Answered step by step

Verified Expert Solution

Question

1 Approved Answer

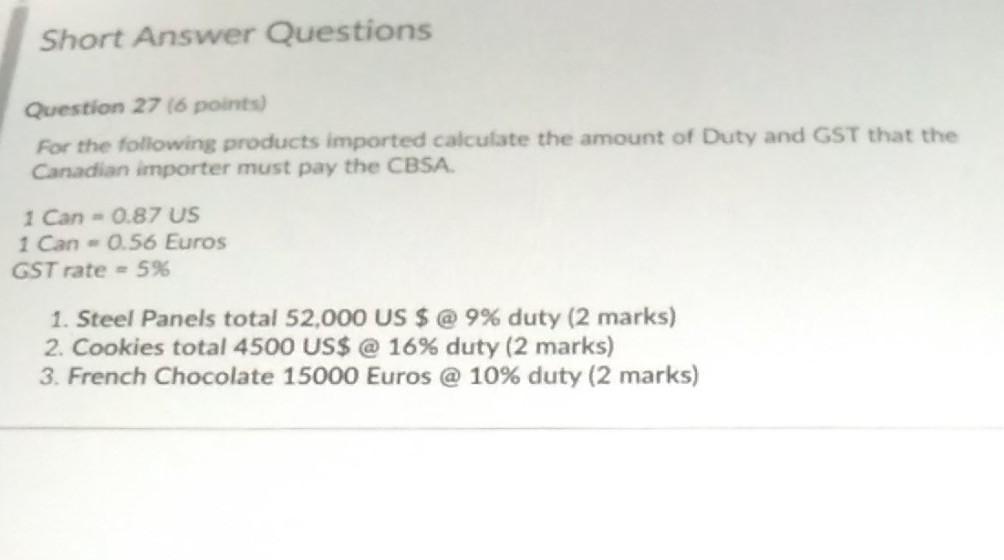

Short Answer Questions Question 27 (6 points) For the following products imported calculate the amount of Duty and GST that the Canadian importer must pay

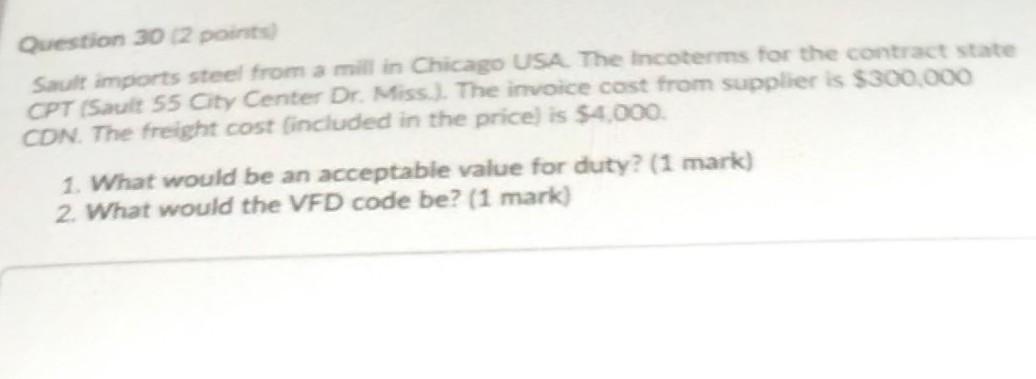

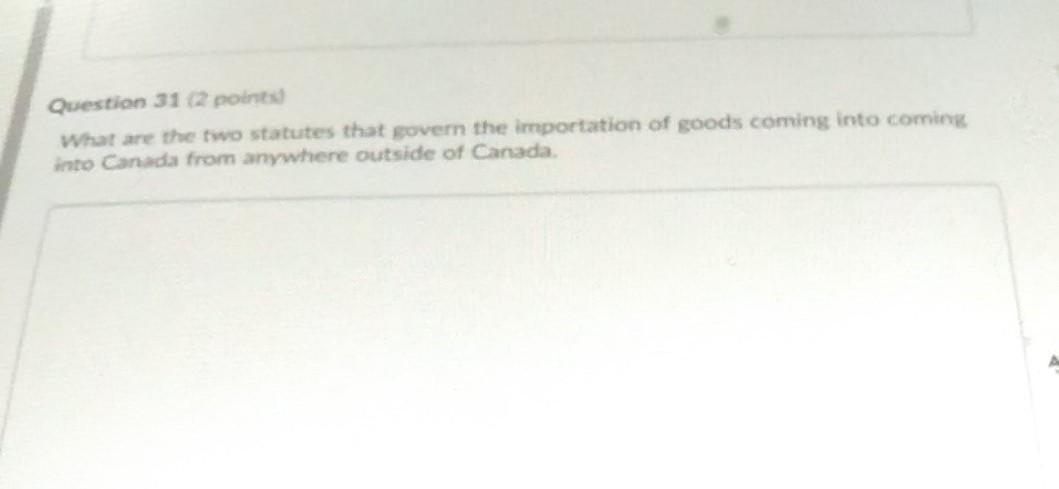

Short Answer Questions Question 27 (6 points) For the following products imported calculate the amount of Duty and GST that the Canadian importer must pay the CBSA 1 Can - 0.87 US 1 Can -0.56 Euros GST rate - 5% 1. Steel Panels total 52,000 US $ @ 9% duty (2 marks) 2. Cookies total 4500 US$ @ 16% duty (2 marks) 3. French Chocolate 15000 Euros @ 10% duty (2 marks) Question 30 (2 points) Sault imports steel from a mill in Chicago USA. The Incoterms for the contract state CPT (Sault 55 City Center Dr. Miss.). The invoice cost from supplier is $300,000 CON. The freight cost included in the price) is $4.000 1. What would be an acceptable value for duty? (1 mark) 2. What would the VFD code be? (1 mark) Question 31 2 points What are the two statutes that sover the importation of goods coming into coming into Canada from anywhere outside of Canada

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started