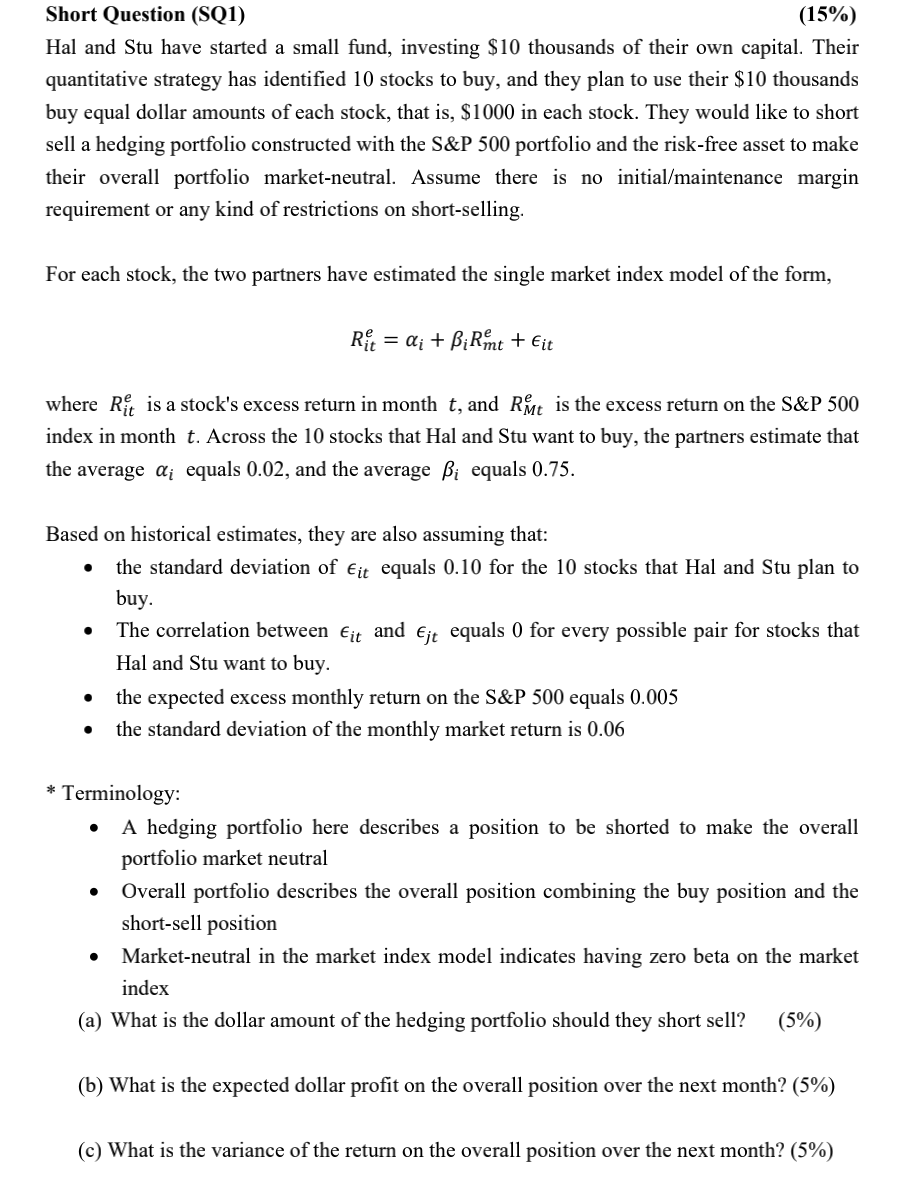

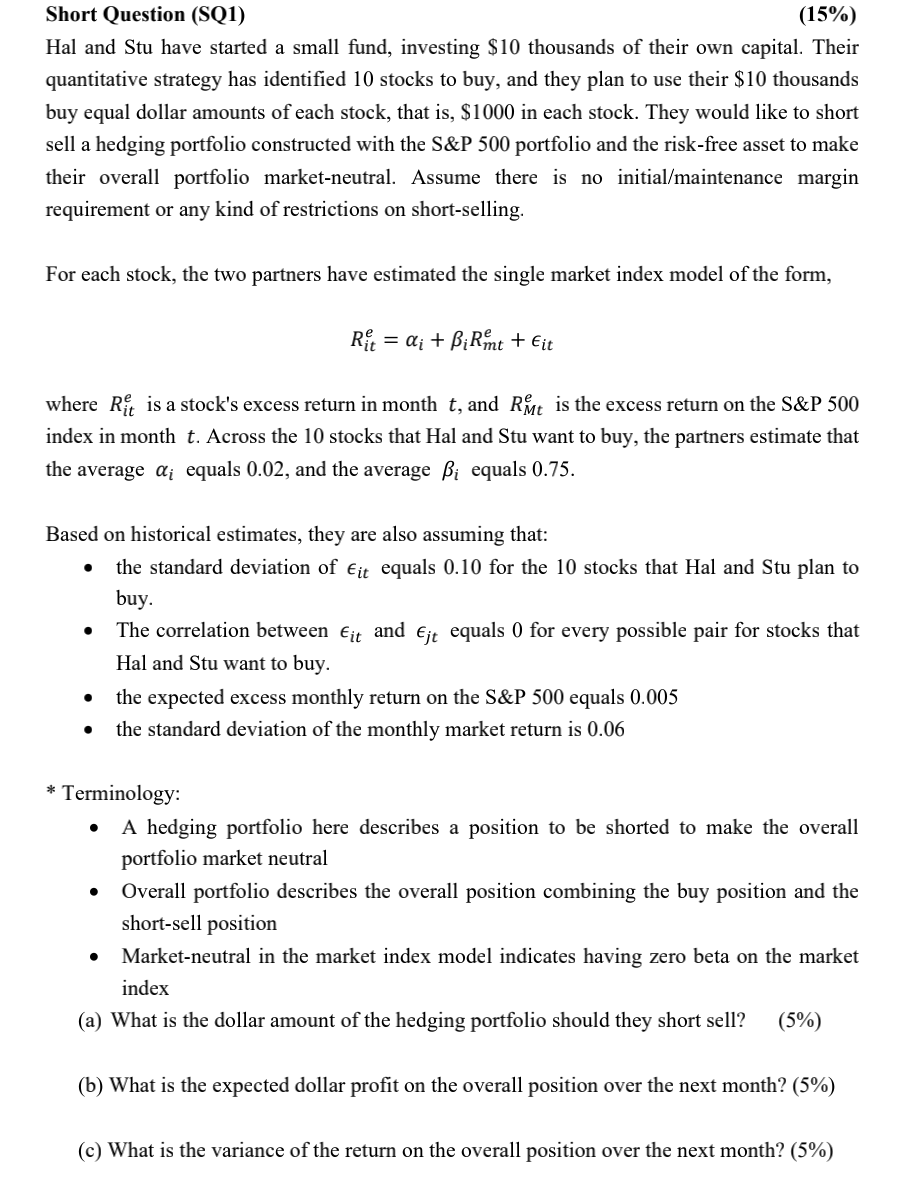

Short Question (SQ1) (15%) Hal and Stu have started a small fund, investing $10 thousands of their own capital. Their quantitative strategy has identified 10 stocks to buy, and they plan to use their $10 thousands buy equal dollar amounts of each stock, that is, $1000 in each stock. They would like to short sell a hedging portfolio constructed with the S&P 500 portfolio and the risk-free asset to make their overall portfolio market-neutral. Assume there is no initial/maintenance margin requirement or any kind of restrictions on short-selling. For each stock, the two partners have estimated the single market index model of the form, Rit = Qi + BiRimt + Eit where Rit is a stock's excess return in month t, and RMt is the excess return on the S&P 500 index in month t. Across the 10 stocks that Hal and Stu want to buy, the partners estimate that the average di equals 0.02, and the average Bi equals 0.75. . Based on historical estimates, they are also assuming that: the standard deviation of Eit equals 0.10 for the 10 stocks that Hal and Stu plan to buy. The correlation between Eit and Ejt equals ( for every possible pair for stocks that Hal and Stu want to buy. the expected excess monthly return on the S&P 500 equals 0.005 the standard deviation of the monthly market return is 0.06 . . . . * Terminology: A hedging portfolio here describes a position to be shorted to make the overall portfolio market neutral Overall portfolio describes the overall position combining the buy position and the short-sell position Market-neutral in the market index model indicates having zero beta on the market index (a) What is the dollar amount of the hedging portfolio should they short sell? (5%) (b) What is the expected dollar profit on the overall position over the next month? (5%) (c) What is the variance of the return on the overall position over the next month? (5%) Short Question (SQ1) (15%) Hal and Stu have started a small fund, investing $10 thousands of their own capital. Their quantitative strategy has identified 10 stocks to buy, and they plan to use their $10 thousands buy equal dollar amounts of each stock, that is, $1000 in each stock. They would like to short sell a hedging portfolio constructed with the S&P 500 portfolio and the risk-free asset to make their overall portfolio market-neutral. Assume there is no initial/maintenance margin requirement or any kind of restrictions on short-selling. For each stock, the two partners have estimated the single market index model of the form, Rit = Qi + BiRimt + Eit where Rit is a stock's excess return in month t, and RMt is the excess return on the S&P 500 index in month t. Across the 10 stocks that Hal and Stu want to buy, the partners estimate that the average di equals 0.02, and the average Bi equals 0.75. . Based on historical estimates, they are also assuming that: the standard deviation of Eit equals 0.10 for the 10 stocks that Hal and Stu plan to buy. The correlation between Eit and Ejt equals ( for every possible pair for stocks that Hal and Stu want to buy. the expected excess monthly return on the S&P 500 equals 0.005 the standard deviation of the monthly market return is 0.06 . . . . * Terminology: A hedging portfolio here describes a position to be shorted to make the overall portfolio market neutral Overall portfolio describes the overall position combining the buy position and the short-sell position Market-neutral in the market index model indicates having zero beta on the market index (a) What is the dollar amount of the hedging portfolio should they short sell? (5%) (b) What is the expected dollar profit on the overall position over the next month? (5%) (c) What is the variance of the return on the overall position over the next month? (5%)