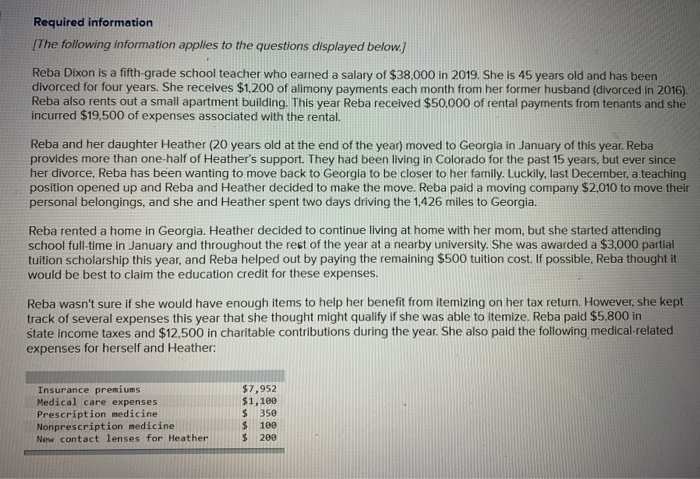

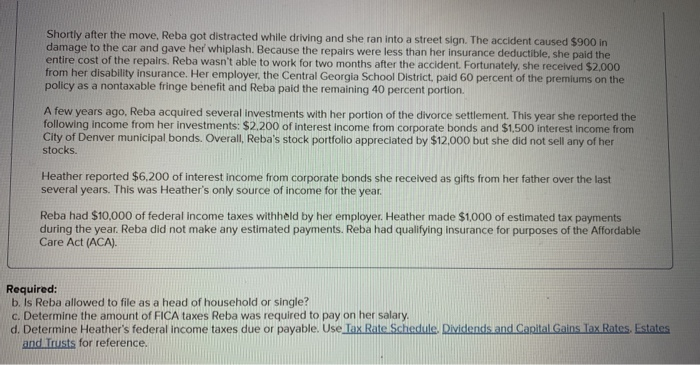

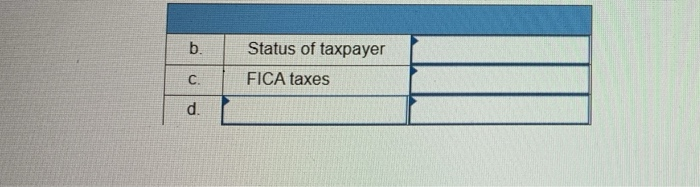

Shortly after the move, Reba got distracted while driving and she ran into a street sign. The accident caused $900 in damage to the car and gave her whiplash. Because the repairs were less than her Insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $2.000 from her disability insurance. Her employer, the Central Georgia School District, paid 60 percent of the premiums on the policy as a nontaxable fringe benefit and Reba paid the remaining 40 percent portion A few years ago, Reba acquired several Investments with her portion of the divorce settlement. This year she reported the following income from her investments: $2.200 of interest income from corporate bonds and $1.500 Interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $12,000 but she did not sell any of her stocks. Heather reported $6,200 of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year. Reba had $10,000 of federal income taxes withheld by her employer. Heather made $1,000 of estimated tax payments during the year. Reba did not make any estimated payments. Reba had qualifying insurance for purposes of the Affordable Care Act (ACA). Required: b. Is Reba allowed to file as a head of household or single? c. Determine the amount of FICA taxes Reba was required to pay on her salary. d. Determine Heather's federal income taxes due or payable. Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates. Estates and Trusts for reference. Shortly after the move, Reba got distracted while driving and she ran into a street sign. The accident caused $900 in damage to the car and gave her whiplash. Because the repairs were less than her Insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $2.000 from her disability insurance. Her employer, the Central Georgia School District, paid 60 percent of the premiums on the policy as a nontaxable fringe benefit and Reba paid the remaining 40 percent portion A few years ago, Reba acquired several Investments with her portion of the divorce settlement. This year she reported the following income from her investments: $2.200 of interest income from corporate bonds and $1.500 Interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $12,000 but she did not sell any of her stocks. Heather reported $6,200 of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year. Reba had $10,000 of federal income taxes withheld by her employer. Heather made $1,000 of estimated tax payments during the year. Reba did not make any estimated payments. Reba had qualifying insurance for purposes of the Affordable Care Act (ACA). Required: b. Is Reba allowed to file as a head of household or single? c. Determine the amount of FICA taxes Reba was required to pay on her salary. d. Determine Heather's federal income taxes due or payable. Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates. Estates and Trusts for reference