Question

Short Rate Dollar Duration SR $ Dur = -(K u -K d )/(r u -r d ), where K u =Asset up payoff, r u

Short Rate Dollar Duration

SR$Dur = -(Ku-Kd)/(ru-rd), where

Ku =Asset up payoff, ru=6.004%

Kd=Asset down payoff, rd=4.721%

What are the SR dollar durations and SR durations of the following assets?

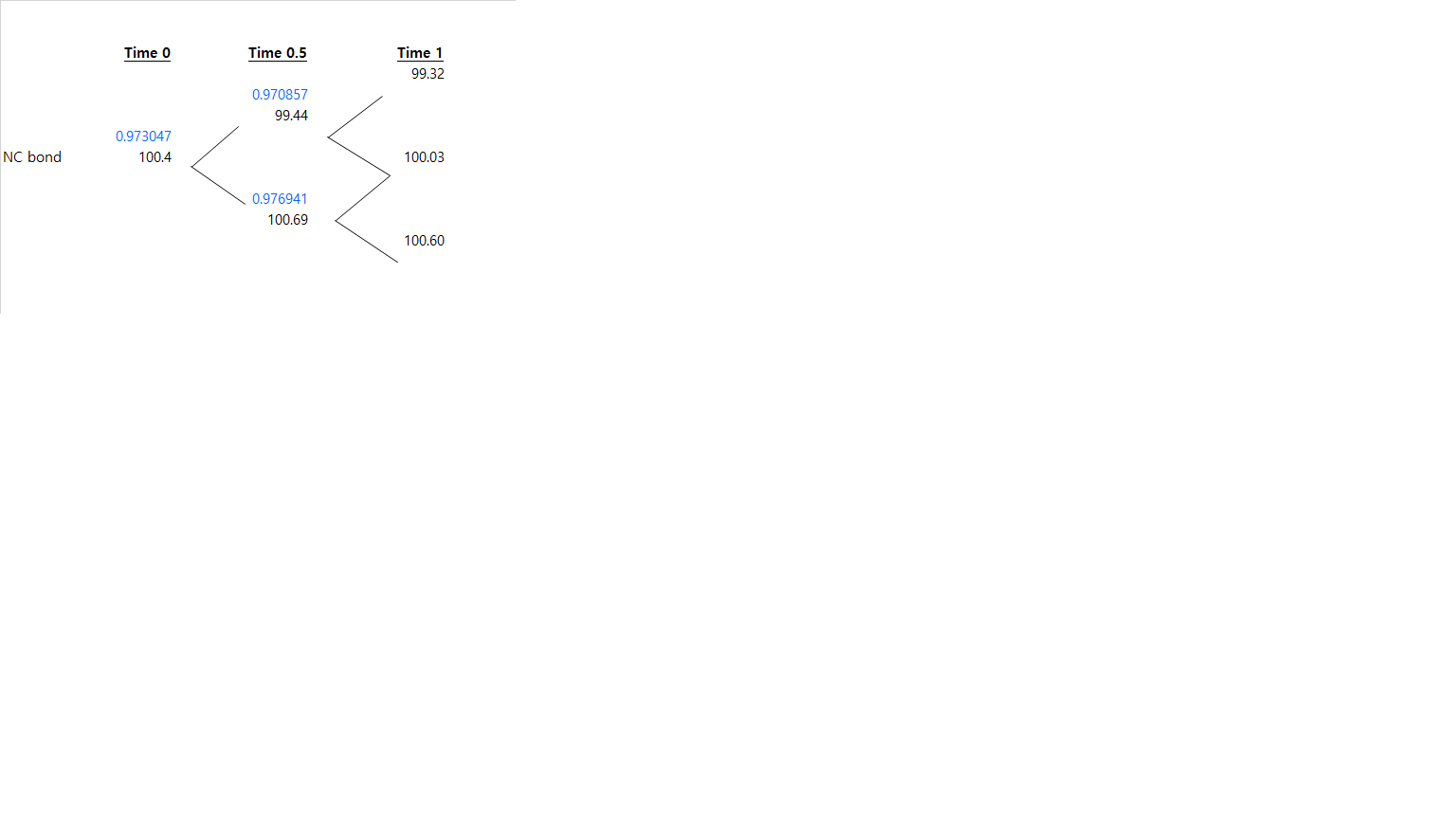

1) the noncallable bond

2) the call

3) the callable bond

Time 0 Time 0.5 Time 1 99.32 0.970857 99.44 NC bond 0.973047 100.4 0.976941 100.03 100.69 100.60

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the shortrate dollar duration SRDur and shortrate duration SR Dur for each asset we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App