Answered step by step

Verified Expert Solution

Question

1 Approved Answer

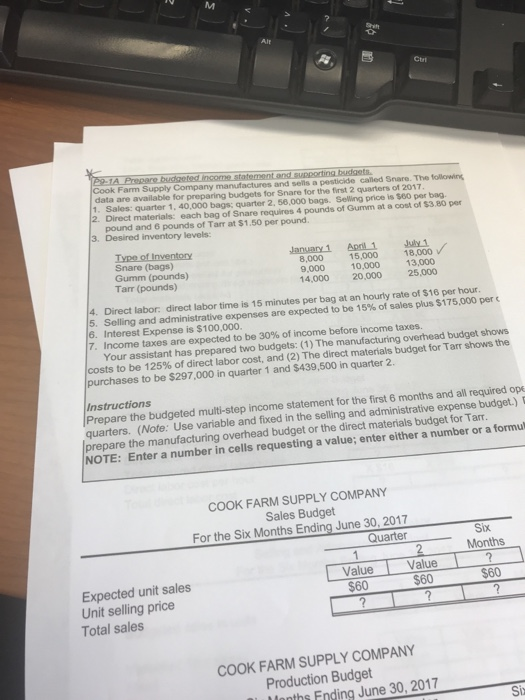

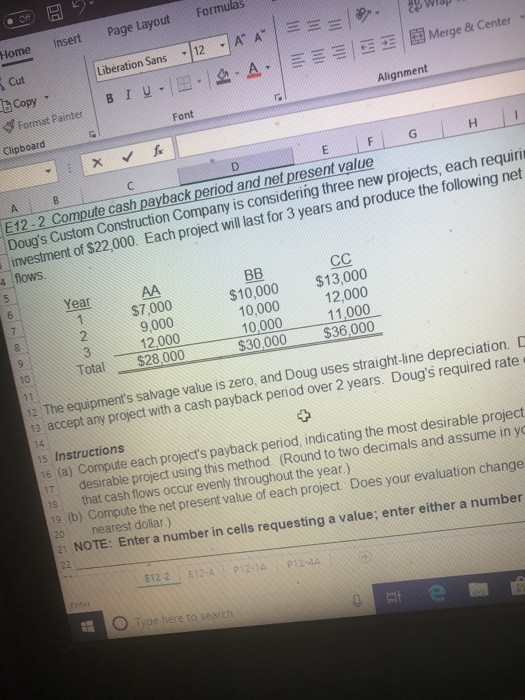

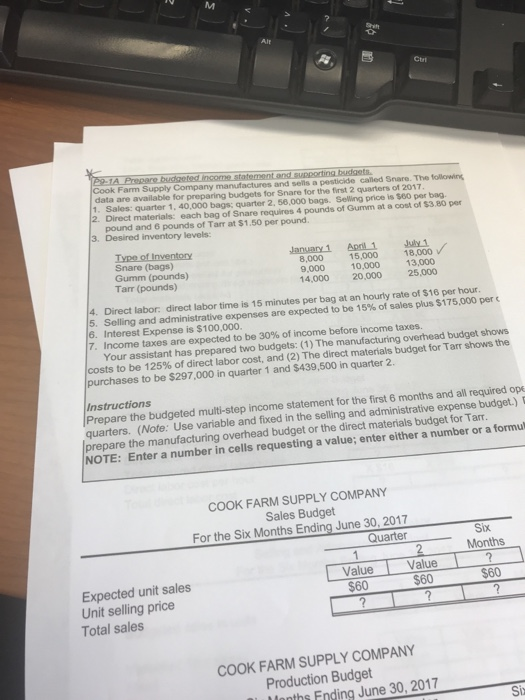

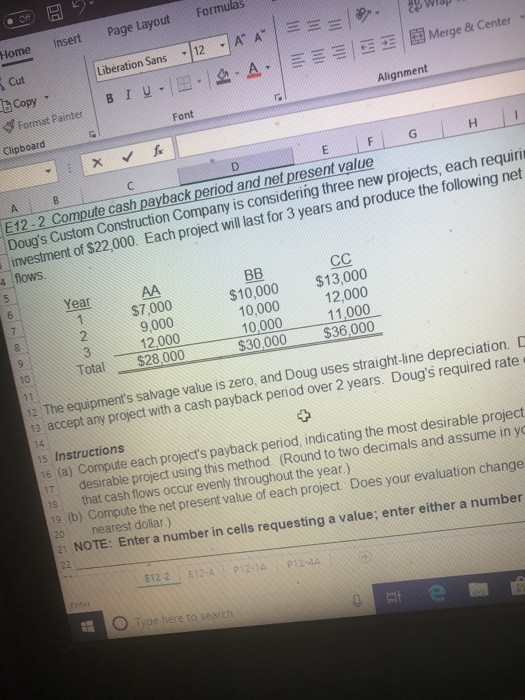

Shit Ctrt Cook Farm Supply Company data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1,

Shit Ctrt Cook Farm Supply Company data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per and ses a pesticide caled Snare. The followng pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: January 1 Apoil 1 y 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 15,000 18,000 9,000 14,000 20,000 25,000 10,000 13,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling 6. Interest Expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. and administrative expenses are expected to be 15% of sales plus $175,000 per Your assistant has prepared two budgets: (1) The manufacturing overhead budget shows costs to be 125% of direct labor cost, and (2) The direct materials budget for Tam shows the purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. Instructions Prepare the budgeted multi-step income statement for the first 6 months and all required ope quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) prepare the manufacturing overhead budget or the direct materials budget for Tarr. NOTE: Enter a number in cells requesting a value; enter either a number or a formul COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30, 2017 Six Months Quarter Value Value Expected unit sales Unit selling price Total sales $60 $60 $60 COOK FARM SUPPLY COMPANY Production Budget Ianths Ending June 30, 2017 Sin Home insert Page LayoutFormulas Cut b Copy oformat painter | B 1-E Liberation Sans 12 A nter " Alignment Font Clipboard E12 2 Compute cash payback period and net present value Doug's Custom Construction Company is considering three new projects, each requini investment of $22,000. Each project will last for 3 years and produce the following net 4 flows Year $7,000 9,000 12,000 Total$28,000 $10,000 $13,000 12,000 11000 10,000 10,000 $30,000 $36,000 12 The equipments salvage value is zero, and Doug uses straight-line depreciation 1a accept any project with a cash payback period over 2 years. Doug's requ 14 15 Instructions payback period, indicating the most desirable project using this method (Round to two decimals and assume in yo net present value of each project Does your evaluation change (a) Compute each projects e that cash flows occur evenly throughout the year ) 19 (b) Compute the 20 nearest dollar) NOTE: Enter a number in cells requesting a value; enter either a number E12.2 . El 2-4 P12-1A P12-4A O Type here to search Shit Ctrt Cook Farm Supply Company data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per and ses a pesticide caled Snare. The followng pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: January 1 Apoil 1 y 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 15,000 18,000 9,000 14,000 20,000 25,000 10,000 13,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling 6. Interest Expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. and administrative expenses are expected to be 15% of sales plus $175,000 per Your assistant has prepared two budgets: (1) The manufacturing overhead budget shows costs to be 125% of direct labor cost, and (2) The direct materials budget for Tam shows the purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. Instructions Prepare the budgeted multi-step income statement for the first 6 months and all required ope quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) prepare the manufacturing overhead budget or the direct materials budget for Tarr. NOTE: Enter a number in cells requesting a value; enter either a number or a formul COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30, 2017 Six Months Quarter Value Value Expected unit sales Unit selling price Total sales $60 $60 $60 COOK FARM SUPPLY COMPANY Production Budget Ianths Ending June 30, 2017 Sin Home insert Page LayoutFormulas Cut b Copy oformat painter | B 1-E Liberation Sans 12 A nter " Alignment Font Clipboard E12 2 Compute cash payback period and net present value Doug's Custom Construction Company is considering three new projects, each requini investment of $22,000. Each project will last for 3 years and produce the following net 4 flows Year $7,000 9,000 12,000 Total$28,000 $10,000 $13,000 12,000 11000 10,000 10,000 $30,000 $36,000 12 The equipments salvage value is zero, and Doug uses straight-line depreciation 1a accept any project with a cash payback period over 2 years. Doug's requ 14 15 Instructions payback period, indicating the most desirable project using this method (Round to two decimals and assume in yo net present value of each project Does your evaluation change (a) Compute each projects e that cash flows occur evenly throughout the year ) 19 (b) Compute the 20 nearest dollar) NOTE: Enter a number in cells requesting a value; enter either a number E12.2 . El 2-4 P12-1A P12-4A O Type here to search

Shit Ctrt Cook Farm Supply Company data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per and ses a pesticide caled Snare. The followng pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: January 1 Apoil 1 y 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 15,000 18,000 9,000 14,000 20,000 25,000 10,000 13,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling 6. Interest Expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. and administrative expenses are expected to be 15% of sales plus $175,000 per Your assistant has prepared two budgets: (1) The manufacturing overhead budget shows costs to be 125% of direct labor cost, and (2) The direct materials budget for Tam shows the purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. Instructions Prepare the budgeted multi-step income statement for the first 6 months and all required ope quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) prepare the manufacturing overhead budget or the direct materials budget for Tarr. NOTE: Enter a number in cells requesting a value; enter either a number or a formul COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30, 2017 Six Months Quarter Value Value Expected unit sales Unit selling price Total sales $60 $60 $60 COOK FARM SUPPLY COMPANY Production Budget Ianths Ending June 30, 2017 Sin Home insert Page LayoutFormulas Cut b Copy oformat painter | B 1-E Liberation Sans 12 A nter " Alignment Font Clipboard E12 2 Compute cash payback period and net present value Doug's Custom Construction Company is considering three new projects, each requini investment of $22,000. Each project will last for 3 years and produce the following net 4 flows Year $7,000 9,000 12,000 Total$28,000 $10,000 $13,000 12,000 11000 10,000 10,000 $30,000 $36,000 12 The equipments salvage value is zero, and Doug uses straight-line depreciation 1a accept any project with a cash payback period over 2 years. Doug's requ 14 15 Instructions payback period, indicating the most desirable project using this method (Round to two decimals and assume in yo net present value of each project Does your evaluation change (a) Compute each projects e that cash flows occur evenly throughout the year ) 19 (b) Compute the 20 nearest dollar) NOTE: Enter a number in cells requesting a value; enter either a number E12.2 . El 2-4 P12-1A P12-4A O Type here to search Shit Ctrt Cook Farm Supply Company data are available for preparing budgets for Snare for the first 2 quarters of 2017 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. 2. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per and ses a pesticide caled Snare. The followng pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: January 1 Apoil 1 y 1 Snare (bags) Gumm (pounds) Tarr (pounds) 8,000 15,000 18,000 9,000 14,000 20,000 25,000 10,000 13,000 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling 6. Interest Expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. and administrative expenses are expected to be 15% of sales plus $175,000 per Your assistant has prepared two budgets: (1) The manufacturing overhead budget shows costs to be 125% of direct labor cost, and (2) The direct materials budget for Tam shows the purchases to be $297,000 in quarter 1 and $439,500 in quarter 2. Instructions Prepare the budgeted multi-step income statement for the first 6 months and all required ope quarters. (Note: Use variable and fixed in the selling and administrative expense budget.) prepare the manufacturing overhead budget or the direct materials budget for Tarr. NOTE: Enter a number in cells requesting a value; enter either a number or a formul COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30, 2017 Six Months Quarter Value Value Expected unit sales Unit selling price Total sales $60 $60 $60 COOK FARM SUPPLY COMPANY Production Budget Ianths Ending June 30, 2017 Sin Home insert Page LayoutFormulas Cut b Copy oformat painter | B 1-E Liberation Sans 12 A nter " Alignment Font Clipboard E12 2 Compute cash payback period and net present value Doug's Custom Construction Company is considering three new projects, each requini investment of $22,000. Each project will last for 3 years and produce the following net 4 flows Year $7,000 9,000 12,000 Total$28,000 $10,000 $13,000 12,000 11000 10,000 10,000 $30,000 $36,000 12 The equipments salvage value is zero, and Doug uses straight-line depreciation 1a accept any project with a cash payback period over 2 years. Doug's requ 14 15 Instructions payback period, indicating the most desirable project using this method (Round to two decimals and assume in yo net present value of each project Does your evaluation change (a) Compute each projects e that cash flows occur evenly throughout the year ) 19 (b) Compute the 20 nearest dollar) NOTE: Enter a number in cells requesting a value; enter either a number E12.2 . El 2-4 P12-1A P12-4A O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started