Answered step by step

Verified Expert Solution

Question

1 Approved Answer

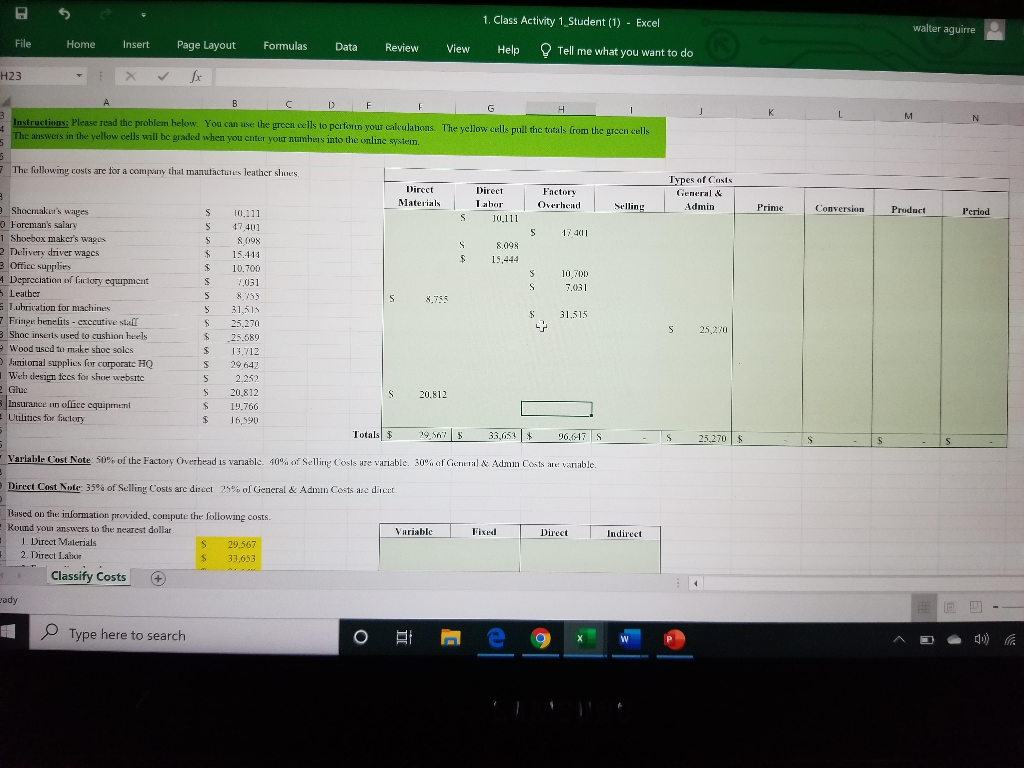

Shoemaker's wages $ 10,111 Foreman's salary $ 47,401 Shoebox maker's wages $ 8,098 Delivery driver wages $ 15,444 Office supplies $ 10,700 Depreciation of factory

| Shoemaker's wages | $ 10,111 |

| Foreman's salary | $ 47,401 |

| Shoebox maker's wages | $ 8,098 |

| Delivery driver wages | $ 15,444 |

| Office supplies | $ 10,700 |

| Depreciation of factory equipment | $ 7,031 |

| Leather | $ 8,755 |

| Lubrication for machines | $ 31,515 |

| Fringe benefits - executive staff | $ 25,270 |

| Shoe inserts used to cushion heels | $ 25,689 |

| Wood used to make shoe soles | $ 13,712 |

| Janitorial supplies for corporate HQ | $ 29,642 |

| Web design fees for shoe website | $ 2,252 |

| Glue | $ 20,812 |

| Insurance on office equipment | $ 19,766 |

| Utilities for factory | $ 16,590 |

Both charts that are green needs to be answered but if I have to choose one I would like the first one answered

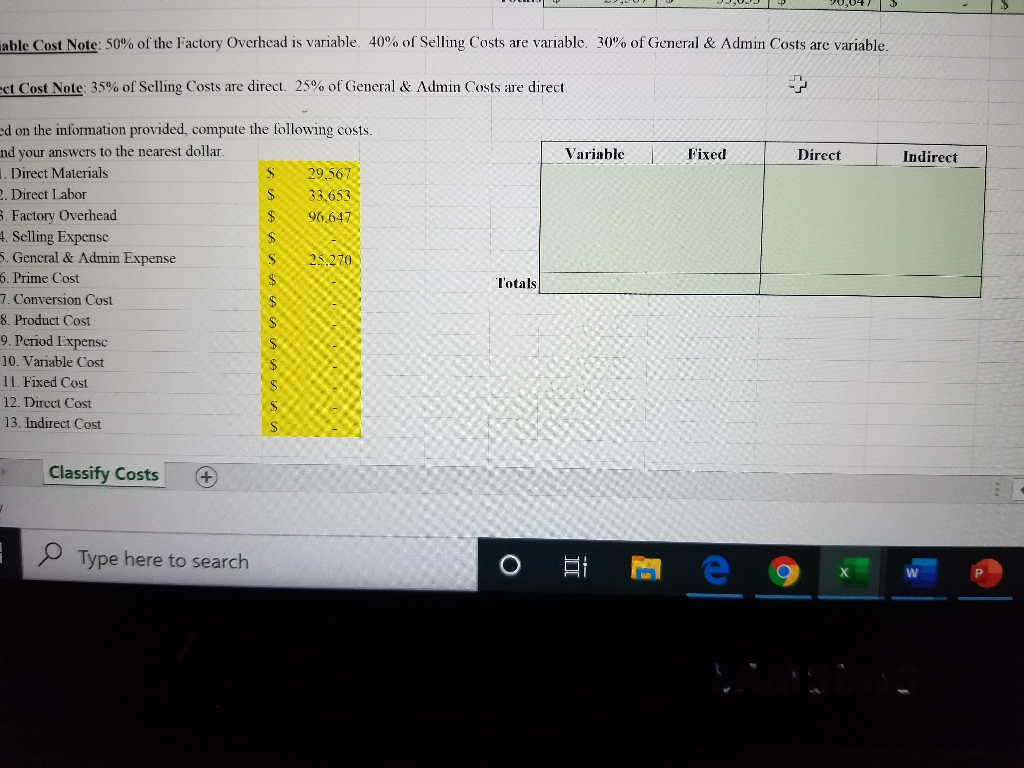

1. Class Activity 1 Student (1) Excel walter aguirre File Home Insert Page Layout Formulas Data Review View Tell me what you want to do Help H23 A B C D G H K Instructions: Please read the problem helow. You can use the green cells to pcrforn youT calculahons. 4 The answers in the yellow cells will be graded when you cnter your numhers into the online svstem N The yellow cells pull the totals from the green cells 7The following costs are tora company that manutactures leather shoes Types of Casts Dircct Direct Factory General& Materials Labor Overhead Selling Admin Shocmaker's wages 0 Foreman's salary 1 Shoebox maker's wages 2 Delivery driver wages 3 Office supplies 4 Depreciation of faclory equipmet Prime Conversion Product Period S 10,111 J0,111 47 401 5 17 401 8.098 8.098 15414 15,444 10.700 10,00 S T031 S 7.031 Leatber Tuhrication for machines 7Fringe henelits- exccutive stall 3Shoc inserts used to cushion heels Wood uscd to make shoe soles 8,755 8.755 31,51S 31,515 25.270 25,270 25.689 13,712 Junitorial supplies for curporate HQ Weh design tecs fos shue websitc 2 Gluc Insurance un olfice cquipmeml Utilities for fictory S 29 642 2,252 20,812 20.812 19.766 16,590 33,653 $ Totals 29,S67 96,647 S S 25,270 Variable Cost Note: 50% of the Factory Overhead 15 vanable. 40% of Selling Cosls are variable. 30% of General&Admn Costs ae: varable Direct Cost Note: 35 % of Selling Costs are direct 23% of General & Admin Costs are dicet Based on the information provided, compute the following costs. Round your answers to the nearest dollar Variable Fixed Direct Indirect I Direct Malerials S 29.567 2. Direct Labor 33,653 Classify Costs + Type here to search e 0,047 able Cost Note: 50% of the Factory Overhead is variable. 40% of Selling Costs are variable. 30% of General & Admin Costs are variable. ct Cost Note: 35% of Selling Costs are direct. 25% of General & Admin Costs are direct ed on the information provided, compute the following costs. nd your answers to the nearest dollar. Variable Fixed Direct Indirect . Direct Materials 2. Direct Labor B. Factory Overhead 4. Selling Expense 5. General & Admin Expense 6. Prime Cost 7. Conversion Cost 29,567 33,653 96647 25270 Totals 8. Product Cost 9. Period IExpensc 10. Variable Cost 11. Fixed Cost 12. Dircct Cost 13. Indirect Cost Classify Costs Type here to search O EiStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started