Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shortening the credit period A firm is contemplating shortening its credit period from 35 to 25 days and believes that, as a result of this

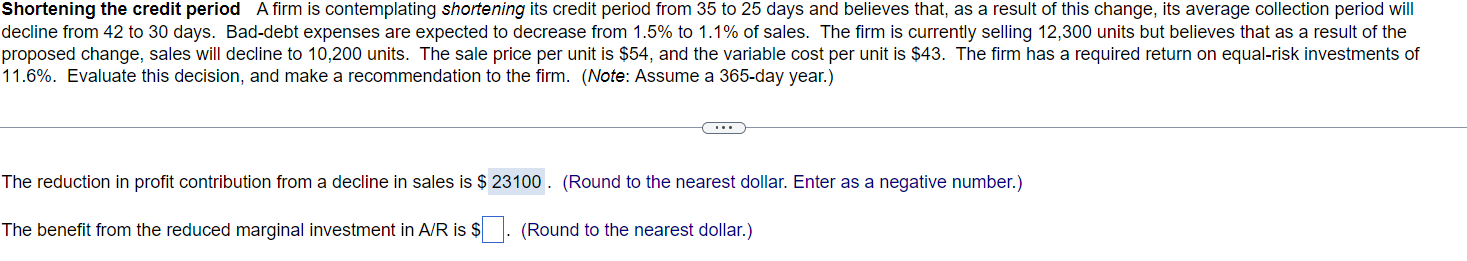

Shortening the credit period A firm is contemplating shortening its credit period from 35 to 25 days and believes that, as a result of this change, its average collection period will decline from 42 to 30 days. Bad-debt expenses are expected to decrease from 1.5% to 1.1% of sales. The firm is currently selling 12,300 units but believes that as a result of the roposed change, sales will decline to 10,200 units. The sale price per unit is $54, and the variable cost per unit is $43. The firm has a required return on equal-risk investments of 11.6%. Evaluate this decision, and make a recommendation to the firm. (Note: Assume a 365-day year.) The reduction in profit contribution from a decline in sales is (Round to the nearest dollar. Enter as a negative number.) The benefit from the reduced marginal investment in A/R is $ (Round to the nearest dollar.) Shortening the credit period A firm is contemplating shortening its credit period from 35 to 25 days and believes that, as a result of this change, its average collection period will decline from 42 to 30 days. Bad-debt expenses are expected to decrease from 1.5% to 1.1% of sales. The firm is currently selling 12,300 units but believes that as a result of the roposed change, sales will decline to 10,200 units. The sale price per unit is $54, and the variable cost per unit is $43. The firm has a required return on equal-risk investments of 11.6%. Evaluate this decision, and make a recommendation to the firm. (Note: Assume a 365-day year.) The reduction in profit contribution from a decline in sales is (Round to the nearest dollar. Enter as a negative number.) The benefit from the reduced marginal investment in A/R is $ (Round to the nearest dollar.)

Shortening the credit period A firm is contemplating shortening its credit period from 35 to 25 days and believes that, as a result of this change, its average collection period will decline from 42 to 30 days. Bad-debt expenses are expected to decrease from 1.5% to 1.1% of sales. The firm is currently selling 12,300 units but believes that as a result of the roposed change, sales will decline to 10,200 units. The sale price per unit is $54, and the variable cost per unit is $43. The firm has a required return on equal-risk investments of 11.6%. Evaluate this decision, and make a recommendation to the firm. (Note: Assume a 365-day year.) The reduction in profit contribution from a decline in sales is (Round to the nearest dollar. Enter as a negative number.) The benefit from the reduced marginal investment in A/R is $ (Round to the nearest dollar.) Shortening the credit period A firm is contemplating shortening its credit period from 35 to 25 days and believes that, as a result of this change, its average collection period will decline from 42 to 30 days. Bad-debt expenses are expected to decrease from 1.5% to 1.1% of sales. The firm is currently selling 12,300 units but believes that as a result of the roposed change, sales will decline to 10,200 units. The sale price per unit is $54, and the variable cost per unit is $43. The firm has a required return on equal-risk investments of 11.6%. Evaluate this decision, and make a recommendation to the firm. (Note: Assume a 365-day year.) The reduction in profit contribution from a decline in sales is (Round to the nearest dollar. Enter as a negative number.) The benefit from the reduced marginal investment in A/R is $ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started