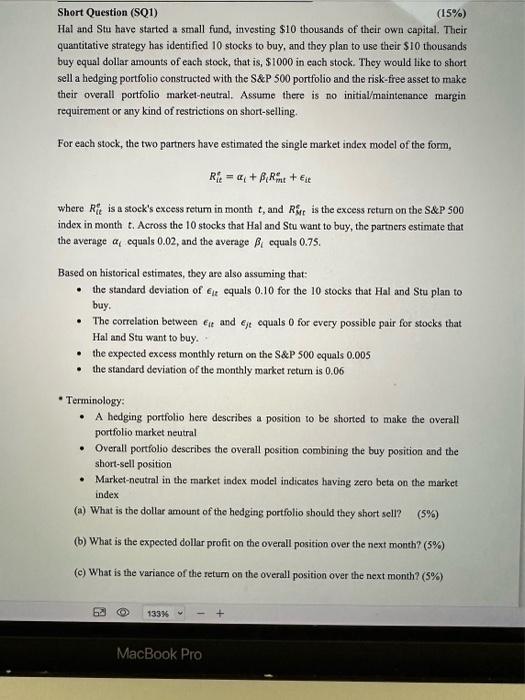

Short Question (SQ1) (15%) Hal and Stu have started a small fund, investing $10 thousands of their own capital. Their quantitative strategy has identified 10 stocks to buy, and they plan to use their $10 thousands buy equal dollar amounts of each stock, that is, $1000 in each stock. They would like to short sell a hedging portfolio constructed with the S\&P 500 portfolio and the risk-free asset to make their overall portfolio market-neutral. Assume there is no initial/mnintenance margin requirement or any kind of restrictions on short-selling. For each stock, the two partners have estimated the single market index model of the form, Ritt=i+iRmte+it where Rite is a stock's excess retum in month t, and RMTf is the excess return on the S\&P S00 index in month t. Across the 10 stocks that Hal and Stu want to buy, the partners estimate that the average i equals 0.02 , and the average i equals 0.75 . Based on historical estimates, they are also assuming that: - the standard deviation of it equals 0.10 for the 10 stocks that Hal and Stu plan to buy. - The correlation between it and jt equals 0 for every possible pair for stocks that Hal and Stu want to buy. - the expected excess monthly return on the S\&P 500 equals 0.005 - the standard deviation of the monthly market retum is 0.06 - Terminology: - A hedging portfolio here describes a position to be shorted to make the overall portfolio market neutral - Overall portfolio deseribes the overall position combining the buy position and the short-sell position - Market-neutral in the market index model indicates having zero beta on the market index (a) What is the dollar amount of the hedging portfolio should they short sell? (5%) (b) What is the expected dollar profit on the overall position over the next month? (5\%) (c) What is the variance of the return on the overall position over the next month? ( 5%) Short Question (SQ1) (15%) Hal and Stu have started a small fund, investing $10 thousands of their own capital. Their quantitative strategy has identified 10 stocks to buy, and they plan to use their $10 thousands buy equal dollar amounts of each stock, that is, $1000 in each stock. They would like to short sell a hedging portfolio constructed with the S\&P 500 portfolio and the risk-free asset to make their overall portfolio market-neutral. Assume there is no initial/mnintenance margin requirement or any kind of restrictions on short-selling. For each stock, the two partners have estimated the single market index model of the form, Ritt=i+iRmte+it where Rite is a stock's excess retum in month t, and RMTf is the excess return on the S\&P S00 index in month t. Across the 10 stocks that Hal and Stu want to buy, the partners estimate that the average i equals 0.02 , and the average i equals 0.75 . Based on historical estimates, they are also assuming that: - the standard deviation of it equals 0.10 for the 10 stocks that Hal and Stu plan to buy. - The correlation between it and jt equals 0 for every possible pair for stocks that Hal and Stu want to buy. - the expected excess monthly return on the S\&P 500 equals 0.005 - the standard deviation of the monthly market retum is 0.06 - Terminology: - A hedging portfolio here describes a position to be shorted to make the overall portfolio market neutral - Overall portfolio deseribes the overall position combining the buy position and the short-sell position - Market-neutral in the market index model indicates having zero beta on the market index (a) What is the dollar amount of the hedging portfolio should they short sell? (5%) (b) What is the expected dollar profit on the overall position over the next month? (5\%) (c) What is the variance of the return on the overall position over the next month? ( 5%)