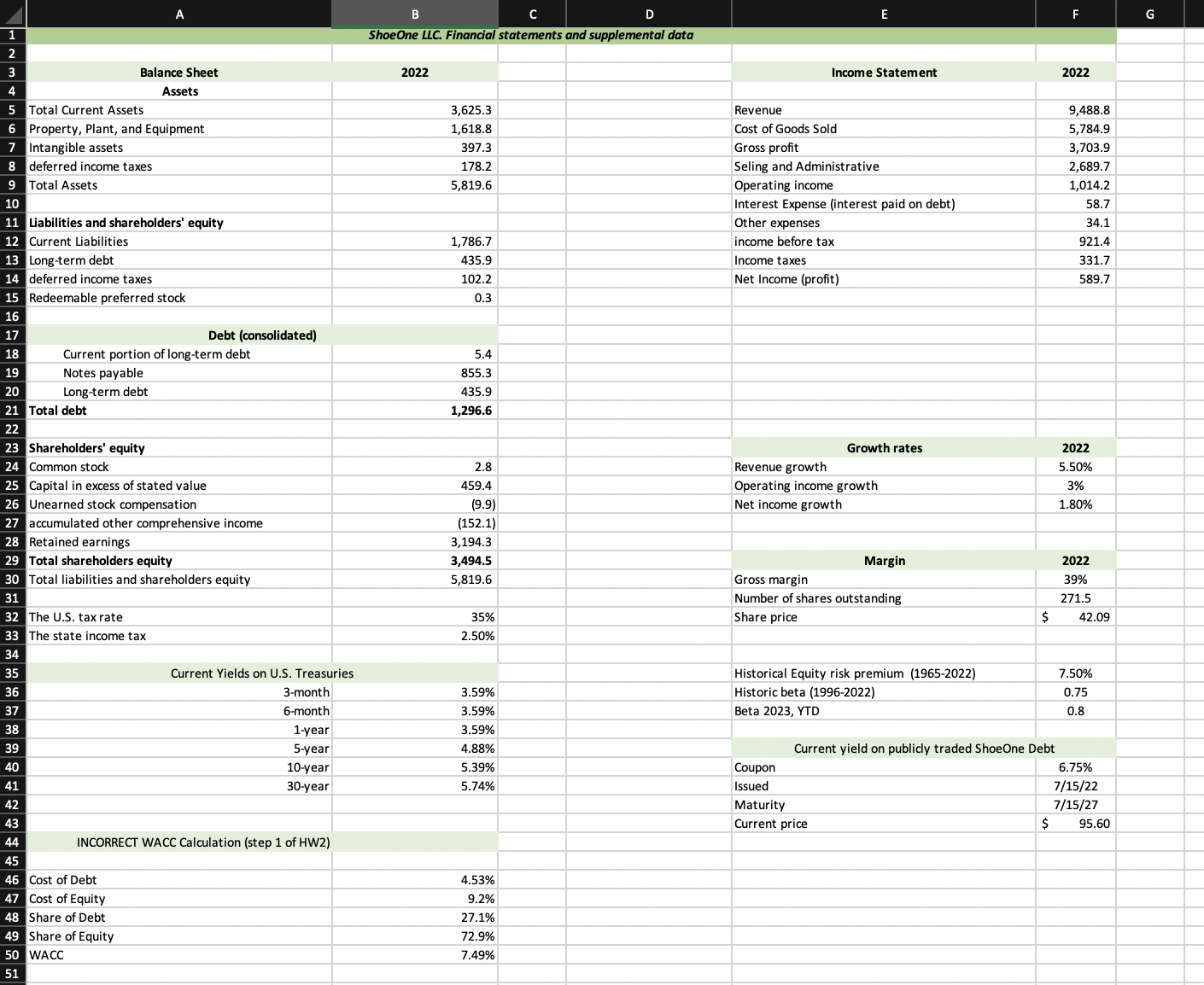

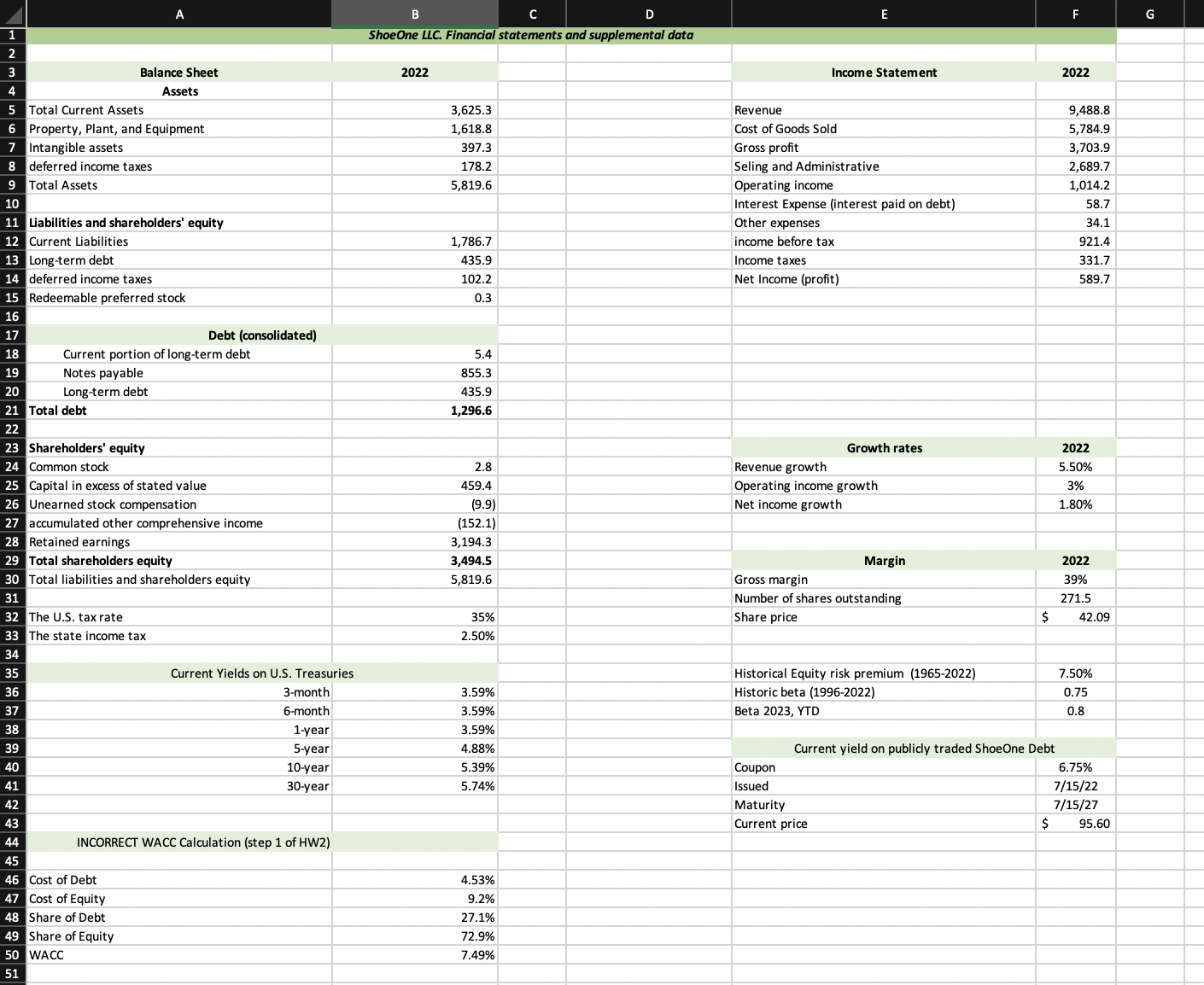

ShoeOne LLC is producing sports clothing. The company faced declining market share from 24% to 18% over the past 3 years. Considering whether to expand their business or not, a company valuation is being done. Please find attached the excel file with company and markets data. Step 1. Calculate share price following the template provided in the excel file using the WACC provided. Analyze the method of provided WACC calculations and find a mistake in it. Step 2. Calculate WACC properly and explain why WACC from Step 1 was incorrect. Step 3. Perform sensitivity analysis of the share price with respect to WACC. Make sure the 2 WACC measures from Steps 1 and 2 are included in the analysis; add lower, larger, and in-between the 2 WACC values. Clearly state your conclusions and explain the danger of calculating WACC using method 1.

A B C D E G ShoeOne LLC. Financial statements and supplemental data Balance Sheet Assets Total Current Assets Property, Plant, and Equipment Intangible assets deferred income taxes Total Assets 10 11 Liabilities and shareholders' equity 12 Current Liabilities 13 Long-term debt deferred income taxes Redeemable preferred stock 16 17 Debt (consolidated) 18 Current portion of long-term debt 19 Notes payable 20 Long-term debt 21 Total debt 22 23 Shareholders' equity 24 Common stock 25 Capital in excess of stated value 26 Unearned stock compensation 27 accumulated other comprehensive income 28 Retained earnings 29 Total shareholders equity 30 Total liabilities and shareholders equity 31 32 The U.S. tax rate 33 The state income tax 34 35 36 37 38 39 40 41 2022 2022 Income Statement Revenue Cost of Goods Sold Gross profit Seling and Administrative Operating income Interest Expense (interest paid on debt) Other expenses income before tax Income taxes Net Income (profit) 2022 9,488.8 5,784.9 3,703.9 2,689.7 1,014.2 58.7 34.1 921.4 331.7 589.7 \begin{tabular}{|c|c|} \hline Growth rates & 2022 \\ \hline Revenue growth & 5.50% \\ \hline Operating income growth & 3% \\ \hline Net income growth & 1.80% \\ \hline Margin & 2022 \\ \hline Gross margin & 39% \\ \hline Number of shares outstanding & 271.5 \\ \hline Share price & 42.09 \\ \hline Historical Equity risk premium (1965-2022) & 7.50% \\ \hline Historic beta (1996-2022) & 0.75 \\ \hline Beta 2023, YTD & 0.8 \\ \hline \multicolumn{2}{|c|}{ Current yield on publicly traded ShoeOne Debt } \\ \hline Coupon & 6.75% \\ \hline Issued & 7/15/22 \\ \hline Maturity & 7/15/27 \\ \hline Current price & 95.60 \\ \hline \end{tabular} INCORRECT WACC Calculation (step 1 of HW2) Cost of Debt Cost of Equity Share of Debt 5.4 855.3 435.9 1,296.6 Share of Equity Current Yields on U.S. Treasuries 3-month 3.59% 2.8 459.4 (9.9) (152.1) 3,194.3 3,494.5 5,819.6 Gross margin Number of shares outstanding Share price 3.59% 35% 6-month 3.59% 5-year 4.88% 5.39% 30-year 5.74% WACC 4.53% 9.2% 27.1% 72.9% 51 7.49% Historical Equity risk premium (1965-2022) Historic beta (1996-2022) Beta 2023, YTD Current yield on publicly traded ShoeOne Debt