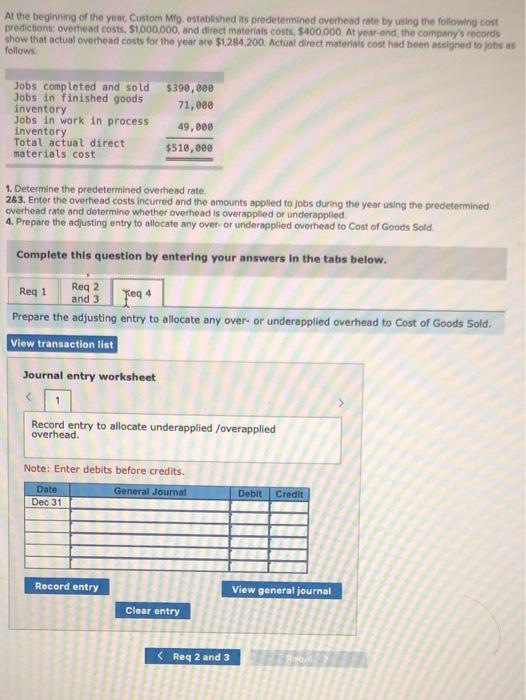

Shire Computer's predetermined overhead rate is based on direct labor cost. Management estimates the company will incur $624,000 of overhead costs and $520,000 of direct labor cost for the year. During March, Shire began and completed Job 13-56. 1. What is the predetermined overhead rate for the year? 2. Use the information on the following Job cost sheet to determine the total cost of the job. Complete this question by entering your answers in the tabs below. Required Reclared Using the Information on the following job cost sheet, determine the total cost of the job. (Round your answers to the nearest dollar amount.) JOB COST SHEET Customer's Name: Keiser Co. Job No: 13-56 Job Description: 5 plasma monitors-61 inch Direct Materials Direct Labor Overhead Total Cost Date Requisition Amount Time-Ticket Costs Amount No. No. Applied Mar. 8 4-129 $ 4,000 T-306 $ 690 Mar. 11 4-142 7.250 T-432 1,290 Mar. 18 4-167 3,800 T-456 1,340 $ 3,320 15,050 At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $1,000,000, and direct materials costs, $400,000. At year-end, the company's records show that actual overhead costs for the year are $1,284,200. Actual direct materials cost had been assigned to jobs as follows Jobs completed and sold $390,000 Jobs in finished goods inventory 71,000 Jobs in work in process inventory 49,000 Total actual direct materials cost $510,000 1. Determine the predetermined overhead rate. 283. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 Reg 4 and 3 Determine the predetermined overhead rate. Overhead Rate Choose Numerator: 1 Choose Denominator: Overhead Rate Overhead rato RE Req 2 and 3 > At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions overhead costs, $1,000,000, and direct materials costs $400,000. At year-end, the company's records show that actual overhead costs for the year are $1.284,200, Actual direct materials cost had been assigned to jobs as follows $390,000 71,000 Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost 49,000 $510,000 1. Determine the predetermined overhead rate. 283. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req1 ki 2 Req 4 akd 3 Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Show less Factory Overhead 0 At the beginning of the year, Custom Mig established its predetermined overhead rate by using the following cost predictions overhead costs. 51,000,000, and direct materials costs $400,000. At year-end, the company's records show that actual overhead costs for the year are $1.294,200. Actual direct materials cost had been assigned to jobs as follows Jobs completed and sold $390,000 Jobs in finished goods inventory 71,000 Jobs in work in process 49,000 inventory Total actual direct $518,000 materials cost 1. Determine the predetermined overhead rate. 283. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied 4. Prepare the adjusting entry to allocate any over or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 rieq Prepare the adjusting entry to allocate any over- or underapplied overhead to cost of Goods Sold. View transaction list Journal entry worksheet Record entry to allocate underapplied /overapplied overhead. Note: Enter debits before credits. Date Dec 31 General Journal Debit Credit Record entry View general journal Clear entry