Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shoe Company sells to a wholesaler in Germany. The purchase price of a shipment is 50,000 deutsche marks with term of 90 days. Upon

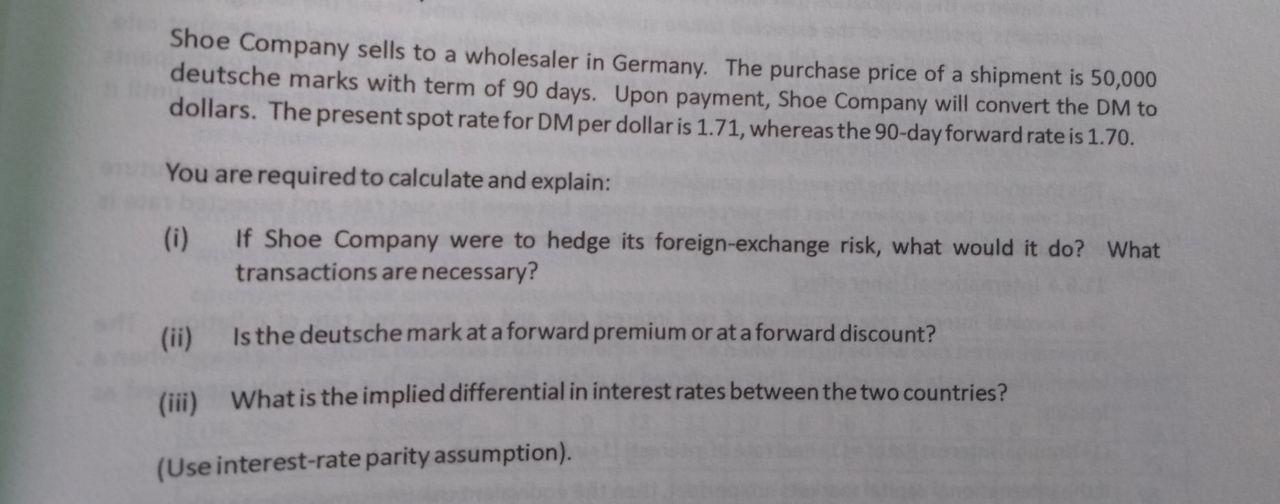

Shoe Company sells to a wholesaler in Germany. The purchase price of a shipment is 50,000 deutsche marks with term of 90 days. Upon payment, Shoe Company will convert the DM to dollars. The present spot rate for DM per dollar is 1.71, whereas the 90-day forward rate is 1.70. You are required to calculate and explain: (i) If Shoe Company were to hedge its foreign-exchange risk, what would it do? What transactions are necessary? (ii) Is the deutsche mark at a forward premium or at a forward discount? (iii) What is the implied differential in interest rates between the two countries? (Use interest-rate parity assumption).

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i In order to hedge its foreign exchange risk the Shoe Company can opt for Forward Contract ie DM at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started