Answered step by step

Verified Expert Solution

Question

1 Approved Answer

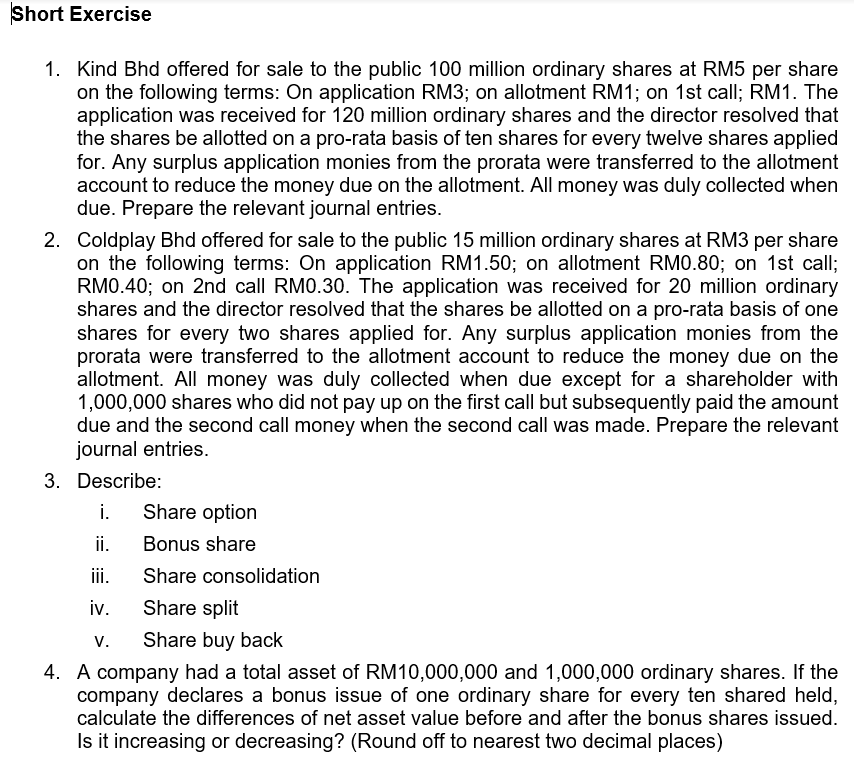

Short Exercise Kind Bhd offered for sale to the public 1 0 0 million ordinary shares at RM 5 per share on the following terms:

Short Exercise

Kind Bhd offered for sale to the public million ordinary shares at RM per share

on the following terms: On application RM; on allotment RM; on st call; RM The

application was received for million ordinary shares and the director resolved that

the shares be allotted on a prorata basis of ten shares for every twelve shares applied

for. Any surplus application monies from the prorata were transferred to the allotment

account to reduce the money due on the allotment. All money was duly collected when

due. Prepare the relevant journal entries.

Coldplay Bhd offered for sale to the public million ordinary shares at RM per share

on the following terms: On application RM; on allotment RM; on st call;

RM; on nd call RM The application was received for million ordinary

shares and the director resolved that the shares be allotted on a prorata basis of one

shares for every two shares applied for. Any surplus application monies from the

prorata were transferred to the allotment account to reduce the money due on the

allotment. All money was duly collected when due except for a shareholder with

shares who did not pay up on the first call but subsequently paid the amount

due and the second call money when the second call was made. Prepare the relevant

journal entries.

Describe:

i Share option

ii Bonus share

iii. Share consolidation

iv Share split

v Share buy back

A company had a total asset of RM and ordinary shares. If the

company declares a bonus issue of one ordinary share for every ten shared held,

calculate the differences of net asset value before and after the bonus shares issued.

Is it increasing or decreasing? Round off to nearest two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started