Answered step by step

Verified Expert Solution

Question

1 Approved Answer

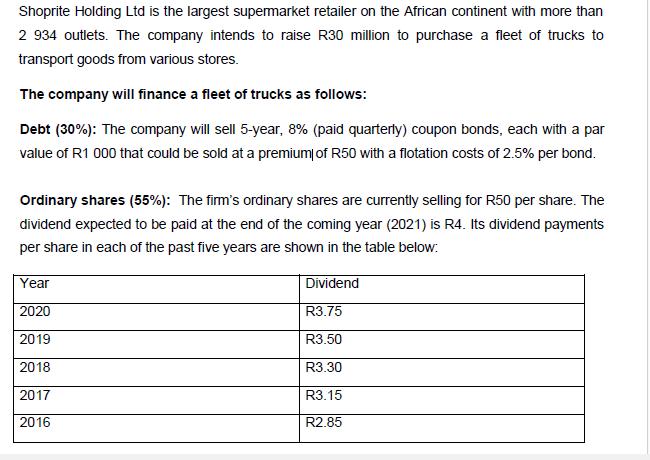

Shoprite Holding Ltd is the largest supermarket retailer on the African continent with more than 2 934 outlets. The company intends to raise R30

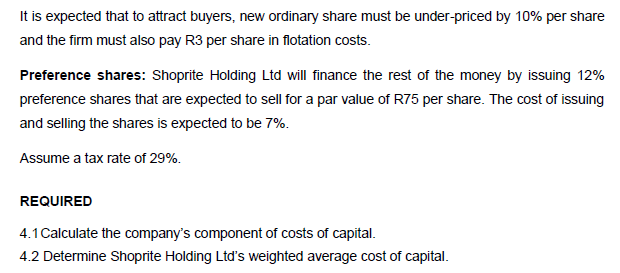

Shoprite Holding Ltd is the largest supermarket retailer on the African continent with more than 2 934 outlets. The company intends to raise R30 million to purchase a fleet of trucks to transport goods from various stores. The company will finance a fleet of trucks as follows: Debt (30%): The company will sell 5-year, 8% (paid quarterly) coupon bonds, each with a par value of R1 000 that could be sold at a premium of R50 with a flotation costs of 2.5% per bond. Ordinary shares (55%): The firm's ordinary shares are currently selling for R50 per share. The dividend expected to be paid at the end of the coming year (2021) is R4. Its dividend payments per share in each of the past five years are shown in the table below: Year 2020 2019 2018 2017 2016 Dividend R3.75 R3.50 R3.30 R3.15 R2.85 It is expected that to attract buyers, new ordinary share must be under-priced by 10% per share and the firm must also pay R3 per share in flotation costs. Preference shares: Shoprite Holding Ltd will finance the rest of the money by issuing 12% preference shares that are expected to sell for a par value of R75 per share. The cost of issuing and selling the shares is expected to be 7%. Assume a tax rate of 29%. REQUIRED 4.1 Calculate the company's component of costs of capital. 4.2 Determine Shoprite Holding Ltd's weighted average cost of capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

41 Calculate the companys component of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started