Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Short-term credit, or short-term financing, is any liability that is scheduled for repayment within one year. Sources of short-term funds include banks, suppliers, securities firms,

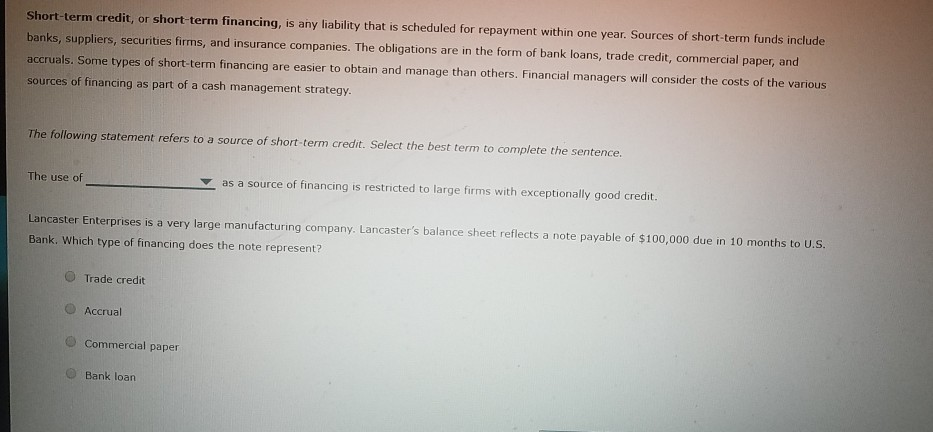

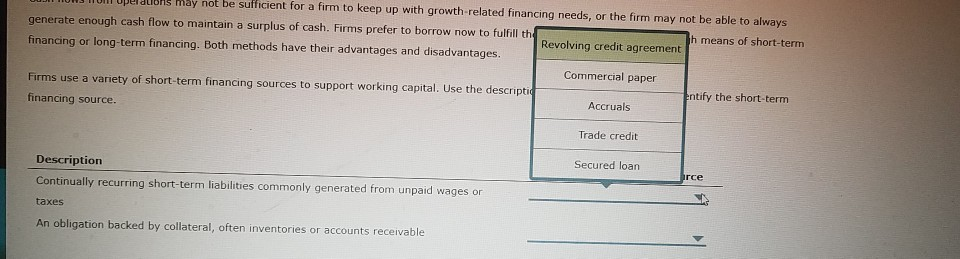

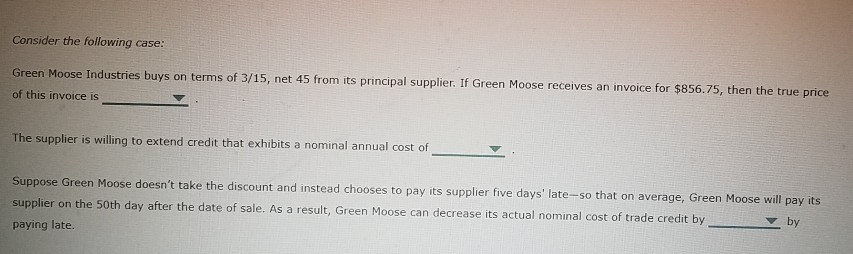

Short-term credit, or short-term financing, is any liability that is scheduled for repayment within one year. Sources of short-term funds include banks, suppliers, securities firms, and insurance companies. The obligations are in the form of bank loans, trade credit, commercial paper, and accruals. Some types of short-term financing are easier to obtain and manage than others. Financial managers will consider the costs of the various sources of financing as part of a cash management strategy. The following statement refers to a source of short-term credit. Select the best term to complete the sentence. The use of as a source of financing is restricted to large firms with exceptionally good credit. Lancaster Enterprises is a very large manufacturing company. Lancaster's balance sheet reflects a note payable of $100,000 due in 10 months to U.S. Bank. Which type of financing does the note represent? Trade credit Accrual Commercial paper Bank loan operacions may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill the h means of short-term Revolving credit agreement financing or long-term financing. Both methods have their advantages and disadvantages. Commercial paper Firms use a variety of short-term financing sources to support working capital. Use the descripti Entify the short-term Accruals financing source. Trade credit Secured loan Description Continually recurring short-term liabilities commonly generated from unpaid wages or taxes An obligation backed by collateral, often inventories or accounts receivable Consider the following case: Green Moose Industries buys on terms of 3/15, net 45 from its principal supplier. If Green Moose receives an invoice for $856.75, then the true price of this invoice is The supplier is willing to extend credit that exhibits a nominal annual cost of Suppose Green Moose doesn't take the discount and instead chooses to pay its supplier five days' late-so that on average, Green Moose will pay its supplier on the 50th day after the date of sale. As a result, Green Moose can decrease its actual nominal cost of trade credit by paying late. by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started