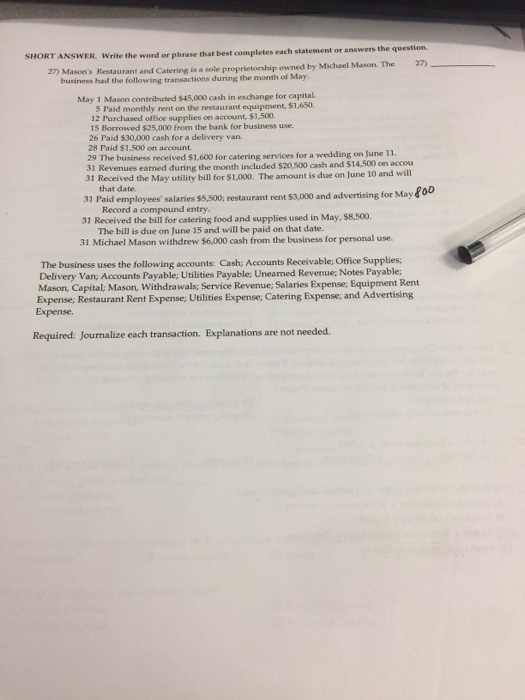

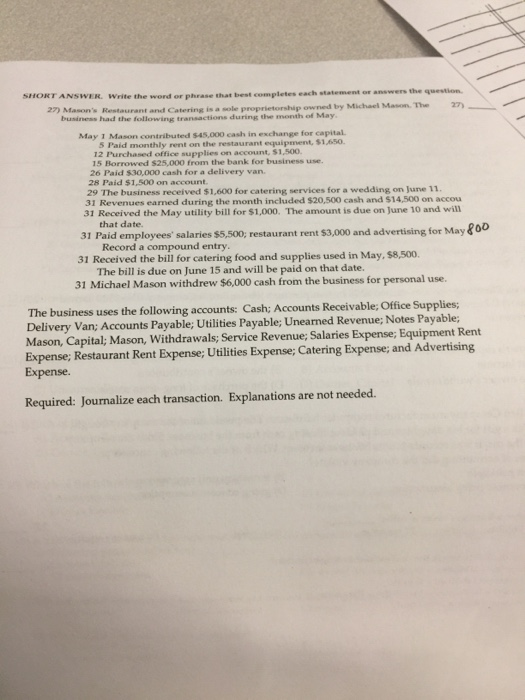

SHORT ANSWER. Write the word or phrase that best completes each statement or answer the question. 27) Mason's Restaurant and Catering is a sole proprietorship owned by Michael Mason. The 27) business had the following transactions during the month of May. May 1 Mason contributed $45.000 cash in exchange for capital 5 Paid monthly rent on the restaurant equipment, $1.650. 12 Purchased office supplies on account, $1,500 15 Borrowed $25,000 from the bank for business use. 26 Paid $30,000 cash for a delivery van. 28 Paid $1.500 on account 29 The business received $1.600 for catering services for a wedding on June 11. 31 Revenues eamed during the month included $20.500 cash and $14.500 on accou 31 Received the May utility bill for $1.000. The amount is due on June 10 and will that date 31 Paid employees' salaries $5.500, restaurant rent $3,000 and advertising for May 800 Record a compound entry 31 Received the bill for catering food and supplies used in May, 58,500. The bill is due on June 15 and will be paid on that date. 31 Michael Mason withdrew $6,000 cash from the business for personal use. The business uses the following accountsCash; Accounts Receivable; Office Supplies; Delivery Van; Accounts Payable; Utilities Payable; Uneamed Revenue; Notes Payable: Mason, Capital; Mason, Withdrawals; Service Revenue; Salaries Expense; Equipment Rent Expense, Restaurant Rent Expense; Utilities Expense; Catering Expense; and Advertising Expense. Required: Journalize each transaction. Explanations are not needed. SHORT ANSWER. Write the word or phrase that best completes each statement or answer the question 27) Mason's Restaurant and Catering is a sole proprietorship owned by Michael Mason. The business had the following transactions during the month of May. May 1 Mason contributed $45.000 cash in exchange for capital 5 Paid monthly rent on the restaurant equipment 51.650. 12 Purchased office supplies on account, 51,500. 15 Borrowed $25.000 from the bank for business use. 26 Paid $30,000 cash for a delivery van. 28 Paid $1,500 on account 29 The business received $1.600 for catering services for a wedding on June 11. 31 Revenues earned during the month included $20,500 cash and $14.500 on accou 31 Received the May utility bill for $1,000. The amount is due on June 10 and will that date. 31 Paid employees' salaries $5,500, restaurant rent $3,000 and advertising for May 800 Record a compound entry. 31 Received the bill for catering food and supplies used in May, $8,500 The bill is due on June 15 and will be paid on that date. 31 Michael Mason withdrew $6,000 cash from the business for personal use. The business uses the following accounts: Cash: Accounts Receivable; Office Supplies Delivery Van; Accounts Payable; Utilities Payable; Unearned Revenue; Notes Payable; Mason, Capital; Mason, Withdrawals; Service Revenue; Salaries Expense; Equipment Rent Expense; Restaurant Rent Expense; Utilities Expense; Catering Expense; and Advertising Expense. Required: Journalize each transaction. Explanations are not needed